Two weeks ago, I brought you the first of a series of two articles on how you can play the clean infrastructure build-out that could come as a result of an Obama victory today. In that article, I made the point that the political and economic ideology that had prevailed in America over the past 30 years, economic laisser-faire, had been severely undermined by the recent credit meltdown and what now looks like it will be the worse economic shock in a generation or more. I further argued that the increasing sidelining of the "small government" discourse in American politics in the wake of this crisis would provide the impetus for an overt return to a Keynesian approach to dealing with recessions, whereby the government would directly undertake expenditures in the economy to jump-start aggregate demand. Finally, I linked this to Barack Obama’s environmental and clean energy credentials, and argued that under his watch, a massive, federally-mandated infrastructure spending program would certainly contain environmental and clean energy components.

Much has happened since I wrote that first article. Firstly, Allan Greenspan, arguably the most influential free-market thinker of the past four decades, shocked the world by admitting that the ideology on which he had relied for the better part of his professional life had been proven "flawed" by the crisis. This admission represents the loss of a major pillar for the intellectual edifice of the Free Market. Second, state and municipal officials’ calls for an economic bailout package grew louder last week, with demands ranging from infrastructure spending to direct help in meeting budgetary shortfalls. Thirdly, a plethora of metrics are now pointing toward a significant softening of the economy in the coming quarters, not the least of which is a record drop in consumer sentiment. Lastly, barring a major onslaught of the Bradley Effect, Obama looks nearly certain to win the presidential contest, and there is a very real possibility that the Democrats could emerge with a filibuster-proof majority in the Senate, giving the new president a significant amount of leeway in moving swiftly on an counter-cyclical spending agenda.

In light of what I just highlighted above, I continue to believe that clean infrastructure on the back of government intervention is a potentially interesting theme. There are, of course, some pretty significant risks to this thesis. Firstly, the US is in no fiscal position to launch into a multi-billion dollar economic bailout effort. Second, although credit markets are slowly thawing, my commercial and investment banker friends will readily share that accessing capital for companies remains a daunting task, government contract or not. Lastly, local content provisions aimed at boosting the domestic multiplier effect could eliminate many foreign companies from being eligible for money.

Stocks For The Clean Infrastructure Build-out, Part 2 – Electricity Transmission & Distribution

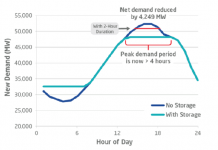

In the first article of this series, I discussed rail power stocks. In this article, I discuss stocks in the second major area of infrastructure that alt energy investors have an interest in: electricity transmission and distribution. As with the first instalment, I did not do an extensive amount of research on most of these companies, so I welcome any insight readers may have. As with rail stocks, I looked for firms that would benefit from spending programs – i.e. suppliers and contractors – rather than companies that operate transmission systems. A decline in industrial production and a weak economy in the US could spell lower volumes for power generators and distributors in certain states with a high concentration of heavy industries.

The ABB Group (ABB) – Financial statements here. ABB has exposure to a number of areas related to transmission and distribution systems. The company makes cables, transformers and various other products related to power electronics and management. ABB is also a leader in providing power equipment for wind farms, including in the emerging area of offshore wind. This is a stock that has gotten blasted in the past few months on worries over significantly weaker infrastructure spending around the globe, and is down about 60% from its high in April of this year. ABB now trades at a last-twelve-month (LTM) PE of around 6.8x, which is cheap by historical standards.

Allegheny Technologies, Inc. (ATI) – Financial statements here. Allegheny is not as pure a play on transmission as ABB is, but it nevertheless produces some products with grid applications. Among them are a number of specialty alloys and metals for transformers and efficient grids. Allegheny also produces iron castings for wind turbines. At a TTM PE of about 4.5x, this is also a down-and-out stock that has taken a beating.

Composite Technology Corporation (CPTC.OB) – Financial statements here. Composite is commercializing an innovative transmission cable solution, and has a wind power division that produces utility-scale turbines. However, this is an earning-less stock and those aren’t for the faint of heart in the current market environment.

General Cable (BGC) – Financial statements here. This company that makes a range of cables, including transmission and distribution cables of different voltages and underground cables. This is a very direct play on cables, as the name indicates. At an LTM of about 3.8x, this stock is trading squarely in cheap territory.

MasTec Inc. (MTZ) – Financial statements here. MasTec is a subcontractor to the utilities and communication industries, building, installing and maintaining electricity transmission infrastructure. The company is earning-less.

Quanta Services (PWR) – Financial statements here. Quanta is also a contractor to the power transmission and distribution industry, with services including infrastructure design, installation and maintenance. At an LTM PE 23.81x, this is a stock that would be too expensive for me in the current market environment, especially that it doesn’t pay a dividend.

Resin Systems (RSSYF.OB or RS.TO) – Financial statements here. Resin Systems makes composite utility poles for electricity transmission and distribution. Composite materials aren’t ubiquitous for utility poles just yet, with wood, concrete and steel still dominating. However, as in other applications, composites probably hold a decent amount of potential. Here, we have an earning-less company trying to set new standards – probably a tall order in this environment.

Schneider Electric (SBGSF.PK) – Financial Statements here. Schneider provides a range of products related to electricity management, distribution and transmission. It is a direct competitor of ABB’s. One interesting factoid about Schneider is that it recently acquired Xantrex, a leading maker of power inverters and converters for the wind and solar industries. At an LTM PE of 6.6x, Schneider is valued similarly to ABB…no big surprise here.

Siemens (SI) – Financial statements here. Siemens makes a range of products for the power transmission and distribution sector, including switchgear, transformer and substations. The company is also a leading manufacturer of utility-scale wind turbine. It is currently trading at a TTM PE of 5.4x.

Valmont Industries (VMI) – Financial statements here. Valmont makes transmission and distribution poles from concrete, steel or a mix of the two.

DISCLOSURE: Charles Morand has a position in ABB.

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

You’ve forgotten the most important domestic, technological and electrical grid transmission company of all …. HTS transmission wires that combat the loss of energy and provide an efficient connect for wind and solar… American Superconductor (AMSC).