A year ago, I brought you 10 Alternative Energy Stocks I thought were worth speculating on for 2008. I revisited these in June, when a balanced portfolio of the 10 was "up 11.4% for the year, compared to the S&P 500 which is down 4.2% and the NASDAQ Clean Edge US Index, which is down approximately 14.3%."

Speculative picks tend to do better than the market as a whole in bull markets, and worse in bear markets, so given the steep drop in markets since then, I would normally expect these more speculative picks to fare worse. This is borne out in the fact that the more speculative of the pick, the worse the stock performed. (I put these picks in rough order of riskiness, with the riskier ones given lower numbers. The exception to this rule was #9, Lighting Science, which probably would have been #3 except that I wanted to talk about it and the other LED stock Cree in the same article.)

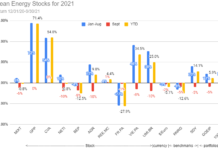

For the morbidly curious, an equal-weighted portfolio of these 10 was down 55% as of the close on December 24th. For comparison, the S&P 500 was down 42% over the same period, while the NASDAQ Clean Edge Index was down 67%.

More interesting to readers is probably my current opinion about these companies. After the Lehman bankruptcy, I sold part or all of nearly all these, but still hold some, often in conjunction with covered calls. Below, I give quick updates on the companies I’m still following.

#10 Cree, Inc. (CREE) Dec 27, 2007: $23.50; Dec 24, 2008: $15.01; -36%

Cree is a leader in light-emitting diodes (LEDs), a technology which is just now coming of age. With no debt, a strong current ratio, and selling only slightly above book value, I no longer class Cree as a "speculative" bet, and the company should be able to use the harsh financial climate to improve its position in the LED industry.

#9:Lighting Science Group (LSGP.OB) Dec 27, 2007: $6.40 (split-adjusted), Dec 24, 2008: $0.40; -94%.

I sold my holdings of Lighting Science in September when the extent of the financial crisis became clear to me. This company is too early stage to make it to profitability without outside funding, which would dilute current shareholders.

Here’s an October article where I went into more detail on both Cree and Lighting Science.

#8 Maxwell Technologies (MXWL) Dec 27, 2007: $8.10, Dec 24, 2008: $5.93; -27%

Although I think ultracapacitors may have a role to play in electric vehicles, Maxwell is not currently profitable, and has only slightly more than a year’s worth of cash on hand. I sold most of my stake in the company since the crisis began, although I am waiting for better prices to sell the rest.

#7 Electro Energy, Inc. (EEEI) Dec 30, 2007: $0.68, Dec 24, 2008: $0.18; -74%

I no longer follow this company, and sold all my holdings in September and October. I discussed my reasons for selling Electro Energy here.

#6 Capstone Microturbine (CPST) Dec 30, 2007: $1.62, Dec 24, 2008: $1.11; -31%

Although Capstone is closer to profitability than Maxwell, the company can only survive about a year without raising more money. The company has a chance of getting a boost from Obama’s planned stimulus package, since its microturbines are often used in Combined Heat and Power (CHP) systems. These systems may be installed as part of energy efficiency retrofits of Federal Buildings. Because of this, I am waiting to see the form the stimulus takes, and if any speculation picks up about how Capstone may benefit.

#5 FuelCell Energy Inc. (FCEL) Dec 30, 2007: $10.30, Dec 24, 2008: $3.65, -74%

Like Capstone, FuelCell might benefit from CHP in Federal Buildings. Unlike Capstone, even that would be unlikely to bring the company anywhere near profitability. I am short some cash covered puts in the company, but do not intend to sell more if they expire unexercised, and will probably sell the stock if it is assigned to me.

#4 Composite Technology Corp. (CPTC) Dec 30, 2007: $1.37, Dec 24, 2008: $0.26; -81%

Composite also has a fairly long way to go before achieving profitability, and has slightly over a year’s worth of cash with which to do it. However, readers know that I have long been enthusiastic about the company’s ACCC cable for electricity transmission. This enthusiasm led me to only sell part of my holdings in response to the crisis. As with Capstone, I’m waiting to see what the stimulus package will do for transmission before deciding what to do with my remaining holdings.

#3 Nevada Geothermal Power (NGLPF.PK) Dec 31, 2007: $1.29, Dec 24, 2008: $0.30; -77%

Although Nevada Geothermal is currently unprofitable, their Blue Mountain geothermal project has sufficient financing to take it to production, which the company expects near the end of 2009. As the expectation of revenue draws nearer, I expect the stock price to appreciate.

#2 Finavera Renewables (FNVRF.PK) Dec 31, 2007: $0.3371, Dec 24, 2008: $0.0238; -93%

I sold my stake in this most speculative of my long picks early in the year, as the darkening financial climate convinced me that a speculative frenzy for ocean power stocks was unlikely to emerge. I no longer follow the company,

#1 SHORT First Solar (FSLR) Dec 31, 2007: $267, Dec 24, 2008: $133.73; +50%

I took my profits on this in June. I don’t usually follow solar companies, because I feel that they are generally too widely followed for me to add much value. I don’t have any particular expectation of how First Solar will fare next year.

DISCLOSURE: Tom Konrad and/or his clients have long positions in CREE, MXWL, CPST, FCEL, CPTC, and NGLPF.

DISCLAIMER: The in

formation and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

I’ll ad my $0.02 on Maxwell. It’s a company I’ve been following for quite a while, and own shares in.

Although MXWL is a big loser this year, the company has made steady progress, and is worth keeping an eye on in 2009.

It’s ultracapacitors are not only useful for electric automobile drive trains (at some point, all cars will have electric drives; since they are lighter, and more efficient than mechanical drives), they are useful in any system that uses a motor, and requires braking. Elevators, cranes, subways, etc…

Also, the caps are useful in applications like backup power systems, and in wind turbine trim systems.

Ultracap revenue has been growing at 50%+ reliably. I think its growth is constrained more by the time it takes for engineers to work it into new designs, rather than macro conditions.

All that said, the company does seem to be addicted to not showing a profit, though. The CEO vows to turn the corner in 2009, but we’ll see.

Thanks for the info, Kevin.

I like that phrase, “Addicted ot not showing a profit.” Let’s hope they can recover from that addiction soon.