Demand Responder Eyes New Growth Areas as Key Market Prices Dip

by Joyce Pellino Crane

EnerNOC, Inc., announced its acquisition of Cogent Energy, Inc., on December 9, signaling a strategic move into the energy efficiency sector that is designed to help it capitalize on the Smart Grid’s growth potential.

But the company was launched in 2004 as one solution to the country’s burgeoning demand for energy, and has grown into a leader among a handful of competitors in the demand response market.

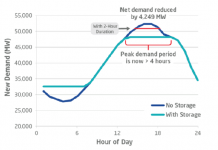

Boston-based EnerNOC (Nasdaq: ENOC) helps businesses and grid operators reduce electricity consumption when demand is peaking and capacity strained. The business model is designed to prevent regional blackouts and reduce the need to build more power plants.

Expectations for growth over the next few years are mixed and dependent on whether the company can successfully penetrate the energy efficiency and other ancillary markets, say some observers.

But so far, the company derives about 96 percent of its revenues from demand response customers. A demand response company, such as EnerNOC, uses technology to cut electricity usage among commercial, industrial, and institutional customers during periodsheat waves and frigid temperatureswhen energy demand surges or supply falls suddenly. It can also be useful if changing weather conditions cause supply from wind or solar to fall suddenly. EnerNOC’s platform inserts a layer of technology between commercial businesses and grid operators to ensure that there is enough power supply for all consumers during peak demand.

The company has shown significant growth in the sector, but it’s uncertain whether EnerNOC can sustain the pattern on a long-term basis.

Ben Schuman, senior research analyst for Pacific Crest Securities in Portland, Ore., said he foresees growth decelerating in EnerNOC’s largest demand response market after 2010.

“The growth in that market after 2010 is going to decelerate mainly because the capacity prices are declining,” he said.

Capacity is an industry term that refers to the energy resources needed to meet the industry’s highest electricity demand.

The country’s power grid is operated by seven regional transmission organizations and independent system operators. The largest market among them belongs to PJM Interconnection of Valley Forge, Penn., which sends electricity to utility companies in all or part of 13 states from Northern Illinois to the Atlantic Ocean, including Washington, D.C. PJM pays EnerNOC and other demand response providers to cut the use of electricity among an aggregated pool of customers. It also pays a monthly fee to keep demand responders like EnerNOC on standby for a cutback when peak demand requires it. The demand responders are then contractually obligated to ensure that electricity usage decreases.

EnerNOC procures capacity obligations through PJM-administered auctions that are three years in advance, giving a clear line of vision to a large portion of its future revenues.

Prices in much of the PJM market are slated to drop each year through June 2012 from the current price of $102 per megawatt day. By mid-2012, some PJM regions will see prices plunge to as low as $16.47 per megawatt day, while others with less capacity will command as much as $222.30.

But the pricing volatility could have an impact, say some industry observers.

Although EnerNOC is committed to managing 2,500 megawatts in PJM territory from 2012-13, the revenues it will derive from its largest customer are projected to be flat. In May, the company announced it had secured about $100 million in future revenues from PJM—roughly the same as reported for the third quarter of 2009, ending September 30. In contrast, noted Schuman, between 2008 and 2009, revenues from the PJM region had more than tripled.

“So what has been a growth market for them flattens out,” Schuman said. “…That isn’t to say there aren’t other markets that they can break into, but I think it will be more difficult for them to grow after 2010 than it was in the past.”

But Shawn Lockman, a senior associate at Ardour Capital Investments in New York, said the company will compensate for the price drop by building a megawatt profile over the next five years that makes up for the difference.

“As they start to advocate for megawatts nationally outside the PJM territory,” he said, “you’re going to see the impact of that price drop be more dissipated.”

Lockman is optimistic about the company’s ancillary services, including monitoring-based commissioning solutions, energy procurement, energy efficiency, and carbon management, “but demand response systems is going to be their base for the foreseeable future,” he said.

Lockman gave EnerNOC’s stock a buy rating in contrast to Schuman’s recommendation to hold.

“This company is strong and they’re well-managed and they have a lot of opportunity out there,” Lockman said. “We don’t see anything that would put a dent in that on a regulatory basis.”

In fact, a recent federal order gave demand response companies a big boost. In October, the Federal Energy Regulatory Commission finalized regulations that strengthen the operation and improve the competitiveness of organized wholesale electric markets through the use of demand response. EnerNOC has leapt ahead of its competitor, Comverge, Inc., (Nasdaq: COMV) of East Hanover, NJ, according to Lockman, in the $5.2 billion US market. The privately-held CPower, Inc., of New York, NY, another competitor in the market, announced a $10.7 million round of financing in April.

EnerNOC’s initial price offering on May 18, 2007 closed at $31.13 per share. Five months later on October 18, share prices peaked at $50.50. Since then, the price has been volatile, dipping to as low as $4.80 on November 21, 2008, and closing on Monday at $28.55.

Third quarter revenues jumped 134 percent to $103 million from $44 million. Net income rose to $26.6 million from a loss of $3 million during the third quarter of 2008. Year-end revenues are projected to be between $187-9 million, according to Tim Weller, chief financial officer. EnerNOC lost $23.5 million in 2007, and $36.6 million in 2008. But today it has about $130 million in cash and marketable securities and about $4.5 million in long-term debt. It is on track to reach $250 million in projected revenues for 2010, said Weller.

“The Wall Street expectation was around $257 million,” said Schuman. “The company has done a good job of exceeding expectations for the past year.”

But warned Schuman, “growth will slow down unless they can do a really good job of penetrating other markets or some of their other services take off.”

The recent acquisition of Cogent Energy is a step in that direction. The company’s solut

ions will enable EnerNOC to service smaller facilities equipped with less sophisticated control systems, according to a company announcement. The acquisition significantly increases the size of EnerNOC’s application to perform detailed analysis on a business’ energy usage. Cogent gives EnerNOC “utility relationships and a customer footprint in California, and experienced head count resources in the area of energy consulting service,” Schuman wrote in a December 10 report. Cogent is expected to deliver about $5 million in revenues in 2010, he added.

Tim Healy, EnerNOC’s chairman and CEO, is determined to change how the world interacts with energy.

“We believe we’re ahead of the pack,” he said. “We envision a world in which energy management is as integral to energy accounting as every other operation.”

Joyce Pellino Crane writes at wordtrope.com/blog. She is a Boston Globe correspondent and a business technology analyst for Trender Research. Follow her on Twitter: JoyPellinoCrane. She can be reached at joyce pellino crane at gmail period com no spaces

DISCLOSURE: No position.

DISCLAIMER: Joyce is not a registered investment advisor. The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.