Year in Review: Ten Green Energy Gambles for 2009

Tom Konrad, CFA

My speculative renewable and alternative energy stock picks for 2009 had mixed results. The gambles came nowhere near the performance of my 10 Clean Energy Stocks for 2009, and only kept pace with their benchmarks. The reasons why can be found on the companies’ balance sheets and cash flow statements.

In January 2009 in response to popular demand, I gave readers ten picks of speculative green energy stocks. I tend to buck the general trend that renewable energy investors tend to be gamblers, but my annual stock picks draw a wider audience, and I decided to give the crowds what they wanted, picking ten green stocks I thought were on the risky side. I summarized my expectations for these stocks by saying, "that although all of these have a chance of spectacular returns, I think the portfolio as a whole will fall, unless financial market conditions improve rapidly."

Financial market conditions did improve rapidly in 2009, but they did not improve uniformly. Lenders and other suppliers of capital became much more discriminating, allowing the strong to raise money at reasonable rates, while the weak fell by the wayside.

What Happened

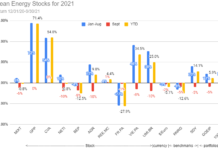

My green energy gambles were collectively up 22%, compared to returns of 31% for the Powershares Wilderhill Clean Energy Index (PBW), and 9% for the iShares S&P Global Clean Energy Index (ICLN), the two ETFs I specified as benchmarks for comparison when I published the original list.

This is an uninspiring performance, so I’m not happy with the overall results. After all, my ten conservative green picks were up an average of 57% in 2009 solidly beating their benchmarks, but my speculations didn’t even beat both benchmarks. In a strong bull market year like 2009, I would normally expect riskier stocks such as these to outperform my more conservative picks. That did not happen, and it did not happen by a wide margin.

I did get some "spectacular returns." Had I known last January that the S&P 500 would be up 28% in 2009, I would have expected at least three of these to return more than 100%. As it was, UQM Technologies (UQM) and Cosan (CZZ) more than doubled returning 252% and 116%, respectively. Nevertheless, it’s disappointing in such a good year for the market as a whole.

What happened?

The Weak and the Strong

When I presented these gambles, I broke them up into three categories:

Unprofitable Companies Without Strong Balance Sheets

- Beacon Power Corporation (BCON), up 7%

- Axion Power International (AXPW.OB), up 17%

- Valence Technology, Inc. (VLNC), down 48%

- Composite Technology Corp (CPTC.OB), no change

- Environmental Power Corp. (EPG), down 76%

- Emcore Corp. (EMKR), down 15%

Unprofitable Companies, Somewhat Stronger Balance Sheets

- UQM Technologies (UQM), up 252%

- Cosan, Ltd.(CZZ), up 116%

- Raser Technologies, Inc. (RZ), down 63%

Profitable Companies, For Now

- Zoltek (ZOLT), up 30%

The companies is the first category performed extremely poorly compared to the companies in the latter two categories, with the last four stocks returning an average of 84%, and the first six stocks returning -19%. Because of this (and the out performance of my ten conservative picks), I call 2009 "The Year of the Balance Sheet." Hindsight, of course, is 20/20, but at least I separated the companies by financial strength for readers who had a better idea of what 2009 would look like than I did.

For 2010, I’m going to try something a little different for any green-minded gamblers out there. Readers of my Green Energy Investing for Experts series have been getting a preview of what I’m talking about. I plan to publish the new list Sunday night or Monday morning.

DISCLOSURE: Long AXPW.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.