by Corporate Bonder

Market Overview

Data compiled by the Bank for International Settlements indicate that the total size of the global debt securities market (domestic and international) was $98.7 trillion as at September 2011, of which $89.9 trillion were notes and bonds. Governments accounted for $44.6 trillion of outstanding debt securities, financial organizations $41.9 trillion, corporations $11.2 trillion and international organizations $1.0 trillion.

The focus of this report is on corporate borrowers. US corporations are the largest debt issuers, accounting for 46% of corporate debt globally, followed by the Eurozone with 20%, Japan 9%, China 6%, and the UK and Canada with 3% each. The Merrill Lynch Global Broad Market Corporate Index (MLGBMCI), excluding financials, can be used as a proxy for the global corporate bond market in order to estimate splits by credit ratings, currency and sectors.

Two thirds of the MLGBMC Index (ex-financials) has been issued in USD and 77% has an investment grade credit rating. Capital intensive industries account the majority of issuance with Utility, Energy, Telecommunications, and Basic Industry sectors accounting for 14%, 15%, 11% and 10% respectively.

Factors affecting issuance during the March 2012 quarter

There were 849 new developed market corporate bonds issued during the quarter, raising over $414 billion. BBB rated corporations were the largest issuer group by credit rating accounting for 29%. Sub-investment grade and European issuers increased their proportion of issuance versus Q4 2011 as market sentiment improved.

The following two charts illustrate how issuance was split by credit rating and currency during the three months to 31 March 2012.

Factors affecting investor demand during the quarter

U.S. long-term mutual funds experienced $105.8 billion net inflows over the quarter. Despite appetite for risk has made a come back, investors in aggregate continued to move out of equities and into bond funds, with $10.0 billion coming out of equity funds and $93.7 billion of net inflows to bond funds over the period.

U.S. long-term mutual funds experienced $105.8 billion net inflows over the quarter. Despite appetite for risk has made a come back, investors in aggregate continued to move out of equities and into bond funds, with $10.0 billion coming out of equity funds and $93.7 billion of net inflows to bond funds over the period.

The ECB’s introduction of the Long Term Refinancing Operation and improving US economic data led to an increase in risk appetite from investors. Credit spreads tightened, particularly for bonds issued by financials and corporations based in so-called periphery nations. Some of the spread tightening has unwound at the end of the quarter and into the start of the second quarter as familiar themes of Spanish sovereign risk and bank balance sheet uncertainty re-emerged.

Developments in the low-carbon corporate bond market

Developments in the low-carbon corporate bond market

The misfortunes of equity investors in publicly listed wind turbine manufacturers are well documented. The following brief analysis is a glance at the bond market for wind turbine manufacturers and explores how bond investors have fared and how they perceive the risks surrounding the companies.

The author could only find two bonds from dedicated wind turbine manufacturer companies, listed in the table below. (In addition, Suzlon (SUZLON.BO) has convertible bonds on issue, but has not issued conventional bullet bonds)

| Table 1. – Wind turbine manufacturer public bonds – What currency? | |||||

| Issuer | Coupon | Maturity | Price* | Yield (YTM) | Credit Spread (OAS) |

| Nordex (NRDXF.PK) | 6.375% | 2016 | 95 | 7.9% | 680 |

| Vestas (VWDRY.PK) | 4.625% | 2015 | 88 | 9.5% | 864 |

* At 12/4/12

Each company had one senior unsecured bond, with the rest of their debt financed through banks in the form of term loans and revolving credit facilities.

Each company had one senior unsecured bond, with the rest of their debt financed through banks in the form of term loans and revolving credit facilities.

In the author’s opinion the bond documentation carries weak covenants, more in line with investment grade bonds, rather than the high yield bonds. Further, the companies do not provide information regarding financial covenants provided to the bank lenders (and not the bond investors), which cedes control to the banks and creates uncertainty for bond investors (and even more so for equity investors).

In the author’s opinion the bond documentation carries weak covenants, more in line with investment grade bonds, rather than the high yield bonds. Further, the companies do not provide information regarding financial covenants provided to the bank lenders (and not the bond investors), which cedes control to the banks and creates uncertainty for bond investors (and even more so for equity investors).

As demonstrated in table 1, the bonds of Nordex and Vestas have lost capital value since they were issued, however Charts 1 & 2 illustrate that bond investors who bought the bonds at the issue date have broken even (so far) with coupons received making up for the capital loss. The charts also illustrate the size of the capital loss that equity investors have incurred over the same period.

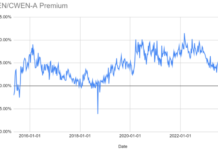

While wind turbine manufacturer bonds have outperformed their equity counterparts, they have underperformed the broader bond markets. Charts 3 & 4 illustrate how the Nordex and Vestas bonds have risen in yield and credit spread versus the Merrill Lynch Eur High Yield B-BB Bond Index (an index of higher risk European corporate bonds) and the Merrill Lynch EMU Non-Financial BBB Bond Index (an index of lower risk European corporate bonds).

While wind turbine manufacturer bonds have outperformed their equity counterparts, they have underperformed the broader bond markets. Charts 3 & 4 illustrate how the Nordex and Vestas bonds have risen in yield and credit spread versus the Merrill Lynch Eur High Yield B-BB Bond Index (an index of higher risk European corporate bonds) and the Merrill Lynch EMU Non-Financial BBB Bond Index (an index of lower risk European corporate bonds).

Neither bond has an official public credit rating. However, 4 gives us an indication of how the market perceives the credit worthiness of the bonds. The higher the credit spread, the higher the credit risk is perceived.

Neither bond has an official public credit rating. However, 4 gives us an indication of how the market perceives the credit worthiness of the bonds. The higher the credit spread, the higher the credit risk is perceived.

When the Vestas bond was originally issued, it was priced with a credit spread close to a low BBB bond, while the Nordex bond was closer to a BB rated bond. The market’s opinion of their credit worthiness has clearly deteriorated since then, with Vestas trading more in line with low single B bonds and Nordex with high single B issuers. The Vestas bond has underperformed Nordex since the latter or

iginally issued its bond in April 2011.

Corporate Bonder is a corporate bond fund manager in the London. This article first appeared on the Climate Bonds Initiative blog.