by Tom Konrad CFA

SunEdison is proposing something entirely new: a YieldCo with a focus on projects in Africa and Asia, but it’s a long way between an S-1 filing with the SEC and and IPO.

The June launch of SunEdison’s (SUNE) first YieldCo, TerraForm Power (NASD:TERP), transformed the parent company’s prospects. Now it wants to repeat the performance with a first-of-its kind YieldCo that will focus on investment in Africa and Asia.

A YieldCo is a publicly traded company that is formed to own operating clean energy assets that produce a steady cash flow, most of which is returned to shareholders in the form of dividends. Like many other renewable energy developers, SunEdison formed TerraForm Power in order to appeal to a pool of income-oriented investors who would never consider owning the company’s common stock. Such investors look for reliable income streams generated by existing businesses, and often won’t even consider buying stock in a company that does not pay a regular dividend.

The low interest rate climate over the past few years has made income-oriented investors, many of who rely on dividend payments to support current expenditures, increasingly desperate for yield and much more willing to enter new asset classes in order to find it. YieldCos and the renewable energy developers that formed them have been direct beneficiaries.

Arguably, no energy developer has benefited more from forming a YieldCo than SunEdison. Unlike large utilities that have formed YieldCos, includng NRG Energy, NextEra, Abengoa SA and TransAlta Corp., SunEdison does not have a history of profits and dividendimg

These utilities’ YieldCos, NRG Yield (NYSE:NYLD), NextEra Energy Partners (NYSE:NEP), Abengoa Yield (NASD:ABY), and TransAlta Renewables (TSX:RNW), appeal to investors who might have been interested in the parent companies’ stock, but like the higher yield and relatively greener assets offered by the YieldCo subsidiaries.

In contrast, SunEdison has never paid a dividend, and has not been profitable under generally accepted accounting principals (GAAP) since before 2011. On an adjusted basis (in which items deemed to be one-off by management are eliminated), the small profits in 2011 and 2012 were more than wiped out in 2013, and analysts expect losses to continue at least through 2015 (see the chart above).

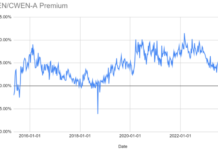

While the lack of earnings and dividends makes SunEdison’s stock unattractive to income investors, they have rushed to buy the stock of TerraForm Power. According to one estimate, investors are effectively paying $5 per watt for TerraForm’s projects when they buy the stock. When such projects are sold in private transactions, they typically fetch only $3 per watt, so TerraForm investors are willing to pay a 67 percent premium over the going market price.

SunEdison has a huge appetite for investor capital. According to its cash flow statements, the company has raised an average of $1.2 billion in debt and equity in each of the last three years. So it’s not surprising that after seeing the appetite of income investors for the mostly developed-market assets owned by TerraForm Power, SunEdison is hoping income investors will also be interested in projects in Asia and Africa.

To date, YieldCos hold a majority of their assets in the developed world, especially the U.S., Canada, and Europe. The reasons for this are simple: income investors consider the safety of a company’s income stream to be extremely important, and developed electricity markets offer long-term contracted power-purchase agreements.

In contrast, electricity markets and grids in Asia and Africa range from the state-controlled to the unreliable and even the nonexistent. The lack of reliable grid infrastructure in some Asian and African countries means that renewable power is often competing with electricity from diesel generators on price. The following slide is from a 2012 presentation by Christian Breyer of the Reiner Lemoine Institut. The green and yellow areas on the map denote places where the economics of displacing some diesel power generation with solar during the daytime is highly economical, even without subsidies. These areas have expanded as solar prices have fallen over the last two years.

Clearly, sub-Saharan Africa and Asia’s interior are both excellent prospects for solar from a purely economic standpoint, without any subsidies whatsoever. Indeed, the slide above shows that diesel subsidies serve to limit the number of countries in which replacing diesel with solar generation makes economic sense.

One problem is that these parts of Asia and Africa are better known for outbreaks of disease and terrorism than for the stable political and economic conditions that usually give rise to businesses producing reliable long-term dividends.

Perhaps SunEdison intends to focus on more stable parts of Asia and Africa, but that will make its projects more dependent on local political support to produce the reliable returns that income investors expect.

Either way, SunEdison is proposing something entirely new. From the perspective of using the power of markets to fight climate change, it’s entirely welcome. What remains unclear is if income investors are ready for the idea. If the new YieldCo can pay a dividend high enough to attract such investors despite the risks, it will be a big win for the planet and for SunEdison’s current shareholders.

***

Disclosure: Long RNW, Short NYLD.

This article was first published on GreenTech Media, and is republished with permission.