Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently consummated purchase of Terraform Power (NASD:TERP) and the soon to be completed purchase of its sister Yieldco (and Clean Energy Stock for 2016) Terraform Global (NASD:GLBL). The Canadian buying spree continued with Yieldco Innergex (TSX: INE and OTC:INGXF) buying Clean Energy Stock for 2012, 2013, and 2014 Alterra Power at a substantial premium.

Performance

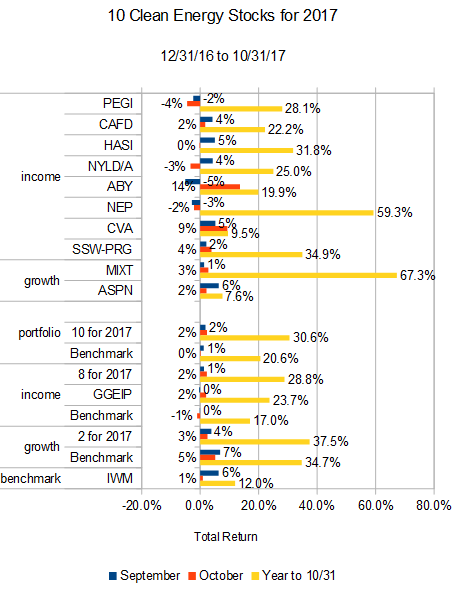

The two months were again good for clean energy stocks, with my growth benchmark PBW up 14.7% although my income benchmark YLCO fell 1.5%. My 8 income stocks did better (up 3.4%) while my two growth stocks lost some of their lead with a gain of only 7.7%. My managed income portfolio, the Green Global Equity Income Portfolio (GGEIP) rose 2.0%. The 10 stock model portfolio was up 4.3% compared to its blended benchmark, which was up 1.8%. For the year to the end of October, my two growth picks are up 37.5%, compared to their benchmark PBW which is up 34.7%. My 8 income picks are up 28.8%, GGEIP is up 23.7%, and their benchmark is up 17.0%. The 10 stock model portfolio is up 30.6% with its benchmark up only 20.6%.

The strength looks likely to continue with a number of companies reporting strong earnings in early November.

See the chart below for individual stock performance.

Stock discussion

Income Stocks

Pattern Energy Group (NASD:PEGI)

12/31/16 Price: $18.99. Annual Dividend: $1.63 (8.6%). Expected 2017 dividend: $1.64 to $1.67. Low Target: $18. High Target: $30.

10/31/17 Price: $23.02. YTD Dividend: $1.252 (6.6%). Annualized Dividend: $1.68. YTD Total Return: 28.1%

Wind-focused Yieldco Pattern Energy Group will report third quarter results on November 9th. The stock has been trading lower since an October offering of common stock at $23.40. It is typical for Yieldcos to trade down in the weeks after a secondary offering, but as long as the Yeildco can invest the proceeds to increase cash flow per share (and Pattern can), these offerings support growth of the dividend and boost the stock’s medium and longer term prospects. As such, buying after a secondary offering (even with the uncertainty of an upcoming earnings announcement) is often a good strategy.

Although I have a large position already, I took the opportunity to sell cash covered $22.50 puts on October 25th, effectively increasing my exposure to the stock.

8point3 Energy Partners (NASD:CAFD)

12/31/16 Price: $12.98. Annual Dividend: $1.00 (7.7%). Expected 2017 dividend: $1.00 to $1.05. Low Target: $10. High Target: $20.

10/31/17 Price: $15.02. YTD Dividend: $0.7931 (4.0%) Annualized Dividend: $1.088. YTD Total Return: 22.2%

Yieldco 8point3 Energy Partners continues to be the wallflower at the high school dance. Its sponsors First Solar (FSLR) and Sunpower (SPWR) continue to look for a buyer for their stakes. Rumors of possible partners have surfaced, and Sparkspread reported that “final bids” in the strategic review were due on October 16th. No offers have been made public, and the silence around the process makes it increasingly likely that the sponsors were not happy with any of the offers they received.

The stock peaked after an optinistic earnings call on October 4th at $15.73, but started to trend down as the lack of public bids slowly deflated the market. Earnings were good, with cash flow coming in ahead of expectations (including mine), but the worrying problem of lack of future growth and approaching debt refinancing in 2020 remain.

Hannon Armstrong Sustainable Infrastructure (NYSE:HASI).

12/31/16 Price: $18.99. Annual Dividend: $1.32 (7.0%). Expected 2017 dividend: $1.34 to $1.36. Low Target: $15. High Target: $30.

10/31/17 Price: $23.98. YTD Dividend: $0.99 (5.2%). Annualized Dividend: $1.32. YTD Total Return: 31.8%

Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its floating rate debt with fixed rate debt. The company has a 60-85% target for fixed rate debt as a portion of overall debt, but the recent issuance brought this ratio to 93%.

Since fixed rate debt bears a higher interest rate than short term debt, the increased interest payments reduced Core Earnings, and will likely do so for several quarters going forward. Although management insists that they are still looking at divided growth going forward, it now looks as if 2017 Core Earnings will be slightly below the current $1.32 per share annual dividend payment. The company has raised its dividend by at least 10% every December since it went public, but this December I expect the increase to be much more modest, probably by only 1 cent (3%) to $0.34 a quarter or $1.36 annually.

Over the longer term, however, the greater portion of fixed rate debt could be a springboard for future dividend growth. If interest rates continue to rise (as most analysts expect), the yields on Hannon Armstrong’s new assets will rise with them. With interest costs largely fixed, the spread between assets and liabilities will increase, leading to more rapid growth in future earnings.

The stock sold off and then quickly rebounded in response to this mixed earnings news. If I am right about a low dividend increase in December, the stock will likely sell off again. That should be a good entry point for long term investors who like the lower risk and potential for accelerating future growth in a rising interest rate environment.

NRG Yield, A shares (NYSE:NYLD/A)

12/31/16 Price: $15.36. Annual Dividend: $1.00 (6.5%). Expected 2017 dividend: $1.00 to $1.10. Low Target: $12. High Target: $25.

10/31/17 Price: $18.34. YTD Dividend: $0.81 (5.3%). Annualized Dividend: $1.12. YTD Total Return: 25.0%

Yieldco NRG Yield’s (NYLD and NYLD/A) parent, NRG Energy (NRG), like 8point3’s parents, continues looking for a buyer. So far, it too, remains a wallflower. While its valuation is not nearly stretched as 8point3’s, it’s not trading at a big discount to its value like the Terraforms. Atlantica, and Alterra were.

The Yieldco announced earnings on November second, and more importantly they increased guidance for 2017, and issued new guidance for 2018. In addition to raising their quarterly dividend to $0.288, management stated they had a target for increasing the dividend a further 15% in 2018 while maintaining an 80% payout ratio.

Lastly, they gave a timeline for understanding how NRG’s current restructuring will affect the Yieldco. “NRG Yield management continues to work closely with NRG on its transformation plan with the resolution of the portion of the transformation plan impacting NYLD expected to be announced by year-end 2017.” Even if there is no sale, we should know something more by the end of December.

The market reacted favorably to the news, most likely because of the improved 2017 guidance and newly issued guidance for 2018.

Atlantica Yield, PLC (NASD:ABY)

12/31/16 Price: $19.35. Annual Dividend: $0.65 (3.4%). Expected 2017 dividend: $0.65 to $1.45. Low Target: $10. High Target: $30.

10/31/17 Price: $22.38. YTD Dividend: $0.76 (3.9%). Annualized Dividend: $1.04. YTD Total Return: 19.9%

While it was Algonquin Power and Utilities that purchased a 25% stake in Atlantica Yield from Abengoa, rather than the previously rumored Brookfield, the fact that Atlantica had found a new sponsor was good news, and the market reacted favorably. While I’m generally more skeptical of the benefits of a strong sponsor than most analysts who follow Yieldcos, but I welcome the end of the uncertainty surrounding Abengoa’s stake.

One immediate benefit Algonquin might be able to bring to the table is helping Atlantica in negotiations with lenders for its Mexican ACT cogeneration plant. Abengoa’s bankruptcy put Atlantica in technical default on the loan supported by that facility, and, until Atlantica can negotiate some sort of waiver or forbearance with the lenders, it is not able to use any of the cash flow generated by the facility. With Algonquin as a new potential guarantor, Atlantica will have one more bargaining chip in these negotiation, or it may be able to refinance the debt entirely. That would pave the way to a large increase in the current quarterly dividend from $0.26 to $0.35 or more.

NextEra Energy Partners (NYSE:NEP)

12/31/16 Price: $25.54. Annual Dividend: $1.36 (5.3%). Expected 2017 dividend: $1.38 to $1.50. Low Target: $20. High Target: $40.

10/31/17 Price: $39.44. YTD Dividend: $1.10 (4.3%). Annualized Dividend: $1.57. YTD Total Return: 59.3%

Two months ago, I wrote “I no longer consider [NextEra Energy Partners (NEP)] to be attractively valued, had have sold all my positions.” The timing was fortunate, because their third quarter earnings on October 26th disappointed the market. The significant shortfall was attributed to extremely poor wind conditions. Despite this, the Yieldco raised its quarterly dividend $0.3925, and its outlook remains on track for continues 12% to 15% growth through 2022.

The stock sold off because of the bad quarter, but I’m not rushing in to buy since the decline was not large enough to bring it down to make it anything resembling a bargain.

Other Income Stocks

Covanta Holding Corp. (NYSE:CVA)

12/31/16 Price: $15.60. Annual Dividend: $1.00 (6.4%). Expected 2017 dividend: $1.00 to $1.06. Low Target: $10. High Target: $30.

10/31/17 Price: $16.23. YTD Dividend: $0.75 (4.8%) Annualized Dividend: $1.00. YTD Total Return: 9.5%

Waste-to-energy developer and operator Covanta Holding’s reported strong third quarter earnings. The results were buoyed by the commencement of operations at its new Dublin plant and a much stronger market for recycled metal.

I highlighted Covanta as an “excellent buying opportunity” in August, with recovering metals prices as a possible trigger for improved results. Even with the recent 14% advance over the last two months, I think the stock remains a good value. I expect the metals and waste markets to remain strong. One factor which might soon start increasing supply of municipal waste is China’s current refusal to take low-quality paper and plastic recycling that comes out of single-stream facilities. If no other taker for these materials can be found, both burn well in Covanta’s incineration facilities.

When I selected Covanta for this list, I highlighted Trump’s bias towards removing environmental protections and how that might benefit Covanta, if not the country or the world as a whole. EPA Administrator Scott Pruitt’s anti-science move to pack the agency’s science advisory board with industry representatives is a case in point. He has appointed Paul Gilman, chief sustainability officer of Covanta, as the new chair of the Board of Scientific Counselors, which reviews EPA’s in-house research. It could be worse, he could have appointed another coal company lobbyist.

Seaspan Corporation, Series G Preferred (NYSE:SSW-PRG)

12/31/16 Price: $19.94. Annual Dividend: $2.05 (10.3%). Expected 2017 dividend: $2.05. Low Target: $18. High Target: $27.

10/31/17 Price: $24.63. YTD Dividend: $2.05 (10.3%). Annualized Dividend: $2.05. YTD Total Return: 34.9%

In its third quarter report, leading independent charter owner of container ships Seaspan reported on continued improvement in the market for container ships. The company even managed to sell three ships it had bought last December at 140% of the December price. The unjustified discount at which the company’s preferred shares were trading last year has largely disappeared, although some room for improvement remains. Going forward, preferred shareholders are likely to see only modest capital gains, supplemented by a still generous preferred dividend.

While still a good value, Seaspan Preferred shares are no longer a steal. I have been selling some of my positions opportunistically to reduce my previously very large allocation, and have removed my hedge on Seaspan common stock. Going forward, I am considering reducing my exposure to the Preferred shares further and adding a position in the common shares. The latter still have potential for significant upside.

Growth Stocks

MiX Telematics Limited (NASD:MIXT).

12/31/16 Price: $6.19. Annual Dividend: $0.14 (2.3%). Expected 2017 dividend: $0.14 to $0.16. Low Target: $4. High Target: $15.

10/31/17 Price: $10.20. YTD Dividend: $0.124 (2.0%). Annualized Dividend: $0.192. YTD Total Return: 67.3%

Vehicle and fleet management software as a service provider MiX Telematics reported continued strong second fiscal quarter results on November 3rd. Subscription growth was a highlight, with subscription revenue growing 18% year over year, with approximately half of the growth from new subscribers and the other half from existing subscribers adding additional services. The rapid subscription growth is feeding in to improving profit margins, with Adjusted EBITDA margin hitting a new high of 25.1% compared to 18% a year earlier.

The company raised its guidance for both revenue and profit for the fiscal year ending on March 31, 2018.

I expect the stock will continue to advance over the short term.

Aspen Aerogels (NYSE:ASPN)

12/31/16 Price: $4.13. Annual Dividend and expected 2017 dividend: None. Low Target: $3. High Target: $10.

10/31/17 Price: $4.45. YTD Total Return: 7.6%

Aerogel insulation manufacturer Aspen Aerogels reported third quarter results on November 2nd. The company has succeeded in enforcing its patents through the International Trade Commission and the US Patent office. This is essential to the company’s long term strategy going forward, and the completion of these actions will also reduce the associated costs, which have dragged down results for over a year. There is a similar action in Germany which is expected to be resolved in the first part of 2018.

The company has been successfully executing on its strategy of diversifying end markets in the face of weakness in its core petrochemical and subsea markets during the recent oil price slump. This sets the company up for stronger growth as its core markets recover.

My Trades

Two months ago, my top picks and largest holdings were Seaspan Preferred, Covanta, and Atlantica. All have advanced significantly since then, but I still consider Atlantica and Covanta to be attractive. I have been taking some gains in Seaspan Preferred, and am considering reducing my allocation to the Preferred shares in order to invest in Seaspan’s common shares (SSW), which (at $6.45) still have significant potential upside in a recovering market.

Recent weakness in Pattern Energy Group is providing a decent entry opportunity for investors who do not yet have a significant position in the Yieldco. Potential investors in Hannon Armstrong should hold off, however, as I expect weakness around what I anticipate to be a disappointing dividend increase in early December, although the company’s prospects remain excellent for the longer term.

Final Thoughts

I entered 2017 with a very cautious attitude towards the prospects of the stock market. Both the stock market’s gains have so far exceeded my wildest expectations. Although a few attractive investments remain, I believe a cautious approach remain in order, and a wise use of this gains so far this year would be a move into cash.

Disclosure: Long HASI, MIXT, PEGI, NYLD/A, CVA, ABY, NEP, SSW-PRG, GLBL, TERP, BEP. TSX:AXY, INE, AQN. Long puts on SSW (an effective short position held as a hedge for SSW-PRG. Short calls on CAFD.)

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Are you worried at the possibility of solar tariffs as recommended by the US ITC? Any guesses how it might affect Atlantica, Hannon Armstrong, 8point3, Pattern, …?

Tariffs will raise costs for new developers, not for existing owners. Should have minimal effect on Yieldcos. As should possible cuts to the PTC in the Republican Budget for wind, if those come to pass.

Might this affect the pipeline from developers and the growth prospects of yieldcos?

Do you believe yieldcos to be sufficiently insulated?

I believe Yieldcos are not at risk from solar tariffs.

Hey Tom. Miss you on SA, curious if there is a site where you regularly post? Love to hear your thoughts on PEGI at these prices and if current tax issues in Washington will have a long to medium term impact (looks like the fear is causing a short term sell off)?

Hope you are well,

Russ

Just not writing as much recently. The main sites are here and GreenTech Media (most of the GTM articles make it here eventually.)

As for PEGI, I think “Buy”. If it does not recover a lot, it’s will be a 2018 top pick.

Hello Ton,

Will there be a ’10 clean energy stocks for 2018′?

Have enjoyed following the 2017 10!

Terry

Yes. I usually try to publish it around January 1st.