by Tom Konrad, Ph.D., CFA

Earnings Season Continues

Below are three more updates on second quarter earnings which I’ve been sharing with my Patreon supporters. If you’d like to support my writing and see those thoughts in a more timely manner, consider becoming a patron. becoming a patron.

For everyone else, I’m reprinting those thoughts below.

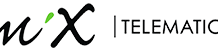

Waste to energy company Covanta Holding Corp (CVA) saw most of its business recovering towards the end of the second quarter. Management is reluctant to predict if the positive trend will continue into the third quarter and for the rest of the year, but I am optimistic because most of Covanta’s facilities are clustered mostly in the Northeast, where most states have been managing the pandemic relatively well.

The company is coping with lower prices for the scrap metal it sells, and lower demand for its environmental services unit (partially offset by lower operating costs in the division), and high costs for covid-19 safety measures.

The company is coping with lower prices for the scrap metal it sells, and lower demand for its environmental services unit (partially offset by lower operating costs in the division), and high costs for covid-19 safety measures.

Overall, Covanta seems to be in a good position with a stable business model. Its dividend cut and cost control measures seem more than sufficient to allow the company to deal with the impact of the pandemic, continue to invest in its growth initiatives, and chip away at its sizable debt.

Investors were pleased with Green Plains’ Partners’ (GPP) second quarter earnings.

Despite the massive downturn in the ethanol market caused by low gasoline prices and sales, GPP cash flow was basically flat from the year earlier due to its minimum volume commitment with its parent Green Palins, Inc. (GPRE).

With the recent dividend cut, dividend coverage was a very healthy 3.99x. However, dividend coverage will fall in the third quarter when GPP begins to make amortization payments on its refinanced loan. Those will amount to $2.5 million a month, lowering distributable cash flow by $7.5 million a quarter to $3.8 million. Had this amortization already begun, the coverage ratio would have been 1.34 times.

As I discussed in June when the loan was refinanced, Green Plains Partners will not have the leeway to raise its dividend above the current $0.12 per share until the loan is paid off at the start of 2022. Until then, investors should be satisfied with the current 6% yield and an improving balance sheet as the partnership pays down its debt.

The current 6% yield and the prospects of dividend increases in 2022 seem like more than enough reason to own the stock in the current environment.

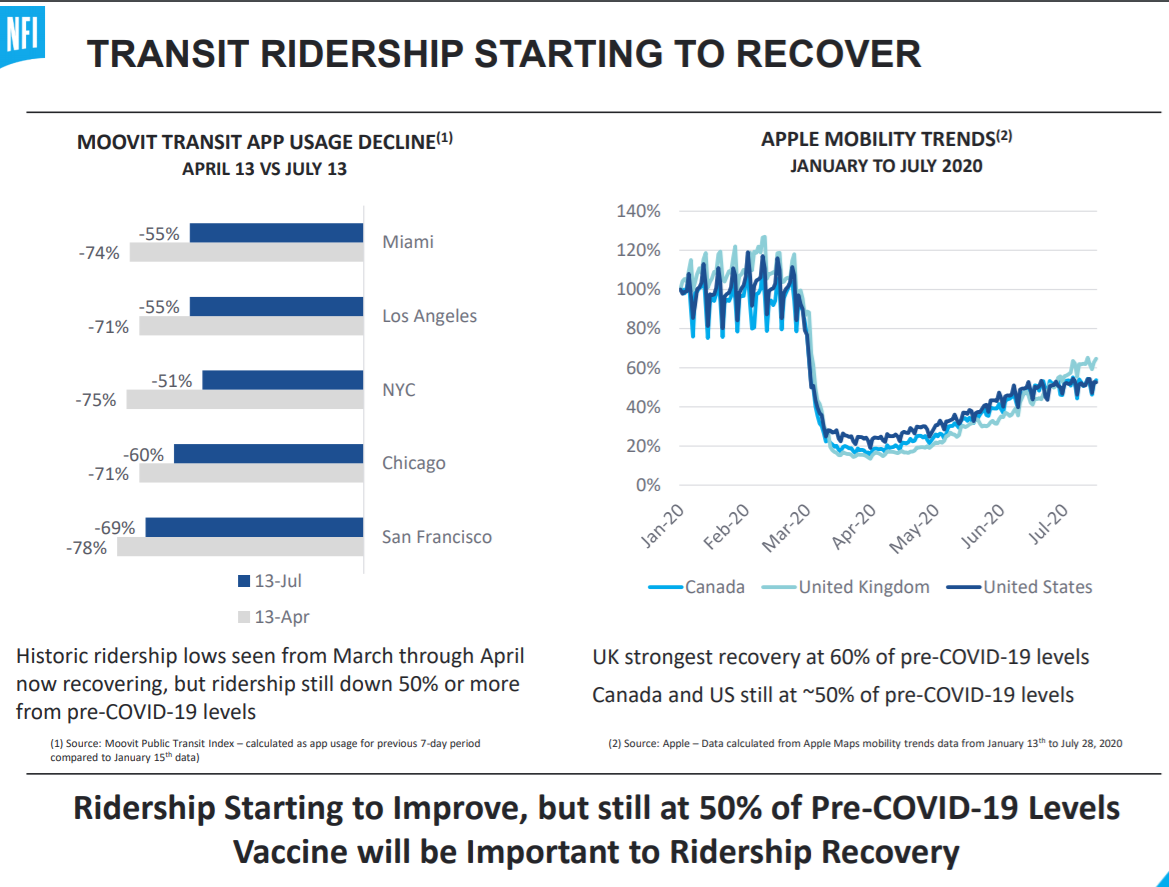

On July 28th I wrote that I was selling NFI Group (NFYEF, NFI.TO) because “I predict a bumpy road for NFI’s customers as transit and intercity coach ridership plummets in response to Covid.

The transit bus and coach manufacturer reported earnings on August 6th. As expected, bus ridership was down more than 50% during the second quarter, and is starting to recover slowly. Overall, NFI seems to be doing an excellent job navigating the crisis and maintaining liquidity. Bids from its transit customers remain mostly intact, although its private motor coach (aka intercity bus) orders have virtually dried up.

The transit bus and coach manufacturer reported earnings on August 6th. As expected, bus ridership was down more than 50% during the second quarter, and is starting to recover slowly. Overall, NFI seems to be doing an excellent job navigating the crisis and maintaining liquidity. Bids from its transit customers remain mostly intact, although its private motor coach (aka intercity bus) orders have virtually dried up.

While the company seems to be doing an admirable job managing the things it can control, it is at the mercy of what it can’t. Despite the current clouds over its industry, the company has a plan for managing through the crisis. Management believes the industry will recover, and “NFI will become an even more efficient market leader.”

I don’t doubt NFI’s ability to maintain market leadership, cut costs, and pay down debt. I continue to worry about the long term prospects of transit ridership and intercity bus ridership. Both will be with us to stay, but I believe that the pandemic will have lasting effects on people’s willingness to use all forms of collective transportation. In cities, I think the crisis will accelerate the trend towards smaller individual vehicles, like e-bikes and scooters, ride hailing like Uber (UBER) and Lyft (LYFT) and, eventually, small automated individual vehicles which will be available on-demand.

It is this secular change in my long-term outlook for transit that has me selling NFI at a loss today. If the stock continues to fall, I would definitely consider getting back in at a lower price in a year or two, once the long term prospects for collective transportation become clearer.

Disclosure: Long NFYEF, CVA, GPP, GPRE.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.