Understanding the Smart Grid

By Harris Roen The modernization of the electric grid is an exciting investment opportunity that promises to be one of the biggest energy investment stories of the early 21st century. Smart Grid systems will provide large growth opportunities for many companies around the globe. This is being accomplished through a combination of updating existing technologies along with the creation of new systems aimed at improving the quality of the electric grid. By understanding how the dream of a smart grid will become a reality, an informed investor will be in a very good position to...

Welcome To The New World

Perhaps ironically, it took one of the worst financial and economic crises of the past three decades to bring "the grid" into investor focus. To be sure, certain alt energy aficionados such as Tom have been on this topic for a long time (Tom is actually the one who introduced me to the grid as an investment theme). However, it is fair to say that most investors, including alt energy investors, have not historically paid the grid a huge deal of attention. That is because most people outside of alt energy and VC circles held, until recently, the Old...

2010: The Year of the Strong Grid? Part V: Hubbell Inc.

Tom Konrad, CFA Hubbell Inc. (HUB-B) is a strong grid stock that also has strong financials, signaled by a recent dividend increase. I came across Hubbell Inc. (HUB-B) when researching General Cable (BGC) for my recent article on the company. Just one more example of when you start researching a sector, (in this case electrical transmission and distribution, or "strong grid") you never know what new companies you may find. Hubbell is a diversified electrical supplier, serving electric utility, residential, commercial, and industrial markets worldwide. About a quarter (26%) of its revenue comes from the "Power...

Equus: A Solar Inverter Play For Free!

Equus Total Return (NYSE: EQS) is a closed-end fund that trades at a 42% discount to its net asset value (NAV). The fund invests primarily in both debt and equity instruments of small-caps and private companies. Each quarter, management must report the fair value of its net assets, but the stock market value of Equus is much lower than that of its net assets. Here's a chart showing Equus' discount to its net assets for the last five years: As we can see, Equus is used to trading at a discount to its NAV, but...

Bold or Bogus? Digi International’s Move toward Smart Grid Technology

Research Analyst Bucks NaysayersBy Joyce Pellino CraneJay M. Meier may be out on a lonely limb, but the senior research analyst at Feltl and Company is unwavering in his enthusiasm for Digi International, Inc. (Nasdaq:DGII)Meier is recommending Digi as a buy, insisting that the company is undervalued given its potential for growth in the smart grid sector.“The company is woefully undervalued,” he said, “and it’s probably going to start growing in the second half of 2010 as evidenced by all the smart grid technology it has...”But other research analysts are not so sure. I spoke with two who...

List of Electric Grid Stocks

Electric grid stocks are publicly traded companies whose business involves electric infrastructure, including transmission, distribution, pricing, conversion, and regulation. Includes the list of smart grid stocks.

This article was last updated on 8/12/21.

ABB Ltd (ABB)

Advanced Energy Industries (AEIS)

AMSC (AMSC)

Avangrid, Inc. (AGR)

AZZ Incorporated (AZZ)

China Ruifeng Renewable Energy Holdings Ltd (0527.HK)

Companhia Paranaense de Energia - COPEL (ELP)

Custom Truck One Source, Inc. (CTOS)

Digi International (DGII)

Echelon Corporation (ELON)

EMCORE Group, Inc (EME)

ESCO Technologies, Inc. (ESE)

Fortis, Inc. (FTS, FTS.TO)

General Electric (GE)

Hammond Power Solutions Inc. (HPS-A.TO, HMDPF)

Hubbell, Inc. (HUB-B, HUB-A)

Itron (ITRI)

Landis+Gyr Group AG (LAND.SW)

MasTec Inc. (MTZ)

MYR Group Inc. (MYRG)

National Grid PLC (NGG)

Prysmian S.P.A (PRI.MI, PRYMF)

Quanta Services Inc...

The Electric Grid Index

Charles Morand A little while ago, we received the following request from a reader: " when are you going to start an ETF or mutual fund called "Energy TS&E". T for transmission, S for storage, and E for efficiency. I guess you need an index first. I'm thinking Quanta, Amer Superconductor, Exide, Axion, Itron, Echelon, etc. There is no good one stop shop for this subsector. Sign me up." While we don't plan on launching a licensable index or a mutual fund because of all the regulatory thicket we'd...

Energy Storage on the Smart Grid Will Be 99.45% Cheap and 0.55% Cool

7.17.09 Storage Week John Petersen Infocast’s Storage Week was all I had hoped it would be, and more. While I thoroughly enjoyed serving on three discussion panels and was warmly received by roughly 250 attendees, including executives of companies that I've occasionally criticized, the most important value for me came from the opportunity to hear four days of high-level presentations by industry executives, national thought leaders and policymakers who repeatedly stressed that: From a utility perspective grid-based energy storage is the functional equivalent of an instantly...

Comparing Electricity Storage and Transmission

Electricity Storage and Transmission are naturally complementary, and more of both will be needed. But given limited time and resources, where should those of us who want to see as much renewable electricity on the grid as soon as possible concentrate our efforts? The choice is not immediately clear. Dennis Ray, ED of Power Systems Engineering Research Center (PSERC) was quoted as saying “Regardless of contractual arrangements that are subject to environmental regulation, the ultimate dispatch pattern that will determine the actual emissions is largely dependent on transmission constraints and reliability considerations.” Horses for Courses At a basic...

EESAT And Energy Storage Opportunities On The Smart Grid

John Petersen Last week I appeared as a luncheon speaker at EESAT 2009, a biennial international technical conference sponsored by the DOE, Sandia National Laboratories and the Electricity Storage Association that focuses on storage technologies for utility applications. The conference included dozens of high-level technical presentations from storage technology developers and was far and away the best-organized event I've ever attended. The only notable absence was a large contingent of buyers, which left some participants wondering whether they were preaching to the choir. Nevertheless, I was encouraged by rapid growth in the number and size of utility-scale demonstration...

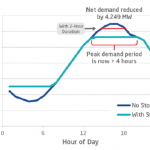

Demand Planning: The Future of Demand Side Management

Electric utilities have a process by which they project future expected demand for electricity, and then find resources, either new electric generation or energy efficiency (Demand Side Management, or DSM) resources to meet that expected demand, or reduce that demand. Progressive utilities and utility regulators now include DSM among the mix of resources as a matter of course. According to Martin Kushler, of the American Council for an Energy Efficient Economy (ACEEE) who spoke at the Southwest Regional Energy Efficiency Workshop about an upcoming report from ACEEE, DSM resources cost an average of 3 cents per kWh of energy...

Fending Cyber Threats with a Fortress

RuggedCom Fortifies the Smart Grid and Captures the Substation Market By Joyce Pellino Crane I wonder how many utility executives lie awake at night worrying about cyberthreats to their electricity substations. If you’ve ever gone a few days without electricity in your home, you’ll quickly realize how minimal life becomes. Working on your computerthe speedway to higher thinking and creativity is impossible. Watching television, charging your cell phone, keeping food frozen, and micro-waving popcorn, can no longer be done. Every task requires planning and, much more physical laborconsider what it would take to wash and...

Powering Advanced Energy

by Debra Fiakas CFA Solar power producers have many challenges. One is the direct current to alternating current dilemma. Solar panels create power that flows one way in a direct current (DC). We use electricity in our homes and businesses in alternating current (AC) that flows both directions, forward and backward. So solar cell producers must use solar inverters that convert the electricity from the direct current in the solar panel into alternating current. This is where Advanced Energy Industries, Inc. (AEIS: Nasdaq) comes in. AEIS makes power inverters for the solar power industry. The...

When Will Solar Microinverters Reach Commercial Scale?

Microinverters are being used in smaller commercial solar installations, but the industry is in flux and coming regulations may drastically change the playing field.

Clean Energy Stocks to Fill the Nuclear Gap

Tom Konrad, CFA If the Japanese use less nuclear power, what will take its place? I'm astounded by the resilience and discipline of the Japanese people in response to the three-pronged earthquake, tsunami, and nuclear disaster, perhaps in large part by my cultural roots in the egocentric United States, where we seem to have forgotten the virtue of self-sacrifice for the greater good. Yet while Japanese society has shown itself to be particularly resilient, the Japanese electric grid is much less resilient. According to International Energy Agency statistics, Japan produced 258 TWh of electricity from...

Democratizing the Grid

by Daryl Roberts

In a previous article I investigated the question of whether private sector capital was being stimulated sufficiently enough to build out renewable infrastructure on pace to reach climate goals. I found that on the upper end, giant institutional funds were only mobilizing a tiny fraction of their total Assets Under Management, due to regulatory constraints and uncompetitive yields. On the lower end, smaller scale funding seemed to be growing, with facilitation from intermediaries, fintech aggregation services, and increased access at lower levels to complicated derisking strategies.

But I now find reporting that capital is over-mobilized, that solar may...