Will LED Stocks Follow Solar Stocks Over the Commoditization Cliff?

Tom Konrad CFA One irony of green investing is that doing good (for the planet) does not always do well for investors. Recently the rewards for do-gooders have been abysmal. For years, I've been warning that the rapid price reductions we need to make solar mainstream are unlikely to be good for the profits of solar companies. This year a combination of subsidy cuts in Europe and photovoltaic (PV) module oversupply brought those price reductions home to roost. Recently, PV ...

Energy Recovery Offers Savings to Gas Industry

by Debra Fiakas CFA

In early December 2014, Energy Recovery (ERII: Nasdaq) staged an analyst and investor event in New York City principally to introduce its most recent technology innovation, VorTeq. The product is a hydraulic fracturing solution for the gas industry. Unlike its other products, the VorTeq is a colossal apparatus requiring a semi-tractor to transport it into place as a replacement for the ‘missiles’ now found at natural gas well sites.

VorTeq Animation

In the current configuration, high pressure pumps are used to drive a blend of fracturing sand, water and chemicals down into the well hole. Pump components,...

Why I’m Selling Rockwool

Tom Konrad CFA Photo: Cubes made of rockwool for indoor cannabis cultivation by D-Kuru/Wikimedia Commons. While some users may use Rockwool insulation to grow their highs, the recent highs in the stock price have led me to sell part of my holdings. Earlier this year, I bought Rockwool International A/S (COP:ROCK-B, OTC:RKWBF) with the intention of holding it for the long term. I chose Rockwool because it was expanding in the US, provides excellent international diversification, has a strong balance sheet with no net debt, and (not least) is a leader in...

Lime Energy: Delivering Energy Efficiency

Tom Konrad CFA The high upfront cost of efficient buildings (and efficiency in general) is more than offset by the significant long term rewards, as you can see from the McKinsey chart below. Despite the long term benefits, the upfront cost is often a barrier, especially to government entities in today's tight budgetary environment. Performance contracting offers them a way to square the circle between the long term budget benefits of efficient buildings and the often significant capital cost. This works by funding the capital improvement with debt secured by future energy savings. An...

A Clean Energy REIT: Hannon Armstrong Sustainable Infrastructure

Tom Konrad CFA On April 18th, Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI) IPOed on the New York Stock Exchange. HASI is one of only two publicly traded Real Estate Investment Trusts (REITs) dedicated to sustainable infrastructure. The other such sustainable REIT is Power REIT (NYSE:PW), which I have written about extensively. PW is both illiquid and involved in significant litigation, two factors which may put off the conservative investors who gravitate towards REITs. In December, Power REIT purchased the land...

Put the LIME in the Coconut

by Debra Fiakas CFA You put the lime in the coconut and call the doctor woke him up, I said Doctor! Is there nothing I can take, I said Doctor! To relieve this bellyache… -Baha Men It is best to avoid corporate drama that involves unexpected resignations and unscheduled week-end board meetings. At least that is my view. However, the company soap operas can be entertaining, so I decided to tune into the Lime Energy, Inc. (LIME: Nasdaq) saga . Based in North Carolina, Lime provides a menu of energy-saving solutions to utilities and large-facility owners. Lime's product...

When Contrary Pays

Debra Fiakas Power One (PWER) looks like a promising contrarian play. It is a scenario that has plays out quarter after quarter. A leading company in popular sector reports decent results, but surprises investors with guidance below the prevailing consensus. Then the stock price crashes as sell-side analysts cut estimates, price targets and ratings. It is a situation that many investors fear as they see once profitable stock positions lose value. Not the contrarian investor! There are potential profits to be made for the obstinate, but fearless investors willing to do their homework. This...

Clean Energy Stocks Shopping List: Five Energy Efficiency Stocks

Stocks may be expensive now, but they won't be forever. Five energy efficiency plays to buy when they're cheap again in efficient HVAC, desalination, thermal imaging, and lighting. Tom Konrad, Ph.D., CFA This article continues my Clean Energy Stocks Shopping List series. In the first, I looked at five clean transport stocks I'll be looking to buy when the market falls. In the second, I took a step back, and outlined why it makes sense to wait for better prices than to buy these companies now. Here are five stocks I'll be looking to buy in my all time...

Power Integrations: Profiting from Efficient Electronics

Tom Konrad, CFA With new climate legislation or a renewable portfolio standard unlikely now that Republicans control the US House of Representatives, progress on clean energy is likely to come mostly from action at the state level, and from regulation at agencies such as the EPA, rather than national legislation. Why Energy Efficiency Standards Make Economic Sense One type of regulation that is fairly uncontroversial is improving energy efficiency standards, that is regulation of the amount of energy an appliance or other device can consume during normal use. In an efficient market, regulation might bring...

Obama’s Next $2 Billion For Energy Efficiency: How To Take The Money And Run

By Jeff Siegel It's all about the money. I don't care how you slice it when it comes to investing, personal politics are irrelevant. This has long been how I've approached wealth creation, and it works quite well. Even as I denounced the continued reliance on outdated and economically inferior energy and transportation systems (i.e. the internal combustion engine and tar sands production), I make no apologies for profiting from new opportunities in fossil fuels. My gains in shale over the past few years alone are reason enough to stick to this strategy. Of course, when I'm given...

The Pure Technologies Takeover of Pressure Pipe Inspection Company

Tom Konrad CFA In February, I published an interview with Sam Healey portfolio manager at Lamassu Holdings about Pure Technologies (PUR.V, PPEHF.PK), a company that can find and repair leaks in water systems without shutting down the system. Last week, Pure Technologies announced that it intended to acquire Pressure Pipe Inspection Company for cash and stock worth as much as C$34.9 million. The market's reaction was initially positive with PUR.V gaining C$0.29 on Wednesday, the day following the announcement, but most of these gains were given back on Thursday and Friday. My initial feeling is that this...

Ten Solid Clean Energy Companies to Buy on the Cheap: #1 Johnson Controls, Inc....

Johnson Controls (NYSE:JCI) has long been one of my favorite energy efficiency picks, with an added bonus coming from their joint venture with Saft to produce batteries for hybrid and electric vehicles. They have also shown some energy saving innovation making parts for auto interiors. Building EfficiencyEfficient buildings are much more complex than simply replacing inefficient HVAC and lighting with more efficient versions. Quite often, the most cost effective measures come from using systems more efficiently. As an analogy to the home, look at any list of quick tips for energy saving around...

The WGA Energy Efficient Buildings Workshop

The WGA Energy Efficient Buildings Workshop: Overview The Western Governor's Association (WGA) held a two day workshop in Denver on July 17 and 18. Colorado's Governor Bill Ritter kicked off the workshop (with a slightly late start due to the shooting of a deranged gunman outside his office on July 16.) The workshop was a step towards achieving the WGA Clean and Diversified Energy resolution which includes a call for a 20% increase in Energy Efficiency in their states by 2020. I attended because I believe: Energy Efficiency can and will do more to meet the challenges...

What Do CPV and LEDs Have in Common?

I recently attended the Optoelectronic Industry Development Association's (OIDA) "Green" Photonics Forum. Unlike dirty industries trying to appear green, the Optoelectronics industry does not really have to try to be green. Two prominent examples familiar to clean energy investors are Concentrating Photovoltaic Solar (CPV) (i.e. using optics to focus light on high efficiency solar cells) and Light Emitting Diodes (LEDs). The presentations on Tuesday focused on the above technologies, and I was struck by a common problem faced by both: heat dissipation. According to Sarah Kurtz, a National Renewable Energy Laboratory scientist leading the team working on high-efficiency, multi-junction...

Can Investors Recover Faith In Energy Recovery?

by Debra Fiakas CFA

Despite reporting the highest gross profit margin in Energy Recovery's (ERII: Nasdaq) history, investors were sorely disappointed with financial results in the Company’s second quarter ending June 2017. On the first day of trading following the earnings release the share price gapped downward and closed even lower under above average trading volume. This is likely because there was some expectation that Energy Recovery could finally report a net profit in the quarter as sales of the Company’s flagship PX Pressure Exchanger to the desalination market had appeared to pick up in recent months. Unfortunately the Company reported...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

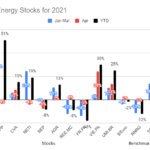

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...