List of LED Lighting Stocks

LED lighting stocks are publicly traded companies involved in the manufacture or deployment of efficient LED lighting technology.

AIXTRON SE (AIXA.DE)

Acuity Brands (AYI)

Amtech Systems Inc (ASYS)

Applied Materials (AMAT)

Carmanah Technologies Corporation (CMH.TO, CMHXF)

Cree, Inc. (CREE)

Energy Focus (EFOI)

EPISTAR corporation (2448.TW)

Koninklijke Philips N.V. (PHG)

Lighting Science Group Corporation (LSCG)

Lime Energy (LIME: Nasdaq)

LSI Industries Inc. (LYTS)

Orion Energy Systems, Inc (OESX)

Osram Licht AG (OSAGF, OSR.DE)

Neo-Neon Holdings Limited (1868.HK)

Revolution Lighting Technologies, Inc. (RVLT)

Rubicon Technology, Inc. (RBCN)

SemiLEDs Corporation (LEDS)

Trans-Lux Corporation (TNLX)

Universal Display(OLED)

Veeco Instruments Inc. (VECO)

Zumtobel Group (ZMTBF: OTC or ZAG.VI)

If you know of any LED lighting stock that is not listed here and should be, please let us know...

Five Green REITs

by Tom Konrad Ph.D., CFA

Why Green Buildings are Profitable Buildings

Buildings are responsible for approximately a third of greenhouse gas emissions, so making buildings more efficient and switching them to renewable sources of energy is an essential part in addressing climate change.

Fortunately, new technologies such as cold climate heat pumps, heat pump water heaters, induction stoves, as well as the ever falling cost of renewable electricity and improvements to insulation and building envelopes often provide opportunities to improve buildings while achieving extremely attractive investment returns from the energy and maintenance savings alone.

Because of the great financial returns, building owners who...

List of Energy Efficiency Stocks

Energy efficiency stocks are publicly traded companies using a wide range of technologies to deliver the same energy services using less energy in the built environment. This includes efficient lighting such as LED lighting stocks, insulation, efficient motors, efficient appliances and appliance replacement services, sensor and control technologies, the internet of things, efficient power conversion and generation, and energy efficient design, construction, and retrofits.

See the list of efficient vehicle stocks and alternative transportation stocks for companies reducing energy used in transportation.

This list was last updated on 7/20/2022.

Acuity Brands(NYSE:AYI)

AIXTRON SE (AIXA.DE)

Ameresco, Inc. (AMRC)

Appliance Recycling Centers of American (ARCI)

Aspen Aerogels, Inc....

Analyzing Greystone Logistics

by Roel Aerts

Greystone Logistics (GLGI) designs and manufactures plastic pallets for the logistics industry. They use recycled plastic which would otherwise be destined for landfill. They grind and pelletize the plastic in house. Injection molding and proprietary resin blend is used to manufacture the pallets.

Greystone is headquartered in Oklahoma and has its manufacturing plant in Iowa.

Recent results and Financials

· The company had invested heavily in manufacturing equipment several years ago, that loaded them with quite some debt. Over the last years they worked on a massive reduction in debt. In 2 years they reduced it from 21.6M$ to 9.4M$...

Wind and Heat Pumps: A Winning Combination

This article has been cross-posted on The Oil Drum. Last month, I brought you some nice maps showing when and where good wind resources are found in the US. Now I've found something better: a visual comparison of electrical load with wind farm production, published by the Western Area Power Administration in 2006. The study compared electricity production from five wind farms in Northern Colorado, Southwestern Nebraska, and Central Wyoming in 2004, 2005, and the start of 2006, compared with electricity consumption in the same area over the same time period. Comparison of Wind Production to...

Atlantica Q1, Buying Hannon Armstrong

By Tom Konrad, Ph.D., CFA

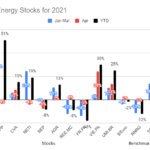

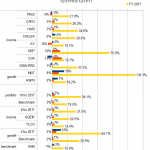

Here are two more updates from last week on Patreon. Also, I realize I neglected to publish the monthly performance chart for my 10 Clean Energy Stocks model portfolio here at the start of the month, so here it is as well:

Atlantica Sustainable Infrastructure Earnings

(published May 11th)

Atlantica Sustainable Infrastructure (AY) released its first quarter earnings announcement and financial statements on May 6th.

Atlantica is one of the higher yielding Yieldcos, 5.3% at the new quarterly dividend rate of $0.43 and a $32.50 stock price. The dividend is safe, since most of Atlantica's debt is fixed rate,...

Can Investors Recover Faith In Energy Recovery?

by Debra Fiakas CFA

Despite reporting the highest gross profit margin in Energy Recovery's (ERII: Nasdaq) history, investors were sorely disappointed with financial results in the Company’s second quarter ending June 2017. On the first day of trading following the earnings release the share price gapped downward and closed even lower under above average trading volume. This is likely because there was some expectation that Energy Recovery could finally report a net profit in the quarter as sales of the Company’s flagship PX Pressure Exchanger to the desalination market had appeared to pick up in recent months. Unfortunately the Company reported...

See You Later, Hannon Armstrong

by Tom Konrad Ph.D., CFA

Sustainable infrastructure financier Hannon Armstrong (NYSE:HASI) is not in my Ten Clean Energy Stocks model portfolio for the first year since its IPO in 2013. I still love the company and its business model, but I have become concerned about its short term prospects.

Dividend Disappointment?

In my last update on the 2017 portfolio, I wrote,

“Sustainable infrastructure and clean energy financier Hannon Armstrong reported earnings on November 1st. The headline numbers were lower than expected, but for a very good reason. The company has spent the last few months locking in low interest rates by refinancing its...

The Big Win You Missed

by Tom Konrad, Ph.D., CFA

My friend Jan Schalkwijk, CFA of JPS Global Investments just asked me if I had any thoughts on Kontrol Energy (KNR.CN, KNRLF), a Canadian smart building firm I had never heard of. (I just added it to AltEnergyStocks.com's Energy Efficiency and Smart Grid stock lists.)

The stock had just shot up after the client sold and went on a kayaking trip. It had disclosed a sensor for detecting COVID-19 from the air.

While I didn't have anything to say about the company, I did have some thoughts on dealing with the emotions around missing out. Since it's...

Hannon Armstrong Declines to Raise Dividend, Sets 3 Year Guidance

Investors did not like Hannon Armstrong's (NYSE:HASI) fourth quarter earnings announcement last night. While core earnings were a little weaker than expected, that is not what has the stock trading down 11% today. What shocked investors is the fact that the company did not raise the dividend this year for the first time since the REIT went public, and it gave 3 year guidance which likely disappointed many investors.

Last month, I wrote,

I expect that Hannon Armstrong will continue to be a well run and conservative business in 2018, and that management will raise the dividend at the lower end...

Bargain Priced Alternative Energy Stocks

A review of Crystal Equity Research’s novel alternative energy indices found a number of companies that have delivered exceptional price appreciation over the last year. Several were reviewed in the recent post “Alternative Returns” on May 8th. Expectations for growth appeared to be driving the price movement, so the last post “Quest for Growth” featured four companies from the indices for which analysts have posted high growth predictions. Not unexpectedly some investors have already bid higher the stocks of those promising companies.

In this post we go back to the lists to find the companies with both high growth predictions and low price-earnings...

What A Portfolio Approach To Climate Policy Means for Your Stock Portfolio

Portfolio theory can lend insights into which carbon abatement strategies policymakers should pursue. If policymakers listen, what will it mean for green investors? Tom Konrad, Ph.D., CFA Good Info, Not Enough Analysis I've now read most of my review copy of Investment Opportunities for a Low Carbon World. The quality of the information is generally excellent, as Charles has described in his reviews of the Wind and Solar and Efficiency and Geothermal chapters. As a resource on the state of Cleantech industries, it's generally excellent. As an investing resource, however, it leaves something to be desired. Each chapter is written...

How Geothermal Heat Pumps Can Soar Like Solar

Tom Konrad CFA Geothermal Heat Pumps (GHP) are a niche market. They shouldn’t be. Disclosure: Long WFIFF, short LXU puts (a net long position.) A Better Mousetrap? Ralph Waldo Emerson never said “Build a better mousetrap, and the world will beat a path to your door.” The mousetrap that likely inspired the misquote was invented seven years after his death. Unfortunately, many people take it literally. GHPs have all the hallmarks of a better mousetrap: They do the job of heating and cooling a building more efficiently than any other option. Despite...

The Alternative Energy Fallacy

John Petersen In 2009, the world produced some 13.2 billion metric tons of hydrocarbons, or about 4,200 pounds for every man, woman and child on the planet. Burning those hydrocarbons poured roughly 31.3 billion metric tons of CO2 into our atmosphere. The basic premise of alternative energy is that widespread deployments of wind turbines, solar panels and electric vehicles will slash hydrocarbon consumption, reduce CO2 emissions and give us a cleaner, greener and healthier planet. That premise, however, is fatally flawed because our planet cannot produce enough non-ferrous industrial metals to make a meaningful difference and the prices...

The Basics of Residential Clean Energy For Realtors and Homeowners

Note: The following is a handout written by AltEnergyStocks Editor Tom Konrad at the request of a leading local Realtor where he lives in Ulster County, NY. It is intended as a handout that local Realtors can give to new homeowners who express an interest in reducing their home energy use and using renewable energy. Some of the information and may not be applicable if you live in other areas because of varying climate, energy costs, and regulation. While most of the locally specific has been removed from this version, and the remainer is broadly applicable, homeowners in other...

Climate Change & Corporate Disclosure: Should Investors Care?

Charles Morand On Monday morning, I received an e-copy of a new research note by BofA Merrill Lynch arguing that disclosure by publicly-listed companies on the issue of climate change was becoming increasingly "important". The note claimed: "e believe smart investors and companies will recognize the edge they can gain by understanding low carbon trends." I couldn't agree more with that statement. It was no coincidence that on that same day the Carbon Disclosure Project (CDP), a non-profit UK-based organization that surveys public companies each year on the state of their climate change awareness, was...