A new investment architecture is set to emerge

By John Fullerton and Tim MacDonald

Stock markets are not as portrayed on TV, the nerve center of capitalism. Stock markets are nothing more than tools to facilitate the exchange of stock certificates that represent contractual rights that have little to do with real ownership. Today’s stock markets are primarily about speculating on the future prices of stock certificates; they are largely disconnected from real investment or what goes on in the real economy of goods and services. It’s time for real investors such as pension funds and endowments to reconnect with business enterprise in long-term relationship through a new investment architecture: the Evergreen Direct Investing (“EDI”) method.

Stock exchanges were originally conceived for the public interest and had a clear public purpose: to allow companies to raise equity from a large pool of investors and to provide a market for investors to later sell their shares in those companies. The promise of a liquid secondary market lowered the cost of that equity to enterprise thereby increasing economic growth and, theoretically at least, shared prosperity.

But capital formation is only a small part of what happens on stock markets today. Yes, successful stock offerings provide the avenue for venture capitalists to recycle investments made in private markets back into new, innovative young enterprises. But it is short-term speculation in stocks, aided by the increased speed of information flow, that has grown like a cancer into a big business of little real value and now dominates stock market activity.

Too-big-to-fail bank (and whale-scale speculator) CEO Jamie Dimon extols liquid capital markets as one of America’s greatest strengths in his latest letter to shareholders. But many who sing the praises of market liquidity are more often than not just self-interested speculators. Indeed, recent history has shown that our world leading liquid markets are as well the source of extreme global instability with dire and ongoing consequences. Nonetheless this trader ideology remains stubbornly at the heart of our short-term-obsessed finance capitalism which, left unchecked, surely will lead us to economic, social, and ecological collapse.

Six reasons combine to make our equity capital markets no longer fit for purpose:

- The privatization of stock exchanges, destroying their public purpose mandate and instead making the growth of trading volume their single-minded goal and high-frequency traders (computers programed to trade) their preferred customers;

- The unrestrained technology arms race in computing power combined with the adoption of technology-driven information flow spurring the rapid acceleration of trading volume, which at critical times can be highly destabilizing;

- The misguided ascent of “shareholder wealth maximization” (at the expense of all other stakeholder interests) in our business schools, board rooms, and the corporate finance departments on Wall Street;

- The well-intended but equally misguided practice of using stock-based incentives, and stock options in particular, as the dominant form of senior management compensation, which incentivizes them to focus only on short-term results at the expense of the long-term health of the enterprise, people and planet;

- The misalignment of interests between short-term focused Wall Street intermediaries and real investors such as pension funds whose timeframe should be measured in decades;

- Regulators’ lack of courage and confidence to counter the trader-driven paradigm and institute substantive structural reform such as a Financial Transactions Tax and other reforms that would penalize excessive speculation while incenting long-term productive investment.

Rather than limit themselves to this deeply flawed system, real investors can build direct relationships with enterprise in negotiated, innovative, mutually beneficial partnerships that are truly aligned with both parties’ long-term goals including the harmonization of financial, environmental, social, and governance imperatives.

The Evergreen Direct Investing Method

Private direct investment in enterprise (in contrast with trading in the stock market) with a long investment horizon, even an “evergreen” horizon, is nothing new. As described in detail in Capital Institute’s fifth installment of its “Field Guide to Investing in a Regenerative Economy,” the EDI method enables long-term investors like pension funds to share in the cash flows of mature stable businesses. Financial returns are earned through these planned cash distributions rather than through a hoped-for sale of the stock at a higher price than originally purchased. Stakeholder interests can be truly aligned, with environmental and social, and governance values negotiated into the partnership up front.

EDI investors will want to target mature, stable, low-growth businesses, often unappreciated by growth-obsessed equity capital markets. They will thus disprove the myth that growth at the expense of the environment or employees is the only path to adequate financial returns. The cash flows of mature, stable businesses may not exhibit the (in our view often unsustainable) growth characteristics equity investors have been trained to desire, but they are far more dependable sources of financial return than speculation-driven capital markets. That resiliency is what stewardship investors will value most in an increasingly uncertain future with growing resource and fiscal constraints hampering economic growth, particularly in the developed economies.

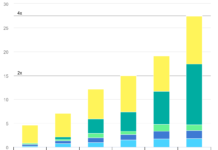

In fact, investing in mature, low growth sectors in which companies pay out rather than retain most of the cash flow they generate (energy infrastructure MLPs, REITs, utilities) is a proven formula for dependable, long-term investment success as the table below reveals:

While the EDI method involves taking businesses or subsidiaries of public companies private, its returns to the investor are not conditional on sales. It thus differs significantly in approach and intention from conventional highly leveraged and therefore less resilient, exit-driven private equity with its excessive fees.

Can EDI be scaled up as an alternative vehicle for investment in large, mature businesses of the mainstream developed economies, while also providing a more effective way to embed ESG values into their investments and the economy in aggregate? It will require a fresh look with a critical eye at the failed promise of modern portfolio theory, and the self-serving interests of our short-term-driven Wall Street trading paradigm.

This is the great promise of Evergreen Direct Investing.

Earlier versions of this post previously ran on The Guardian’s Sustainable Business Blog and on Capital Institute’

s Future of Finance Blog.”

John Fullerton is the founder and president of Capital Institute, and a recognized New Economy thought leader. He is also a leading practitioner of “impact investment” as the principal of Level 3 Capital Advisors, LLC. He was previously a Managing Director of JPMorgan, where he worked for over 18 years.

Tim MacDonald, Capital Institute Senior Fellow, is a theorist-practitioner in the evolving new field of purposeful investment by stewardship investors, and the principal architect of the Evergreen Direct Investing method. He was previously a tax partnership lawyer.

First off I signed in with facebook. There it defaults to “we would like to post using your facebook account” which I thought if I said no to I would not be able to login. Do you guys know the login process is so intrusive?

Now the reason I wanted to post was to say thank you for such a good article. I’ve been saying much the same thing for years. It now seems the best thing about the stock market is that it generates interest in low latency routing through the internet so computerized trading can be completed a millisecond faster than another computer being routed through another country. The bad part is the tail is wagging the dog. Successful companies are often successful only because they manipulate the stocks so they have money to do as they please, that is dominate, and then they become successful in the actual market place. It should be the other way around. And the ones that are the other way around often end up failing because they don’t know how to woo the market and so the market destroys them with short term quarterly profit demands.

Sorry you found the login process so intrusive. If you sign up for an account with us, we don’t require more than an email address.

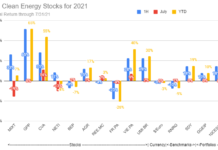

I’m not quite as pessimistic as John & Tim (the authors) but I agree with them that the best stock market investments are the infrastructure cos that are currently raising $.

I actually “met” them because I interviewed them for my article on the subject: http://www.altenergystocks.com/archives/2013/05/does_buying_green_stocks_do_any_good.html