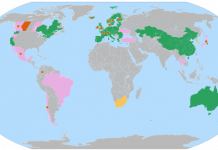

UBS (NYSE:UBS) announced on Friday the launch of the UBS World Emissions Index (UBS-WEMI) – the world’s first index based on global carbon markets. At the moment, only the two exchanges linked to the EU Emissions Trading Scheme (ETS) , the Nordic Power Exchange (Nordpool) and the European Climate Exchange (ECX), qualify for WEMI. The index is composed of future contracts on CO2 weighted between the two trading platforms as follows: ECX, 72.11% and Nordpool, 27.89%. The weights are allocated based upon the liquidity of the underlying exchanges as well as their respective share in the European carbon market. The index is calculated in USD, EUR and CHF and the following three indices are published daily: (a) price, (b) excess return, and (c) total return. The admissibility of a given carbon trading platform to WEMI rests, beyond liquidity and open interest considerations, on links to a formal emissions reduction scheme containing an allowances program and financial penalties for non-compliance. UBS will thus be looking to expand the index as more such programs are implemented, notably in the north east and California. Now the interesting thing about WEMI is that it will provide the first ever benchmark for derivatives referencing carbon markets. Although the word “world��? is a bit of a misnomer (the conditions required by WEMI for inclusion only currently exist in Europe and won’t exist anywhere else, barring a major surprise, until RGGI goes into effect in 2009), this initiative provides an interesting first look at the spectrum of possibilities that will arise once more jurisdictions jump on the carbon trading bandwagon. Such indices will provide excellent bases for financial engineers to unleash their creativity in constructing structured products around global carbon markets. UBS already offers two products based on its index – one priced in USD and the other in CHF.