Black and Veatch Corporation (B&V) recently completed and in-depth assessment of renewable energy generation potential [.pdf] for three Arizona utilities (Arizona Public Service (APS), the Salt River Project (SRP), and Tucson Electric Power (TEP)) which must comply with Arizona’s Renewable Energy Standard. Nate Blair, a senior energy analyst (and fellow board member at the Colorado Renewable Energy Society) at the National Renewable Energy Laboratory sent me the link. Thanks, Nate!

The Renewable Energy Standard requires that APS and TEP generate 15% of their electricity from renewable sources by 2025, and the SRP has adopted a similar goal. This assessment of the renewable energy potential in Arizona will doubtless be useful for these utilities in their planning for renewable electricity generation, but it is likely to also be useful to investors who hope to profit from the decisions that these utilities and other utilities make in their investment in renewable electricity generation.

Choosing Technologies

The excerpt below shows the technologies B&V felt were worth further investigation by Arizona utilities… but this can also serve as a guideline for investors who want to know which technologies are more likely to receive investment from such utilities.

Excerpt:

Technologies that are bold and underlined in the list below were recommended for further study in Phase 2 due to their large potential and/or low cost.

In Arizona, the winning technologies are likely to be Biogas, large scale solar, hydroelectric, Wind, Geothermal, and the more conventional forms of Biomass. Even more interesting perhaps are the technologies that B&V thought worth less consideration: Higher tech methods of converting biomass into electricity, newer forms of Concentrating Solar Power (CSP) such as Power Towers and Compact Lens Fresnel Reflector (CLFR), Residential photovoltaics, Fuel Cells, and Compressed Air energy Storage (CAES).

The general trend is clear: Established technologies with long track records were broadly preferred over newer technologies. The only exception to this broad trend is the selection of "Parabolic Dish Engine" (which I usually refer to as Dish-Stirling) and the emphasis of large scale Photovoltaic over small scale residential solar photovoltaic (most likely due to the better economics of larger Solar Photovoltaic installations.) Even the larger scale photovoltaic options did not make it past the cost screen, because photovoltaic power tends to be more expensive on a per-kWh basis than CSP.

Due to its high cost, grid tied photovoltaic technologies did not make it into the resource assessment. I thought their reasons for dismissing Concentrating Photovoltaic (CPV) technologies particularly interesting: "Based on Black and Veatch’s assumptions, technology advancements in CPV technology will not make that technology competitive with conventional solar parabolic trough technologies for utility scale operations." This agrees with my assessment of the prospects for CPV in my recent article on solar technologies. They were more optimistic about the prospects for Dish-Stirling, and also dismissive of CLFR as a demonstration stage technology.

Adding Availability: Avoided Cost of Generation

Because this study was done looking only at a price per kWh, since the utilities were pursuing it in order to achieve their mandated energy production, it makes sense for an investor to include other factors, just as utility planners will in the real world. As I emphasized last week in my presentation to the Kieretsu Forum, when electricity is generated can have a massive impact on how much it is worth to a utility.

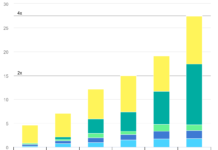

I took the following chart from the report, showing per kWh cost of electricity from each type of resource, as well as the near term potential for in GWh/yr for developing that resource (Note that the 10,940 GWh/yr of potential Solar Thermal (also known as Concentrating Solar Power or CSP) power was not limited by the available resource as were the other resources. B&V chose to limit CSP at that level solely because that was the amount needed for the utilities to comply with their mandates.

On top of the B&V chart I added (in blue) a qualitative "Availability" scale which ranks how valuable those resources can be to the utility in terms of when the power is produced. They say, "The model does not assess value (i.e. avoided cost) of the resource as determined by its degree of firmness or time of delivery (e.g. on-peak vs. off-peak.) In selecting projects, utilities may consider these factors, which may result in a different order of resource/project development.

Dispatchable power is the most valuable, and intermittent power the least valuable. Intermittent power can be more or less valuable depending if the power tends to arrive at times of high demand, or at times of low demand. The length and positions of the blue lines are my qualitative understanding of the value of the timing of these sources of power, with higher value options on the left.

A national or international investor will also want to adjust B&V’s results for Arizona’s particular resource availability. Arizona is blessed with a gigantic resource for CSP, but has less biomass, animal waste for Anaerobic Digestion, Landfill gas (due to the dry climate) and wind than most other states, so each of these resources should be expected to be used more broadly in a national or international context, while CSP will likely be used much less.

Taking Availability into Account

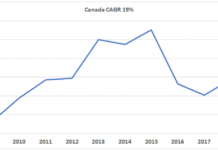

In complying with the Arizona Renewable Energy Standard, these utilities are likely to use somewhat less wind than B&V project, and more CSP and Geothermal, with the other resources fairly in line with what B&V has assessed. The wild card would be the case in which the standard is increased beyond 15% by 2025, just as Colorado’s Renewable Portfolio Standard was raised this spring. In that case, all the resources in the table above would be used, with some additional large amount of CSP since that is the only resource listed which has a large enough resource base not included in the table.

What to Take Away

If you were surprised by any of these findings, don’t dismiss them out of hand. If you hadn’t thought much about one of the lower profile techno

logies that B&V nevertheless believes Arizona utilities should consider, maybe you should also consider them as an investor. If you’re shocked that Photovoltaics did not make the grade, you can take some consolation in the fact that west facing PV has a very high avoided cost of generation, which does make it economic, especially in congested area of the grid where it is difficult to build cheaper forms of generation. While solar is the best renewable energy option for most homeowners, utilities have a different perspective. Making electricity from landfills and manure isn’t sexy, but landfill gas and anaerobic digestion are likely to generate more energy than PV for a long time to come, even in a dry state like Arizona with relatively little of either.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.