An interesting piece yesterday in POLITICO on how carbon prices on the Chicago Climate Exchange (CCX) have been trending up in recent months, mostly since it’s become clear that all three remaining presidential hopefuls will likely regulate CO2 emissions at the federal level.

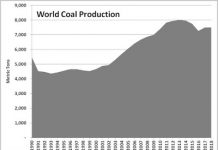

In fact, as per the chart above, prices for the right to emit a metric ton of CO2 have been on a tear, recovering from a pretty significant slump in the preceding months. Last week, the World Bank Carbon Finance Unit released its annual update on the state of global carbon market (PDF document), and, as expected, that market continued to grow appreciably. But is the latest hype around the CCX contracts justified? After all, should there be federally-mandated carbon caps, no one yet knows what the rules will be and what will count as a valid carbon credit. The CCX currently has its own rules for certifying a tradable emission reduction, and it’s unclear whether these reductions will be worth anything at all in the eyes of US environmental regulators. For instance, the RGGI, the first regulated carbon market in the US, engaged a small firm called World Energy (XWE.TO) to write the auction software that will be used for the trades. A safer play would therefore be to buy the exchange because ANY contract can be traded on it, so revenue would spike with volumes. It appears as though the marketplace has picked up on that one as well, pushing up the price of Climate Exchange (CXCHF.PK), the CCX’ parent company, by upwards of 90% in the last three months. Mind you, this increase is probably due in large part to the fact that Climate Exchange’s 2007 annual figures (PDF document) looked strong, with a 1,164% increase in revenue on 2006 and a loss per share of GBP0.0953, up from a loss per share of GBP0.3168 in ’06. However, the current stock price certainly includes a significant future growth premium, and a good chunk of that premium is linked to CCX’s positioning in US carbon markets.

But is this a reasonable bet? A few months ago, NYMEX, a much bigger rival, announced the creation of The Green Exchange to directly compete in the environmental commodities space. The Green Exchange is currently awaiting regulatory approval to introduce a carbon contract for the RGGI. Regulation-driven carbon trading will dwarf the voluntary market, which is CCX’ current stronghold in the US (it is the leader in the regulated market in Europe). The main question now is: will there be enough room in the US carbon market to accommodate multiple players, or will a dominant exchange outcompete everyone else? Can a pure-play carbon exchange survive in an era of increasing exchange consolidation? There is a lot of growth currently built in Climate Exchange’s share price…is it too much?

DISCLOSURE: The author does not have a position in any of the stocks discussed in this article

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Charles

Good points you make…However, CLE is more than a one-trick pony. CLE is the holding company for ECX (European Climate Exchange), CCX, and CCFE (Chicago Climate Futures Exchange)..CCFE is a futures exchange that trades SO2, NoX, CO2, index futures, and a weather contract. In fact, the biggest volume contract is SO2, not CO2!

ECX, as you are probably aware, is the largest futures exchange for the trading of EUAs, with a market share approaching 90%. Daily turnover has been as high as 16mm tons this year.

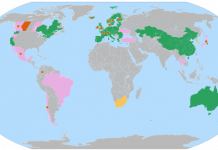

Finally, don’t forget that CLE, via CCX, has reached out to both India and China to sign memorandums of understanding to create voluntary carbon markets in those countries…Should CCX succeed in establishing markets there, the overall enterprise will be a truly GLOBAL marketplace for the trading of GLOBAL carbon.

While the race is still on to see which exchange might be the winner in the US, if/when a carbon market gets enacted into law, CLE has the #! futures market in Europe, and appears to have a head start in key nations such as India and China…

Perhaps the stock’s valuation discounts a lot of growth, to be sure…But all that growth is NOT just in the US.

Thanks for the great blog. Do you have any opinion on APWR? I mostly invest in wind energy and am trying to find the best way to invest in wind energy in China. I think local Chinese companies will benefit the most of wind energy use in China. I own CWSI.ob, but I am wondering if APWR is the best play?

Mike:

All very valid points, and, as pointed out in the article, their financials are also improving.

Despite this, the company is still loosing money and therefore trades at a hefty premium. While it is not possible determine exactly which factor drives what portion of that premium, I would contend that it is in large part the anticipation of federally-mandated carbon caps in the US.

This stock has been volatile over the past year, and, despite good strides in business development, it’s unclear at this stage that they have a competitive advantage that can’t be replicated by competitors, which is what typically justifies a high premium.

Barry:

I did not know APWR – thanks for letting me know about it.

Seems like an interesting play and trades a fair PE multiple. I will have a look!

Good article, well done. Climate warming and specially the carbon factor is in a need of worldwide attention urgently. Let us hope the elected president in this

election will take a required step both at home and abroad. Thanks