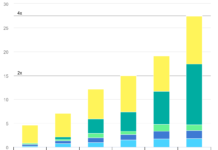

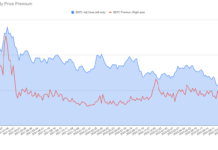

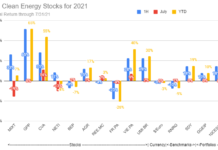

A comparison of the charts for clean energy ETFs and broader market ETFs seems to show that, clean energy funds have, if anything, underperformed the market as a whole in recent months. Nevertheless, the quarterly performance update for my 10 Clean Energy Stocks for 2009 showed my picks strongly outperforming the market, although the much riskier 10 Clean Energy Gambles was only performing in-line with the sector indices.

It’s unlikely that my picks are due to stock picking skill. My personal experience has shown that I’m much better at picking sectors than individual stocks: my strength is in spotting trends, not picking individual companies which will outperform.

Trend Spotting

If my picks are not doing better because of stockpicking, it’s either because of luck, or because I spotted a trend. The relative performance of the two portfolios gives a clue as to what it might be. When Lehman Brothers declared bankruptcy, I began selling stocks that had weak cash flows or balance sheets, and I continue to believe that companies which can internally finance all their capital expenditures and expenses will outperform the rest for years to come. As such, my Ten Clean Energy Stocks all had strong balance sheets and cash flows, while most of the Ten Clean Energy Gambles will likely need to raise more money by the end of the year.

If I’m right about this trend, then clean energy stocks have indeed been outperforming the market, but this trend has been masked as the market as a whole fell by the fact that most clean energy stocks are young growth companies; they often have weaker balance sheets and cash-flows than older, more established companies.

Testing the Trend.

To test my hypothesis, I turned to the Capital Asset Pricing Model, or CAPM. CAPM accounts for the general riskiness of companies by means of a statistic Beta, which is a measure of how much a company moves in response to moves of the market as a whole. Because clean energy companies tend to be riskier than the market as a whole, they tend to have Betas greater than one, and hence tend to decline more than the market as a whole when it declines, but advance more than the market as a whole when it advances. Some commentators think that green funds will outperform in a recovery solely because of the higher Beta, but I suspect there’s more to it. Any difference between the performance of a stock and the expected performance given the performance of the market as a whole is called Alpha, and if my hypothesis is correct, clean energy stocks are likely to have had positive alpha over recent months.

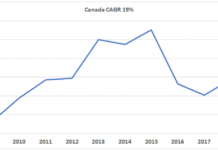

I chose to test my hypothesis over three and six month periods, since that is how long I feel I have been seeing an out-performance of clean energy stocks (I think it started slightly before President Obama’s election, when it became fairly clear that he was going to win.) The CAPM model says:

Alpha = Actual Return – (RFR + Beta*(RM-RFR))

Where RFR is the risk-free rate, usually taken to be a long term treasury rate of interest, and RM is the market return. On October 24, 2008, the ten year Treasury note was yielding 3.7%, and on January 27, it was 2.5%. The total return of the S&P 500 has been -1.2% and 2.4% for six and three months, as of April 24th. That means that for the 3 month period, RFR3 = 2.5%/4 = 0.6%, and RM3-RFR3= 2.4%-0.6% = 1.8%, while for the 6 month period since October 24, RFR6 = 3.7%/2 = 1.9%, and RM6-RFR6= -1.2%-1.9% = -3.1%.

With this data in hand we can now check to see if clean energy stocks in general have been outperforming.

Clean Energy ETFs

To understand how the sector is performing as a whole, I will use several Clean Energy ETFs: for the sector as a whole, the two domestic ETFs: The First Trust NASDAQ Clean Edge US Liquid (QCLN) and The PowerShares Clean Energy (PBW.)

| ETF |

Beta |

3 month | 6 Month | ||

| Performance | Alpha | Performance | Alpha | ||

| QCLN | 1.85 |

9.4% |

5.5% | 4.4% | 8.2% |

| PBW | 1.74 | 7.7% | 4.0% | -1.4% | 2.1% |

Clearly, both these clean energy ETFs have been strongly outperforming the market since Obama was elected and assumed office. Until the recent market recovery, however, the general market downtrend, combined with the high Betas of alternative energy stocks have been obscuring the strong outperformance.

Subsectors: Solar, Geothermal, Efficiency, Smart Grid

There are also Solar ETFs and Wind ETFs, which would allow us to see how these subsectors are performing relative to the whole market, but this would require comparison with a global market index, and some time spent importing data into a spreadsheet to calculate beta. As I mentioned at the end of a recent article on clean energy mutual funds, I expect that the subsectors most likely to outperform are those on which President Obama has been emphasizing in his policy: Energy Efficiency, Smart Grid, High Speed Rail and Transit stocks and those power generation sectors which are most likely to contribute significantly to his goal of tripling renewable energy, Geothermal and Wind. Solar has also been outperforming, but only over a much shorter time period.

The boost to solar came from China, not Obama, and so it has only been felt for the last month or so. Since I don’t have appropriate sector ETFs, I used a selection of individual stocks I hoped might be representative of their sector. I mostly chose stocks which are not in one of the two sets of ten stocks for 2009 discussed above.

Some of these stocks follow the patterns I would expect if their performance is being driven by the new administration’s policies, but with just a few companies to choose from, I hesitate to draw conclusions about clean energy subsectors. Probably the best fit is the battery manufacturer Enersys (ENS). Battery manufacturers received a large boost from the stimulus package, and, this was more of a surprise than with other clean energy sectors. If you look at my discussion of the likely components of the stimulus package from December, you will see that I expected investment in the electric grid (including smart grid), energy efficiency, wind, and geothermal.

Batteries were not on my radar, and the large investment in battery technology seems to have come as a surprise to most other investors as well. Enersys slid in the three months after the election but before the stimulus was unveiled, but then took off in the last three months. In contrast, the gains in my wind stock, smart grid, rail, and energy efficiency stocks were spread out over the whole 6 month period. The geothermal stock saw most of its gains early on, perhaps because there was little explicit boost for geothermal in the American Recovery and Reinvestment Act.

| Stock |

Beta |

3 month | 6 Month | ||

| Performance | Alpha | Performance | Alpha | ||

| FSLR (solar) | 1.99 | 4.5% | 0.3% | 22% | 27% |

| AMSC (wind) | 1.87 | 51.7% | 48% | 123% | 127% |

| ORA (geothermal*) | 1.21 | -.6% | -3.3% | 35% | 36% |

| PEIX (ethanol) | 1.55 | -27% | -30% | -47% | -44% |

| ENS (batteries) | 1.16 | 56% | 53% | 29% | 31% |

| ENOC (smart grid) | 1.52 | 74% | 71% | 190% | 193% |

| POWI (energy efficiency) | 1.14 | 8.0% | 5.4% | 25% | 27% |

| PRPX (rail) | 1.39 | 11% | 8% | 41% | 43% |

* Ormat (ORA) is in my Ten Clean Energy Stocks for 2009, but there really is no other choice for a representative geothermal stock.

Tom Konrad, Ph.D.

DISCLOSURE: The author has long positions in AMSC, FAN, ORA, PRPX, and POWI.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Thanks for the analysis Tom, this is very interesting.

One of the problems with Beta as the main risk metric in the CAPM is the underlying assumption that firm-level risk can be diversified away in a portfolio and thus should not matter – the only risk worth considering is the degree of correlation with the market.

It’s unfortunate that a better metric is not readily available to determine expected returns, especially for retail investors who might have fewer cheap options for optimal diversification.

But alas, in the absence of such a metric, this remains an interesting analysis and a trend worth following. Thanks!

I actually never had a problem with the assumptions about diversifiable risk… I find it works pretty well for me… of course I own stock in about 70 companies, so even if one blows up, that only means a 1.4% loss. I only lose significant money when I’m wrong about macro trends, not when one of my companies blows up.

I tend to prefer factor models to CAPM, but the problem with factor models is that the necessary data to calculate returns is not not readily avialable… with CAPM, you can just get beta off od Yahoo! and calculate a few returns, and you’re done.

But one possible interpretation of this article is that there is a “clean energy” factor which has been causing the sector to outperform.

In the end, however, figuring out what’s going on in the market is a lot more art than science… it’s great to know the theory, but to trust it would be foolish.