My Quick Clean Energy Tracking Portfolio continues to outperform all benchmarks and expectations… is it luck, or did I stumble onto a better way to invest in green energy stocks?

I continue to be stunned at how the portfolio which I intended as an easy way to duplicate green energy mutual fund performance at much lower cost continues to blow those green mutual funds out of the water. I last published an update on this portfolio at the end of May, and was shocked to find that it had beaten the funds it was intended to replicate by over 20% in 3 months. The trend continues… it’s now almost 7 months later, and the portfolio has widened its lead over the mutual funds by 30%.

Winners and Losers

In May, I hypothesized that the out performance might have been due to how I constructed the portfolio: I chose five stocks from the top holdings of the mutual funds which had performed worst over the preceding three years. I did this because there is a fairly well-documented winner-loser effect [pdf], that shows systematic price reversals in stocks that show long-term gains or losses. In particular, stocks showing long term losses are more likely to make gains in following years than long term winners.

I tried to test if the out-performance was solely due to winner-loser effects by going back to my original data and seeing how a portfolio constructed with winners rather than losers would fare. To my surprise, the "winners" portfolio also significantly outperformed the mutual funds (by 10% over 3 months). I’ve updated the performance of the "winners" portfolio as well, and it also has increased it’s gains compared to the mutual fund portfolio, and is now outperforming by 15% over 7 months.

Winner-loser effects seem to be playing a role, but at most, they explain about a quarter of the out-performance of the "Losers" portfolio so far. There may be other, as yet unknown, causes of the superior performance of the "Losers" portfolio.

No matter what the cause, for winner-loser effects to explain all of the difference, the "Winners" portfolio would have to be under-performing the mutual funds by about as much as the "Losers" portfolio is outperforming. Where did the other three quarters of the out-performance come from? Is it just luck?

"Losers" Tracking Portfolio

| Company | Shares | Price 2/27/09 | Close 9/24/09 | % Change |

| Citrix Systems (CTXS) | 48 | $20.58 | $37.65 | 82.94% |

| Echelon Corporation (ELON) | 165 | $5.99 | $12.82 | 114.02% |

| SunTech Power (STP) | 162 | $6.09 | $15.96 | 162.07% |

| Cemig (CIG) | 94* | $10.47* | $14.66 | 40.02% |

| Vestas Wind Systems (VWSYF.PK) | 22 | $44.85 | $69.50 | 54.96% |

| Total | $4998.65 | $9,415.06 | 88.35% |

*Dividend and split adjusted.

"Winners" Tracking Portfolio:

| Company | Shares | Price 2/27/09 | Price Close 9/24/09 | % Change |

| LSB Industries (LXU) | 114 | $8.66 | $15.34 | 77.14% |

| Echelon Corporation (ELON) | 165 | $5.99 | $12.82 | 114.02% |

| First Solar Inc (FSLR) | 9 | $105.74 | $150.62 | 42.44% |

| South Jersey Industries (SJI) | 28* | $35.11* | $34.83 | -0.80% |

| American Superconductor (AMSC) | 23 | $13.46 | $29.73 | 120.88% |

| Total | $4975.30 | $8,394.90 | 71.10% |

*Dividend adjusted.

Mutual Fund Portfolio

| Mutual Fund | Shares | Price 2/27/09 | Close 9/24/09 | % Change |

| CGAEX (Calvert) | 122.19 | $6.82 | $10.29 | 51% |

| ALTEX (First Hand) | 171.47 | $4.86 | $7.20 | 48% |

| GAAEX (Guinness Atkinson) | 205.76 | $4.05 | $6.49 | 60% |

| NALFX (New Alternatives) | 29.75 | $26.68 | $41.51 | 56% |

| WGGFX (Winslow Green Growth) | 111.71 | $7.46 | $12.28 | 65% |

| Total | $4999.98 | $7,794.71 | 56% |

The Other Three Quarters

Since I did the first update, I’ve come up with three hypotheses to explain the phenomenon:

- Higher Beta: The stocks I picked may be more sensitive to market moves than the mutual funds as a whole. Since the market has been rising, the "Winner" and "Loser" portfolios have been rising more.

- Cleantech sectors: My picks put more emphasis on certain Cleantech sectors than do the funds; perhaps the overweight sectors have driven the out-performance.

- Mutual Fund Manager skill: The mutual fund managers are likely to hold more of their favorite stocks than they hold of other stocks. If they each have a few good ideas, then I am taking advantage of those good ideas by selecting my portfolios from the mangers’ top five holding. The high diversification of the mutual funds keeps mutual fund shareholders from fully benefiting from their managers’ skill.

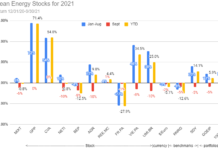

Below, I’ve graphed the performance of the "Winner" and "Loser" portfolios against several possible benchmarks: the blended performance of the mutual funds, the S&P 500 index, and five green energy ETFs (ICLN, QCLN, PBW, PBD, and GEX.) Since the ETFs each track a difference index for the Cleantech sector, it’s reasonable to assume that they represent the performance of the average Cleantech stock.

This promises to be a fairly long investigation, so I plan to break it up into a series that I’ll publish over the next few days. I’ll add links to the articles here as I publish them. The first one, in which I look into my "Higher Beta" hypothesis, will be published here shortly.

It could turn out that none of my hypotheses explain the out-performance we’ve seen. In that case, it could be luck, or it could be something I have not thought of.

Easy Green Money… Too Good to be True?

I’m hoping that I find some evidence for mutual fund manager skill. To do that, I’ll need to eliminate the other possibilities. If I can, we can expect this method to produce out-performance in the future, and under any market condition. In other words, my attempt at a tracking portfolio might just be a better way to play green stocks. An easy way to play green energy, without having to pay high fees? It sounds to good to be true, but in the wild west of green energy investing, in might last for a year or two.

What do you think? Is there something else I should investigate? If so, please leave your suggestion in the comments.

DISCLOSURE: Tom Konrad and/or his clients own LXU, ELON, and AMSC. The Guinness Atkinson Fund is an advertiser on his website, AltEnergyStocks.com

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Climate Change and Corporate Disclosure: Should Investors Care?

Charles Morand ( AltEnergyStocks ) submits: On Monday morning, I received an e-copy of a new research

Green Stocks: A Better Way to Play?

Tom Konrad ( AltEnergyStocks ) submits: My Quick Clean Energy Tracking Portfolio continues to outperform

Peak Oil: What Is It?

Charles Morand ( AltEnergyStocks ) submits: Peak Oil is a term that has become common currency in energy

Portfolio Outperformance Due to High Beta?

Tom Konrad ( AltEnergyStocks ) submits: My Quick Clean Energy Tracking Portfolio has produced unexpected