Tom Konrad CFA

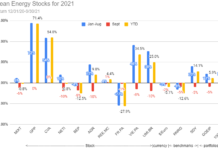

In the six months since I published my annual clean energy mini-portfolio, it has far outperformed my industry benchmark, the Powershares Wilderhill Clean Energy Index (PBW). The dismal performance of renewable energy stocks so far this year is likely to lead to great buying opportunities in the rest of the year.

2010 is the third year in a row that I’ve published a list of ten renewable and energy efficiency stocks that I expect to perform well over the coming year. The details on the list for 2010 are here; this article is my second quarterly look back at the performance of the ten stocks so far this year.

These stocks are intended for small investors wanting to put some money in the sector, but not satisfied with the performance or holdings of clean energy mutual funds or clean energy exchange traded funds (ETFs). Please consult your investment advisor to decide if any or all of them are appropriate for your portfolio.

The diagram below shows the two versions of the my Ten Clean Energy Stocks for 2010 mini-portfolio, with the outer ring denoting an equal weight portfolio of ten stocks, including three energy efficiency stocks, three electric grid stocks, three alternative transportation stocks, and one biomass/waste to energy stock. The inner ring denotes a simplified portfolio, which substitutes the Smart Grid Infrastructure Index Fund (GRID) for the three electric grid stocks and the Powershares Global Progressive Transport ETF (PTRP) for the three alternative transportation stocks. For future reference, I’ll call the portfolio shown in the outer ring “10 stocks for 2010” and the portfolio shown in the inner ring “4 stocks plus 2 ETFs for 2010.”

Performance

Since December 27th, the Russell 3000 broad market benchmark has fallen 3.67%, while the Powershares Wilderhill Clean Energy Index (PBW) has fallen 21.7%. Both portfolios are trailing the broad market by less than 2%, while outperforming the industry benchmark by almost 16%, producing a nearly identical -5.21% for the ten stocks for 2010 and -5.34% for the four stocks plus two ETFs for 2010.

Coming Opportunities

While the performance against PBW is impressive, most investors would have probably been happier if they had simply stayed out of the market, or hedged their market exposure so far this year, which is exactly what I’ve been urging readers to do (see here, here, and here.) Although I saw some brief buying opportunities in clean energy at the end of May (I picked up a little Exide (XIDE) at $3.85 and US Geothermal (HTM) at $0.70) those opportunities were short-lived, and probably do not represent the market bottom for clean energy.

If the year continues to progress as I expect, the broad market will continue to decline, as will the clean energy sector. Individual clean energy stocks will likely continue to present excellent buying opportunities when the market as a whole has been declining rapidly. Buying opportunities in clean energy are likely to lead buying opportunities in the market as a whole, because the rapid decline of the whole clean energy sector over the last year is already producing great valuations. These great valuations broaden the appeal of clean energy stocks beyond the base of committed environmental investors, drawing in dyed-in-the-wool value investors who may not even think that Global Warming is happening, but know a good value stock when they see one.

I personally am still maintaining an overall short position in the market, but expect to be buying clean energy stocks with a focus on profitable micro-cap companies opportunistically.

Since these ten stocks have held up better than clean energy as a whole, we’re liable to find fewer than average great buying opportunities in this list. C&D Technologies (CHP), currently trading at $0.95 is the best value I see among them at the moment, and this company may have already see its low for the year ($0.90 on June 10.)

One opportunity for short term gain may have just re-emerged in Portec Rail Products (PRPX). The company is the subject of a takeover bid from LB Foster (FSTR) which I covered in detail on June 1. The judge in a shareholder class action lawsuit lifted her earlier injunction blocking the merger on June 25th. The merger is not a done deal, however, since, as of May 28, only 59% of Portec shares had been tendered, and 65% are needed for the successful completion of the buyout. Foster may have to raise the offer price in order to consummate the deal.

Conclusion

At some point, I hope to be able to say it’s time to buy this portfolio as a whole, but I think that time is not yet. Just the best strategy for the first six months of the year so far has been to stay in cash, and I think that will continue to be the best strategy for at least few more months. Now is still a time to remain mostly in cash, while keeping an eye out for individual buying opportunities.

DISCLOSURE: Long CHP, NFYIF, PRPX, WFIF, XIDE, HTM.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.