Tom Konrad CFA

Income investors can also invest in clean energy.

Over the past four years, changes in Canadian tax law have led the renewable energy income trusts I introduced investors to in March 2007 to either be bought out like the Boralex Power Income Fund (bought by manager Boralex [BLX.TO, BRLXF.PK]) or convert to corporations like Algonquin Power and Utilities [AQN.TO, AQUNF.PK].

Those that converted to corporations are still out there, and still paying good dividends. And while a few are gone because of mergers, there are also a few new ones that I did not mention in my 2007 article. They are a great place to start for investors who want a green portfolio, but need income or can’t handle the stomach-turning gyrations of the solar or wind stocks.

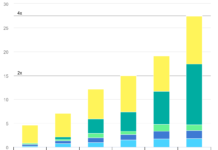

I’ve listed the funds I know of in the table below, along with their current dividends and the sectors they invest in.

| Company (Canadian ticker, US Ticker) | Price | Yield | Mkt Cap | Sectors |

| Algonquin Power and Utilities (AQN.TO, AQUNF.PK) | C$4.95 | 4.8% | C$471M | Elec, Nat Gas,&Water distrib, cogen, biomass, hydro |

| Brookfield Renewable Power Fund (BRPFF.PK,BRC-UN.TO) | C$21.41 | 6.2% | C$2.2B | Conventional and run-of-river hydropower |

| Innergex Renewable Energy Inc. (INGXF.PK,INE.TO) | C$9.74 | 6.0% | C$580M | Run-of-river hydro and wind |

| Macquarie Power & Infrastructure Corp. (MCQPF.PK,MPT.TO) | C$8.43 | 7.8% | C$480M | Cogen, Wind, Hydro, Biomass, Solar, District heating |

| Northland Power Inc. (NPIFF.PK,NPI.TO) | C$15.81 | 6.8% | C$1.2B | Nat Gas, Wind, Biomass |

As you can see, although these companies have become corporations, the yields will appeal to income investors.

DISCLOSURE: Long AQUNF, NPIFF.

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.