Tom Konrad Ph.D. CFA

In my bio, I usually state

My study of chaos theory led to my conviction that knowing the limits of our ability to predict is much more important than the predictions themselves, a lesson I apply to both climate science and the financial markets.

Despite having written about financial markets and clean energy stocks regularly since 2006, I have never before explained in print what I meant by that. This summer’s heat wave and stock market turbulence illustrate how my intuition about chaos theory informs both my understanding of the climate and the stock market.

Chaotic Systems and Feedback

The definition of a chaotic system I use is any system in which a tiny change in initial conditions can lead to a large change in results. Most chaotic systems are chaotic because they contain positive feedback. Positive feedback tends to amplify trends over time, while negative feedback tends to reduce trends over time. Complex systems such as climate and the financial markets have both positive and negative feedback.

The definition of a chaotic system I use is any system in which a tiny change in initial conditions can lead to a large change in results. Most chaotic systems are chaotic because they contain positive feedback. Positive feedback tends to amplify trends over time, while negative feedback tends to reduce trends over time. Complex systems such as climate and the financial markets have both positive and negative feedback.

In the weather, we can see positive feedback when a series of hot, sunny days create a static high pressure system which keeps storms from moving in to cool things off. When a storm does move in, you can get positive feedbacks cooling things off. National Weather Service forecaster Daryl Williams said the following about a storm which broke the summer heat wave in Oklahoma: “It’s kind of feeding on itself, cloud cover and rainfall cools the air and the ground.” (italics mine.)

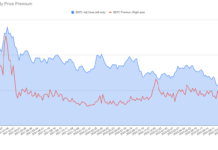

In stock markets, financial bubbles grow with the help of several types of positive feedback. One such is “The specious association of money with intelligence,” as John Kenneth Galbraith described it in his short and very readable book on bubbles, A Short History of Financial Euphoria: Financial Genius is Before the Fall. When we see others make money in a stock market rise, we tend to think they must have been smart to have known when to get in. If we made money recently by buying stocks, we tend to think we are smart for having done so. In both cases, we’re more likely to think that buying stocks is a smart thing to do, even if the profits were just dumb luck. Collectively, this leads to more buying, which further raises prices. Even if those price rises are justified in the beginning, the positive feedback can carry them up far beyond any level justifiable by the value of the underlying companies. Many other positive feedbacks such as the wealth effect, relative valuation methods, and the increased ability to borrow against inflated asset prices operate in financial bubbles and bull markets. In contrast, fundamental and value investors produce negative feedbacks by buying when prices have fallen and selling when prices have risen.

As with weather, external shocks to the system can reverse even these self-reinforcing trends, as we recently saw when the US’s political paralysis around the debt ceiling debate and Europe’s inability to effectively deal with their debt crisis recently ended the two year bull market in July.

Strange Attractors and Regime Change

Strange Attractors and Regime Change

Highly complex systems which have both positive and negative feedbacks tend not to be chaotic all the time, but rather exhibit chaotic behavior only some of the time. The system will behave quite predictably in a deceptively regular fashion for a while, but then shift with little warning into another mode of behavior that is also regular and predictable, but seems to follow a different set of rules.

Such behavior can be mapped with simple chaotic systems and often exhibits a pattern called a Strange Attractor, tow of which are pictured with this article. As the system moves through such a strange attractor, it will often stay in one set of the rings curves shown for an extended period, before jumping to another set after an unpredictable period.

In the weather, we see this sort of behavior with extended heat waves, cold spells, or periods when it is hot in the morning followed by an afternoon thunderstorm. Such patterns persist for days or weeks, but then quickly end to be replaced by a new pattern or a period of less predictable weather.

In the stock market, we have bull and bear markets. In bull markets, good news is greeted with euphoria and strong stock buying, while bad news is discounted or ignored. In bear markets, the opposite is true: good news is often ignored, while bad news leads to repeated bouts of selling. In his excellent but somewhat inaccessible book, The Alchemy of Finance, George Soros describes how he tries to spot such tipping points or regime changes as they happen. Much theoretical work has been done to understand and model such changes, but the lesson I draw from chaos theory is that recognizing such changes in hindsight may be simple, but predicting them in advance is and will continue to be extremely difficult. That’s probably why Soros did a much better job describing market regimes than explaining how to spot them.

Nassim Taleb also addresses regime change in chaotic systems in his book The Black Swan. His Black Swans are events which cannot be predicted solely by studying the past. Such events occur, he says, because the rules we infer from the observation of events never contain the full range of possibilities. He applies this lesson to societal events, personal experiences, and financial markets all of which are chaotic systems. There are also climatic Black Swans.

Global Weirding

If you accept that the world’s climate is a chaotic system characterized by a strange attractor and a large number of climate regimes such as ice ages and warm periods, you should also accept that the relatively small changes we are making to the atmosphere have the potential to shift the world’s climate into a new regime where the weather patterns humanity is familiar with are replaced with a new set of patterns that we’ve never seen before in human history.

We are already aware of a few positive feedback mechanisms with the potential to amplify the effects of climate change, such as the ability of a release of methane from arctic permafrost and clathrates to rapidly accelerate global warming, or the disruption of the North Atlantic current due to melting polar glaciers. Such scenarios are chilling enough, but the knowledge that climate and weather are a chaotic system raises the possibility of yet unknown mechanisms that might create rapid climactic shifts. In a chaotic system, the past is not always a reliable guide to the future. Climactic past performance is no guarantee of future climactic results.

“Global Warming” can sound somewhat comforting. “Climate Change” can sound clinical and distant. A better description is “Global Weirding:” the climate is not becoming a warmer version of what we’re used to, it’s becoming an entirely new system, with a new set of patterns that will surprise anyone expecting a version of the old climate regime.

Conclusion

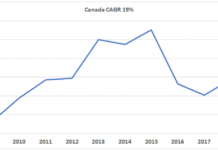

There is only one climate, while there are hundreds if not thousands of financial markets operating at any one time. Financial markets also operate on a much more compressed time scale, with bubbles and busts compressed into a few short years or decades. Ice Ages, on the other hand, last tens of millions of years.

This difference financial markets and climate in number and scale means that we know much more about the chaos of financial markets than the chaos of climate. We’ve probably already seen most possible financial market regimes in at least one of the thousands of financial markets, from tulip bulbs to CDOs, that have operated over the course of human history. Although the rules of markets change with new technology and communication, the basic rules of human psychology which govern these regimes have not. To paraphrase Mark Twain, financial history may not repeat itself, but it does rhyme.

Climactic history may also rhyme, but we’ve not yet read a full line of the poem: We don’t know what it will rhyme with. Ice ages and warm periods often last tens of millions of years. Given the infrequency of shifts between one climactic regime and another, it’s quite likely that the new climactic regime we are heading into will be unlike anything that has prevailed during human history, and possibly unlike anything in the geologic record.

The benefit of the slow pace of climactic history is that we do have a few years or decades during which we will be able to influence the path of global weirding.

In a chaotic system, a tiny change today can lead to a large change in future outcomes.

What tiny change are you making?