Tom Konrad CFA

|

| Deepwater Horizon Oil slick, as seen by NASA satellite, May 24, 2010 |

For a growing number of people, ecological responsibility means more than just recycling and changing our light bulbs. Many have started to ask, “How much good does saving a few hundred gallons of gas with a hybrid car do, when the mutual funds in your 401k own companies that are allowing 6.6 million barrels of oil to spill into the Gulf of Mexico, or fund misinformation about climate change?”

For most, the answer is, “Not enough,” and that conclusion has led to a growing interest in ecologically-oriented mutual funds and ETFs.

It’s not cheap being green

Unfortunately, the desire to do right for the environment has often been at odds with the need to see decent returns on many green investments. Ecologically minded and socially responsible mutual funds, like the Calvert Equity Portfolio (CSIEX), Portfolio 21 (PORTX) or the Gabelli Green Growth Fund (SRIGX) often charge relatively high management fees (1.2%, 1.45%, and 2%, respectively.) Many investors may think these fees are worth it, since the returns of such funds have typically beaten the market over long (5 and 10 year) periods, despite the fees and more recent (three years or less) underperformance, especially considering the fact that most of these management fees were considerably higher in the early years when the funds were small.

Market research generally shows that ecological and socially responsible investing provides a long-term edge, which most assume is because the more ecologically and socially responsible companies operate with an awareness of environmental and social risks which can harm the bottom line.

The ETF option

If ecologically and socially responsible investing produces superior returns, only to have these returns eaten up by mutual fund fees, it makes sense to ask if the performance can be replicated in a cheaper ETF option. Unfortunately, the only socially responsible ETFs which have been around longer than three years, the iShares KLD Select Social Index Fund (NYSE:KLD) and the iShares KLD 400 Social Index Fund (NYSE:DSI) have underperformed the S&P 500 and two of the three mutual funds mentioned above over the last five years. The two ETFs don’t yet have ten year track records.

The lower five year performance of KLD and DSI occurred despite substantially lower expense ratios, at 0.50% for both, which should give them an edge over the mutual funds of between 3.5% and 7.7% over five years.

Is active management required?

Although the data is too sparse to reach a conclusion, the weaker performance of socially responsible ETFs may be a sign that in order to retain an edge in terms of returns, ecologically and socially responsible investing requires more active judgement than can be had in a passively managed index fund like KLD or DSI. This makes a certain amount of sense, because judging a company’s sustainability is still far more of an art than a science.

An actively managed ecological ETF

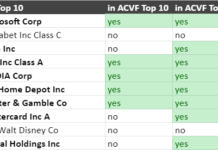

Investors who want the relatively low fees of an ETF, along with ecologically and socially conscious active management now have an investment option. In June, Huntington Asset Advisors launched the actively-managed Huntington EcoLogical Strategy ETF (NYSE:HECO.) Fund expenses are capped at 0.95% and will fall if the fund is successful attracting assets.

As a recently launched fund, HECO does not have data on past performance, but I recently spoke to HECO’s lead manager, Brian Salerno CFA about HECO and his strategy, and also attained some past performance data. Salerno is also an investment advisor, and has been managing portfolios using the same “Ecological” strategy he is using for HECO since 2008, based on Global Investment Performance Standards (GIPS®). GIPS is not exactly comparable to the total return methodology used to create the past performance data of the mutual funds and ETFs, because it accounts for fund inflows and outflows differently, but for want of anything better, I compare his net-of fees performance for the last three years with the other funds I’ve mentioned in this article in the chart below:

Conclusion

As you can see from the chart, Salerno’s EcoLogical strategy falls at the lower end of the middle of the pack over the three years he’s been managing portfolios using it. Unfortunately, the differences in performance measures and the short track record mean that I can only conclude that the EcoLogical strategy’s performance is in that “middle of the pack” range.

In short, it’s still too early to conclude if HECO’s active management will allow investors to capture the r

eturn advantage of ecological and socially responsible investing without it being all eaten up in high mutual fund fees. In order to help you decide for yourself, I’ll take a deeper look into Salerno’s strategy in future articles.

Disclosure: No positions.

This article was first published on the author’s Forbes.com blog, Green Stocks.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.