by Jan Schalkwijk, CFA

ESG investing is all the rage these days. That is, investing that includes the non-traditional environmental, social, and governance factors in the investment process. Its appeal to the broader investment industry is twofold:

1) The writing is on the wall: as wealth is passed down to younger generations who in the aggregate care more about values alignment, the asset management industry does not want to lose the assets and the fees they generate.

2) Thematic investing is popular and ESG is one of the hottest themes. Wall Street is not going to miss out. Much like crypto is too good to pass up.

Not everyone is enamored. Some folks accuse ESG investing of greenwashing, others argue that ESG is progressive politics spilling over into investing, that heretofore was “neutral,” and just concerned with the financial bottom line.

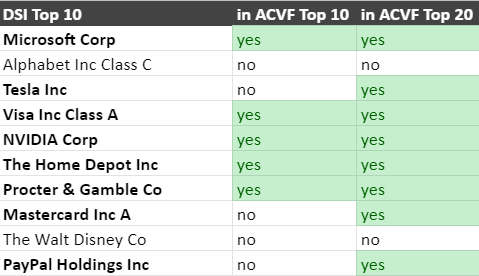

In the spirit of every niche gets an ETF, there now is fund that is unabashedly the anti-ESG fund: the American Conservative Values Fund (ACVF). It has $10m in assets under management, so not competing with ESG anytime soon or ever, but what struck me is that its top 10 holdings have a 50% overlap with the top 10 holdings of iShares MSCI KLD 400 Social (DSI), which tracks the broadest and longest-running US SRI/ESG index.

In the spirit of every niche gets an ETF, there now is fund that is unabashedly the anti-ESG fund: the American Conservative Values Fund (ACVF). It has $10m in assets under management, so not competing with ESG anytime soon or ever, but what struck me is that its top 10 holdings have a 50% overlap with the top 10 holdings of iShares MSCI KLD 400 Social (DSI), which tracks the broadest and longest-running US SRI/ESG index.

If the ESG flagship benchmark, and the anti-ESG fund agree on 5 of their 10 biggest holdings, then that begs the question: what is ESG anyway?

Jan Schalkwijk, CFA is the founder and Chief Investment Manager of JPS Global Investments, an investment firm specializing in green investing on a global basis.