Tom Konrad

The 5.7 MW Solar Farm in Salisbury, MA is the largest solar farm in New England. The land under if was purchased by Power REIT (NYSE:PW) in December. Photo source: Power REIT |

I first wrote about Power REIT’s (NYSE:PW) plans to invest in renewable energy real estate in May 2012. The intent was to buy the real estate underlying a solar, wind, or other renewable energy project, charging the project owners rent. This can be done profitably because REITs often have a lower cost of capital than other businesses, such as renewable energy power producers.

At the time, I (and Power REIT’s CEO, David Lesser) thought such a deal was immanent.

Then life got in the way.

A Potentially Lucrative Distraction

Life, in this case, was a civil action between Power REIT and the lessees (Norfolk Southern Corp. (NYSE:NSC) and sub-lessee (Wheeling and Lake Erie Railroad, aka WLE)) of its only asset at the time, 112 miles of railroad track. Although still making lease payments, WLE and NSC had failed to comply with the terms of the lease, at least in Power REIT’s interpretation. Power REIT attempted to foreclose on the lease, and WLE and NSC filed a civil action to prevent the foreclosure.

Power REIT initiated the foreclosure attempt because WLE had failed to pay some of its legal fees, as the lease requires the lessee do for all such fees reasonably incurred in order to maintain Power REIT’s interest in the leased track. Since the lease requires the lessee to pay all its legal fees, Power REIT has little incentive to drop its attempt at foreclosure, as might be expected when a tiny company has to take on a much better-funded opponent in court. In addition, the lessees could be forced to pay as much as $84 million dollars (PW’s market capitalization is currently only $16.2 million) in debt and back interest incurred since the inception of the lease in 1967. Even if, in the worst possible case, Power REIT loses in all counts and is unable to foreclose, the $15.9 million principal portion of this indebtedness could be written off on Power REIT’s taxes. That write-off would allow 25 years’ worth of its current dividend to be characterized as a return of capital, and hence be tax-free to PW’s shareholders.

Investment Delays

Despite the heads-I-win-big-tails-I-still-win situation for Power REIT in court, the litigation has been a massive drain on the firm’s resources and management’s time over the last year. While Power REIT’s legal costs are likely to be recovered through the court, WLE is not currently reimbursing them. Meanwhile, the legal tussle with much larger companies has been making some lenders and investors wary, leading to a low stock price and making it more difficult to finance renewable energy real estate transactions.

A few months ago, I noticed that Power REIT had removed the investor presentation from its investor relations page. This presentation had detailed its investment plans for renewable real estate. When I asked Lesser about this, he told me it was because so much of the firm’s focus had been on the litigation.

Proof of Concept

Location of True North solar farm from Salisbury Assessor map.

As it turns out, Power REIT’s renewable plans had not been completely to the back burner. On January 4th, the company filed an 8-K with the SEC detailing an investment in 54 acres of land under a 5.7 MW solar farm in Salisbury, MA. Given its size, location, and 54 acre site with 43 buildable acres, I identified the farm as the solar farm recently completed by Power Partners MasTec (NYSE:MTZ), and owned by True North, LLC. The total cost to Power REIT was $1.037 million, including the assumption of a $122,000 municipal sewer financing carrying a 5% interest over 19 years. Lesser’s investment company provided an $800,000 bridge loan at 5% for six months, to allow the transaction to close quickly. According to Lesser, the seller wanted a quick sale. Lesser’s statement is corroborated by this article, which states the land was listed for sale in October with a “minimum bid” of $1.75 million. It seems unlikely that True North would have come down 42% from its asking price in just two months if there had not been some urgency to sell. [Update: Since this was written I spoke to a Salisbury reporter who has been covering the True North solar farm since before its inception. She confirmed that the developer of True North was under considerable financial pressure.]

The bridge loan can be extended for another six months at 8.5% interest. In an interview, Lesser told me he believes Power REIT will be able to obtain bank financing for the property at an interest rate in the high 5% range.

True North has a 21 year lease on the property paying $80,800 annual rent, with a 1% annual escalation. Power REIT will be responsible for paying real estate taxes on the property (but not taxes on the solar farm.) According to the Salisbury Assessor’s website, the Fiscal 2013 Tax Rate is $11.51 per thousand dollars (1.151%) of assessed value. The property is currently assessed at $715,100, for an annual tax bill of $8,231. If the property is assessed at the sale price of $1 million and tax rates are unchanged, annual tax will be $11,510 in 2014. Annual interest on the sewer financing is $6,100.

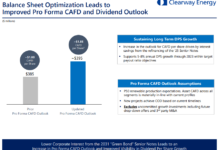

Power REIT’s revenue from the lease will be $80,800 in 2013 and $81,608 in 2014. Between 2000 and 2010, Salisbury property taxes have increased at a 4.6% compound annual rate. If we assume the higher property assessment and a 5% annual increase in property taxes, Power REIT will have $63,422 in annual income to cover the financing costs on the $915,000 closing price. That means that the transaction

should increase earnings per share if Power REIT is able to obtain financing at an interest rate below 6.9%, or if they receive more than $7.25 for any shares issued to finance the deal.

Since PW stock is currently trading around $10 a share, and Lesser thinks banks will be willing to lend against the property at interest rates below 6%, the deal will likely increase PW’s earnings per share. However, given the small size of the deal, the annual earnings increase will be less than a penny a share. I estimate the earnings increase will be approximately 0.5 cent a share.

After the Lease

After the current lease is up, it seems likely that Power REIT will be able to extend the lease on terms at lease as favorable as the current lease. After all, solar farms typically last longer than twenty-two years, and they are difficult to move. Furthermore, according to Lesser, the property was assessed at twice the purchase price in 2010. Given that assessment, Power REIT will likely have several financially viable options for the land when the solar farm is at the end of its useful life, or if it is not possible to extend the lease on favorable terms.

Delayed Dividend

In the same SEC filing, Power REIT declared its regular $0.10 quarterly dividend for the fourth quarter of 2012, to shareholders of record on January 14th, 2013. The dividend was delayed because Power REIT’s low income in 2012 (caused by legal expenses) and the possibility of a tax write-off in 2013 make it more advantageous to pay the dividend in the 2013 tax year. Power REIT still intends to pay usual $0.10 first quarter dividend as well.

Conclusion

The Salisbury solar transaction is likely to increase Power REIT’s earnings per share, if only in a small way. The more important aspect of this transaction is as a proof of concept for Power REIT’s business plan. It shows the company can increase earnings per share by investing in real estate underlying renewable energy production. Power REIT’s strong balance sheet should make more and larger deals possible in the future, especially once the litigation with WLE and NSC is resolved.

Disclosure: Long PW

This article was first published on the author’s Forbes.com blog, Green Stocks on January 7th.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.