Tom Konrad CFA

March Clip Art by Phillip Martin |

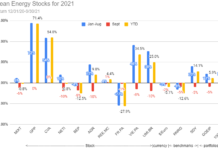

While the broad market of small stocks as measured by my benchmark the iShares Russell 2000 Index (IWM) managed to turn in a small 2% gain in March for the third month in a row, clean energy stocks repeated February’s performance, giving back more of January’s spectacular gains. My clean energy benchmark, the Powershares Wilderhill Clean Energy Index (PBW), declined 3.2% to end the quarter up 5.5% for the year, while IWM closed up 12.2% for the first quarter..

As designed, my ten clean energy picks for 2013 (introduced here) again weathered the downdraft of the broader clean energy sector, a relative stability which comes at the expense of not participating in the clean energy sector’s periodic blistering rallies. For the month, my model portfolio was flat, turning in a total return of 6.8% for the first quarter. For the first time this year, my portfolio has closed ahead of its industry benchmark, although it still lags the broader market.

The chart and table show individual stock performance for my ten picks plus the six alternative picks I presented in a second article.

Significant Events

Below, I highlight significant events I feel affected performance of the stocks in these two lists.

Waterfurnace Renewable Energy (TSX:WFI, OTC:WFIFF)

Geothermal heat pump manufacturer Waterfurnace reported 2012 annual and fourth quarter results on March 13th. The headline numbers were weak, but the outlook was strong. In the conference call, management said they expect a much stronger 2013: Heat pump sales tend to lag housing starts by six to nine months, and the housing market has recently been recovering. While most of my managed portfolios are already heavily invested in Waterfurnace, I added it as a holding to a hedge fund which I co-manage.

| Ticker |

Company |

March USD Return |

| TSX:WFI | Waterfurnace Renewable Energy | 3.6% |

| NASD:LIME | Lime Energy | -5.4% |

| TSX:PFB | PFB Corporation | -5.5% |

| NASD:MXWL | Maxwell Technologies | -39% |

| Amsterdam:ACCEL | Accell Group | -4.2% |

| NASD:ZOLT | Zoltek Companies, Inc. | 46% |

| NASD:KNDI | Kandi Technologies | 6.7% |

| TSX-V:FVR | Finavera Wind Energy | 5.4% |

| TSX:AXY | Alterra Power | -16% |

| NYSE:WM | Waste Management | 5.6% |

| Alternative picks | ||

| TSX:NFI | New Flyer Industries | 2% |

| NYSE:LXU | LSB Industries | -14.2% |

| NASD:AMRC | Ameresco, Inc. | -8.4% |

| NYSE:PW | Power REIT | -1.2% |

| NYSE:HTM | US Geothermal | 12.4% |

| TSX:RPG | Ram Power Group | -14.1% |

Lime Energy (NASD:LIME)

On March 6th, a NASDAQ hearings panel granted Lime until June 30, 2013 to file all its delayed and restated financial results. Expect the company to push the deadline. Unsurprisingly, Lime just announced that its 2012 results would also be delayed until prior years’ results are sorted out.

Maxwell Technologies (NASD:MXWL)

Maxwell Technologies gave investors a nasty shock on March 7th, when they announced that some revenue had been booked too early. When writing an article about it on March 9th, I realized that there would probably be more bad news to come. Growth in Maxwell’s Accounts Receivable was not fully explained by revenue growth and the errors they had reported on the 7th. Details are here.

I promptly sold in all my managed accounts at $8. Readers of the article on my Forbes blog should have been able to sell in the $7.90 to $8 range.

On March 19th, Maxwell’s independent accounting firm McGladrey LLP resigned. McGladrey stated that it “could no longer rely on management’s representations,” and that “there are material weaknesses in [Maxwell’s] internal control over revenue recognition and potentially, more broadly, in [its] overall control environment.”

I take the accountants’ resignation as likely confirmation of my suspicions, and believe readers should sell even at the current price of $4.98, down 39% for the year. Hence, I am replacing Maxwell in the portfolio with an equal amount of Ameresco, Inc. (NASD:AMRC,) one of my six alternative picks. Ameresco is also down this year (-25.9%) but I believe the company’s fundamentals are

strong, for reasons I will discuss below.

I will substitute the two as if MXWL had been sold at the current (April 2nd) price of $4.98 and Ameresco had been bought at the current price of $7.27. Although it would be tempting to use their prices when I published my warning about Maxwell, this portfolio is intended to model the results of a small investor who follows my advice, and only trades more than once a year in very unusual circumstances. Such an investor would likely not be following my writing closely enough to get out as soon as I published my warning.

PFB Corporation (TSX:PFB, OTC:PFBOF)

Green building product manufacturer PFB also reported 2012 results. Headline earnings were ugly, hurt by a slow housing market and a margin squeeze caused by high chemicals costs and a charge due to the failed acquisition of an upstream supplier. Despite the poor 2012 results, PFB, like Waterfurnace, should be able to benefit from the recovering housing market, and management believes that cash flow is sufficient to protect PFB’s C$0.06 quarterly dividend going forward. I recently added a little to my position at $5.51.

Zoltek Companies (NASD:ZOLT)

Carbon fiber manufacturer Zoltek’s recent rise was explained when turn-around specialist investment firm Quinparo partners and allied investors revealed a 10.13% stake in the company and called for a special election to replace the board. I interviewed Quinparo’s founder, Jeffry Quinn, and concluded that the firm would not go quietly, and possibly make a hostile bid for Zoltek (details here.)

On April 2nd, Zoltek announced a “review of its strategic options,” part of an agreement with Quinparo to defer the investment firm’s special meeting request. Such a review will almost certainly include an independent evaluation of offers from Quinparo, as well as any other outside bidders which might be interested in the firm. The stock was up 46% in March, and continues to rally as I write today.

Kandi Technologies (NASD:KNDI)

Chinese ATV and Electric Vehicle (EV) maker Kandi announced 2012 results, with full year revenues up 60.6% and earnings up 33.6% to 30 cents a share. EV sales for the year were 3,915, with EV revenues up 204% to $19 million. This was still less than the 1,000 vehicles per month starting in August I expected when Kandi signed their agreement with the city of Hangzhou last July, but Kandi’s EV sales are clearly ramping up, and a trailing P/E of 13 is quite cheap for a company growing this quickly.

This morning, Kandi announced the completion of its (and China’s) first full-scale EV production line, with annual production capacity expected to reach 100,000 EVs.

Finavera Wind Energy (TSX-V:FVR, OTC:FNVRF)

Finavera is taking longer than expected to finalize its deal with Pattern, announced in December, and the reason I included the stock in my list. In the meantime, Finavera issued C$42,200 worth of shares at the current market price of $C0.21 a share to settle debts to insiders. While I don’t like even this mild dilution, it does show some faith among insiders that the deal is likely to go through, since a failure of the Pattern deal would be disastrous for the otherwise cash-starved company.

Alterra Power (TSX:AXY, OTC:MGMXF)

Renewable energy developer and power producer Alterra lost ground because of delays in multiple development projects caused by uncertainty surrounding the terms of one off take power purchase agreement, and planning studies for for a hydropower project being more complex than anticipated. Also, the possible sale of Alterra’s stake in the Icelandic HS Orka geothermal plant has been put on hold because Iceland’s capital controls would prevent the repatriation of the sale proceeds. Instead, Alterra is working to arrange for HS Orka to start paying a small dividend, the proceeds of which should not be affected by the capital controls.

Alterra has trimmed staff and cut overhead to accommodate the delays and preserve cash for its longer than anticipated pre-construction periods. While the delays reduce the current value of development assets, I don’t feel any of these events undermine the original reason I included the stock in my list: the stock price is far below the value of its assets, especially when the stock’s recent decline in considered. I also added to my position in Alterra in March.

Six Alternative Clean Energy Stocks

New Flyer Industries (TSX:NFI, OTC:NFYEF)

Transit bus maker New Flyer also had lower sales and profits in 2012 compared to the previous year, but this was mostly due to a now-resolved supplier quality issue and the delay of a notice to proceed on a large order from the New York City Transit Authority. Nevertheless, the results exceeded analyst expectations, and the company’s backlog continues to grow, most recently with an order for 120 compressed natural gas buses for the city of Phoenix.

LSB Industries (NYSE:LXU)

LSB fell significantly in March, despite beating analyst estimates for both earnings and revenue at the end of February. My best guess as to the reason for the decline is significant stock sales in the $38-$40 range by a number of insiders. My regular readers were fortunately able to exit this one as well, since I highlighted it as one to sell at $42 in mid February, after which it traded as high as $42.15.

I’m considering getting back in if it falls below $30.

Ameresco, Inc. (NASD:AMRC)

Performance contractor Ameresco again disappointed expectations in Q4 because many of its clients were delaying making final decisions on previously awarded projects. Because they are unable to determine when the current climate of uncertainty will end, management revised revenue and earnings guidance for 2013 downward. The stock fell significantly as a result. I added to my positions because I like the company’s long term prospects and growing backlog, as well as the current price.

Note that I’m going to be substituting Ameresco for Maxwell in the “10 Clean Energy Stocks for 2013” portfolio for the remainder of the year; see the comments under Maxwell above for more details.

US Geothermal (NYSE:HTM)

US Geothermal announced what I expect to be the first of many quarterly profits. Commercial operations and higher output at multiple geothermal plants achieved in 2012 mean that I expect a profitable 2013 is a near certainty, and will probably be over 4 cents a share for the year. The company also received a $33 million cash grant for the completion of its N

eal Hot Springs project this month.

Ram Power Group (TSX:RPG)

Geothermal developer Ram Power announced 2012 results and raised C$50,855,000 in secured 8.5% debt and $0.30 warrants to refinance the company’s outstanding balance on its credit facility, where the company had been paying 16% annual interest, and extended the term to 2018. Revenue increased six-fold to C$28 million in 2012 from 2011 with Phase I of its signature project operating for most of the year. The increased revenues narrowed Ram’s loss from 64 cents in 2011 to 19 cents per share in 2013. Most of this loss was due to an impairment charge, and with Phase II having achieved commercial operation in December, we should see a move to positive earnings in 2013.

Conclusion

While I like to be beating my benchmark, I would prefer if clean energy stocks as a whole were ahead of the broad market for once. Still, I’m happy that the good news at Zoltek offset the ugly surprise at Maxwell. Such effective diversification is the reason why I chose ten stocks, and not just one or two. I hope most of my readers also managed to do a bit better than this portfolio by getting out when I raised the alarm about Maxwell on my Forbes blog, rather than waiting until now.

I added to existing positions in several of these stocks in some of the accounts I manage. Stocks bought are Waterfurnace, Accell, Finavera, Alterra, and Ameresco. I sold Maxwell Technologies, and reduced my exposure to Zoltek by selling calls. New Flyer and PFB Corp were both bought and sold, depending on the need for investment or cash in particular accounts.

Disclosure: Long WFI, LIME, PFB, ACCEL, ZOLT, KNDI, FVR, AXY, WM, NFI, LXU, AMRC,PW, HTM, RPG. Short: MXWL.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.