James Montgomery

2014 is predicted to be a breakout year for solar financing, as the industry eagerly pursues finance innovations. Many of these methods aren’t really new to other industries, but they are potentially game-changing when applied in the solar industry.

Not all options are ready to step into the spotlight, though. Master limited partnerships (MLP) and real estate investment trusts (REIT) promise more attractive tax treatment than securitizations or yieldcos, but they require some heavy lifting and difficult decisions at the highest levels: MLPs need an act of Congress even for an infinitesimal language tweak to remove a legislative exclusion to solar and wind, while REITs involve a touchy reclassification of assets from the IRS that could have broader and undesirable tax consequences. Yet another model gaining traction is a more institutionalized version of crowdfunding, led by Mosaic (technically they call it “crowdsourcing”), but crowdfunding is awaiting more clarity from the Securities and Exchange Commission about what rules must apply.

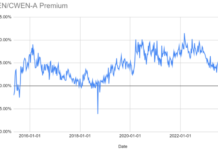

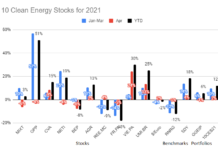

And so, while patiently waiting for Paleozoic movement out of Washington, the industry is turning its attention and anticipation toward ushering in two other new financing models: securitizations (converting an asset into something that is tradable, i.e., a security) and “yieldcos” (publicly traded companies created specifically around energy operating assets to produce cash flow and income). Their build-up actually began last year: in the fall SolarCity (SCTY) finally launched the first securitization of distributed-generation solar energy assets, with a pledge to do more and significantly larger ones in the coming quarters, and throughout 2013 several companies (NRG, Pattern, Transalta, Hannon Armstrong) spun off yieldcos with varying levels of renewable energy assets in their portfolios. These were NRG Yield (NYLD), Pattern Energy Group (PEGI), TransAlta Renewables (RNW.TO), and Hannon Armstrong Sustainable Infrastructure (HASI).

Just weeks into 2014 we’re already seeing an uptick in activity. While the industry awaits SolarCity’s next securitization move, in the meantime the company has acquired Common Assets, which had been building up a Web-based platform for managing financial products (most especially renewable energy investments) for individual and institutional investors; the first SolarCity-backed products are expected to start rolling out by this summer. We’re also hearing rumors of up to half a dozen other securitization deals working through the pipeline, referencing unidentified large players with long histories of building out projects some names frequently invoked as potentially fitting those criteria include familiar residential-solar companies such as Vivint, Sunrun, Sungevity, and several others.

On the yieldco front, in mid-February SunEdison announced plans for its own “yieldco” IPO aimed at unlocking more value within its solar energy assets. Pricing wasn’t announced at press time, but earlier reports suggested it could generate a $300 million payday. SunPower also recently has been talking about doing a yieldco in a 2015 timeframe, likely to feature its 135-MW Quinto project and possibly its 120-MW Henrietta project. Others reportedly eyeing the yieldco model include Canadian Solar, Jinko Solar, and First Solar.

What Capital Markets Can Do For Solar Companies

What’s coming together to bring these two financial innovations into the arena right now? Put simply, it’s the confluence of plunging PV prices and blistering installation growth which are achieving a scale and maturity that outstrips the capacity of traditional tax-equity sources but it also means they can now entertain large-scale financial instruments, explains Joshua M. Pearce, Associate Professor at the Michigan Technological University’s Open Sustainability Technology Lab, who recently published a study of solar securitizations. Look at it from a macro level: even conservative growth estimates for U.S. solar energy capacity additions point to 20 GW coming online by the time the investment tax credit (ITC) is planned to run out in 2017, notes NREL energy analyst Travis Lowder, author of another recent report. At an average of $3/W that’s $60 billion in assets, of which a third or even half could generate securitizable cash streams for solar developers. Spin that equation around: a single $100 million securitization deal could support 72 MW of residential solar assets, 100 MW of small commercial solar, or 133 MW of larger commercial/industrial projects.

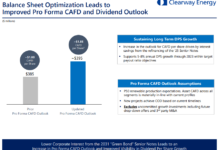

Number of PV Systems (by Market Sector) Potentially Financeable Through a Single Securitization Transaction. Credit: NREL

What does that mean for individual companies? In its 3Q13 financial results SunEdison calculated its current business model of building and selling solar projects yields about $0.74/Watt, but those assets’ true value could jump as high as $1.97/W if the company could find ways to lower its cost of capital, apply various underwriting assumptions, and factor in residual value in power purchase agreements. That’s a startling 2.6x increase in potential value creation that SunEdison thinks it can unlock, by choosing to hang onto its projects vs. simply selling them off. In its mid-February quarterly financial update the company revealed more value-creation calculations: it captured an additional $158 million during 4Q13 through those retained assets, with a resulting metric of “retained value per watt” at $2.02/W. By applying most of the 127-MW on its balance sheet with an estimated $257 million in “retained value” to its proposed yieldco, the company says, it now has sufficient scale to unlock the true value of those solar assets.

The ability to lower the cost of capital deserves extra emphasis. SolarCity’s securitization last fall had a 4.8 percent yield, only slightly higher than a 30-year fixed mortgage and with twice the payout on current 10-year treasury bonds, which is great for investors but for the company it represented roughly half the cost of capital vs. what can be obtained currently for distributed solar PV financing, noted Rocky Mountain Institute’s

James Mandel.

“This trend is transformative for the solar industry” because of how it can unlock so much more value and generate more returns, explained Patrick Jobin, Clean Technology Equity Research analyst with Credit Suisse. (Disclosure: SunEdison is one of his top picks specifically for that reason.) “We’re probably in the first or second inning of the public capital markets appreciating what this does for the industry.”

Securitization vs. Yieldco: The Good, Bad, And Unknown

Both securitization and yieldcos increase access to lower-cost financing by pooling solar assets into an investment vehicle, separating the more reassuring elements of them (payments from operating energy assets under a power contract) from the riskier ones (project development). Both of them promise returns, though yieldcos come as dividends that vary with the company’s performance while securitizations are fixed-income meaning investors get locked-in payments for a set period. And most importantly to the solar industry, they offer a lower cost-of-capital compared to the usual funding sources: debt, tax equity, and sponsor equity.

Generalized solar securitization transaction. Credit: NREL

One key difference: yieldcos own both the energy producing assets and the contracts, which means they can monetize federal investment tax credits. An equity owner can’t use power-purchase agreements to create a securitization and also take the tax benefits. The real challenge, says Yuri Horwitz, CEO of boutique financial services firm Sol Systems, will be building a yieldco that has income-producing assets that create tax liability, coupled with solar projects that have tax benefits. NRG’s yieldco last year did that, and he thinks they have a leg up because of it. Moreover, yieldcos will go out into the market to compete aggressively with other options such as specialty financing that offer similar returns. The hope is that as yieldcos mature and more operating assets are added in their competitiveness will improve.

Defining what assets are best securitized and best spun out into yieldcos exposes a gap that neither properly addresses. Larger projects are good candidates for yieldcos; securitizations typically involve residential solar assets. (An exception: MidAmerican used debt securities/project bonds for its 550-MW Topaz solar farm, as did NextEra (NEE) for its two 20-MW St. Clair solar projects in Canada.) In between is the commercial/industrial segment which presents a more complicated financing challenge. “[Securitizations and yieldcos] don’t really work in the center,” Horwitz said. A different class of securitizations, “collateralized loan obligations,” are more applicable to the commercial sector where less diversity in assets means more risk in making ensuring offtakers’ credit-worthiness, suggests NREL’s Lowder.

Something else that successful securitizations and yieldcos have in common: the more scale and diversity the better. But that’s also a limiting factor: not everyone can pool a wide distributed portfolio of solar assets to mitigate risk, or a smaller portfolio of larger ones. And the more diverse it is, the harder it is to evaluate them as a whole, value them, and get underwritten. By definition, they require someone who can offer up a large pool of assets as de-risked and diversified as possible, and backed by a brand-name sponsor, pointed out Tim Short, VP of investment management at Capital Dynamics. “There’s plenty in the wings that will never make it,” he said. “There’s not a whole lot of people to bring all the ingredients together.”

One other factor to account for in any solar-backed financial models is the externality of policy changes. While investors appreciate the value in a solar offtake contract, but they need to factor in potential risk of any retroactive policy changes, such as is on the table in the net metering debates raging in several states. If net metering policies end up being reduced or even repealed, “solar contracts may default and reducing predicted income streams,” Pearce said. “Ensuring policy stability and communicating that stability to investors will be key to the on-going attractiveness of solar assets.”

The Need to Standardize

What will be critically important as more of these financing innovations emerge, and more solar companies try to take advantage of their promise, is pinpointing ways to standardize how the process works, in specific areas and as a whole. “The number-one priority is standardization, especially moving forward with vastly more distributed-generation assets coming online, said Haresh Patel, CEO of Mercatus. That’s the glue that will hold these offerings together with both developers and investors and it needs to be embedded in developers’ DNA from the very beginning, so their solar assets can be evaluated and bundled repeatedly and reliably.

Addressing the databasing of solar asset performance metrics are NREL and SunSpec with their open-source OSPARC database. One “Gordian knot” issue: who owns the data and are they willing to share it? That pathway of data ownership can get muddled because not all issuers outright own their systems, and it gets worse by adding a tax equity layer. Figuring out that chain of data ownership protection and security is hugely important., notes Mike Mendelsohn, senior financial analyst at NREL. That’s part of OSPARC: anonymizing and rolling up data into a friendly fashion so it’s easy for solar companies to present to investors, and for them to digest. “We need to build confidence that those issues are adhered to,” he said.

Startup kWh Analytics is similarly targeting aggregation and benchmarking of information about solar asset performance, which is crucial because it tells institutional investors about the soundness of the collateral (the system and the leasee). What are individual PV panels and inverters doing compared with other options; are the customers with FICO scores in the 650-700 range paying off their bills? Developers also want to know how their chosen systems are performing comparatively and increasingly so with the emergence of these new investment vehicles, where the developer retains those assets as a financing tool.

Mercatus, meanwhile, wants to address the whole package, assessing everything from system components to permitting. “What entities look for is consistency for which they can reduce risk,” said Haresh Patel, CEO of Mercatus, which is tackling that problem with its own platform: quickly process and synthesize projects’ data so they can be more easily pooled for investors and in the same language project after project, especially as new assets come into the pool. Establishing a mechanism to organize this on a repeatable basis is “the biggest friction point,” he said.

Project summary view inside Mercatus’ 2.0 “Golden Gate” platform. Credit: Mercatus

Standardizing offtake contracts “is the best place to start as this problem impacts every step in the process,” Pearce suggested. “Uniform contracts facilitate comparison, reducing asset evaluation costs and promotes pooling. They also simplify data collection and analysis. Uniform contracts will better facilitate data collection and analysis, asset comparisons and pooling, all of which means reducing costs.

As part of SolarCity’s securitizati

on last fall, Standard & Poors (which rated it BBB+) revealed some interesting background info about the assets being offered, including an impressively high FICO score for residential system owners (and strong mostly investment-grade ratings for the nonresidential ones). There is no solar version of FICO scores, which took decades to become the standard for credit ratings and lending. Addressing this particular pain point is the truSolar Working Group, formed a year ago by 15 solar companies and organizations, trying to develop uniform standards similar to a credit score for measuring the risks associated with financing solar projects, explained Billy Parish, founder/president of Mosaic and a truSolar founding member.

“Standardization will happen much sooner than people think,” Patel said. “Standards drive velocity.” He invoked the efforts of the DoE-NREL multi-year project Solar Access to Public Capital (SAPC), which folds in well over a hundred organizations with activities from standardized PPAs to installation techniques, “mock pools” of solar assets to rating agencies, and collecting performance data.at involving groups with touchpoints all along the solar energy chain from panel suppliers to banks.

Message to the Masses

As solar companies come around to how much extra value they can unlock, part of that process is coming up with new metrics to calculate that value potential, such as “net present value per watt” or “retained value per watt,” and then educating investors who might persistently adhere to the traditional metrics like earnings per share. Issuers including SolarCity and SunEdison and the investment banks go out and do their part with investor roadshows, but also out in the field helping educate about solar asset-backed investments is SAPC is out pounding the pavement too, engaging both sell-side investment banks and buy-side capital market managers to get everyone more comfortable with how these vehicles will work.

“We are now in a positive feedback loop,” said Michigan’s Pearce. “By successfully accessing lower-cost capital, the solar industry can fund high rates of growth in the future, continuing the current momentum of eliminating antiquated and polluting conventional electricity suppliers.”

Jim Montgomery is Associate Editor for RenewableEnergyWorld.com, covering the solar and wind beats. He previously was news editor for Solid State Technology and Photovoltaics World, and has covered semiconductor manufacturing and related industries, renewable energy and industrial lasers since 2003. His work has earned both internal awards and an Azbee Award from the American Society of Business Press Editors. Jim has 15 years of experience in producing websites and e-Newsletters in various technology.

This article was first published on RenewableEnergyWorld.com, and is reprinted with permission.