by Debra Fiakas CFA

Last week Badger Meter (BMI: NYSE) joined a building fraternity: companies reporting strong year-over-year sales growth, but delivering weaker than expected earnings. However, the Badger Meter actually increased earnings by a greater magnitude than it grew sales. The Company reported $83.5 million in net sales, representing 16.3% growth over the same quarter last year. Net income grew by 59.3% year-over-year to $4.6 million or $0.32 per share. As impressive as these results appear to be, the consensus had been for earnings per share of $0.41. The stock declined sharply as investor registered their displeasure with the short-fall.

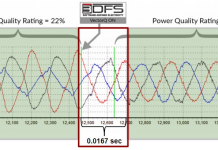

Badger Meter supplies flow measurement and control technologies products to industrial, commercial and utility customers around the world. The company is so much more than a simple meter reader supplier. Anybody who has a system through which fluids flow can benefit from Badger’s wide range of flow control and metering products. The company is included in our Mothers of Invention Index of developers of energy efficiency and conservation technologies. The alternative energy and water industries are key beneficiaries of Badger’s products.

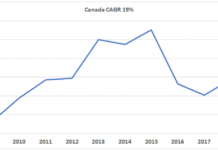

Like its peers in the water metering industry the Badger Meter struggled during the recent recession, but has managed to recover. In 2013, the Company reported record sales of $334 million, on which it earned $24.6 million in net income. Importantly, operations generated $34.8 million in cash. That represents a sales-to-cash conversion rate of 10.4% that helps support future growth and dividends for shareholders.

BMI has been a part of the Crystal Equity Research coverage universe for some months. In our view, the sell-off of the stock was unjustified given the Company’s actual performance. However, it is also the responsibility of management to provide sufficient guidance to publishing analysts so as to avoid egregiously high expectations.

A new and clearly bearish sentiment began building in the shares several days before the earnings announcement. Most likely this bearish sentiment is company-specific and beyond the weakness observed in the broader U.S. equity market in recent weeks. A review of recent trading patterns in BMI reveals a so-called “double bottom breakdown” that occurred the week of April 14th. This chart pattern portends future weakness in the stock and investors should be concerned that stock could fall even further.

Earlier this week we warned our research subscribers that although we were maintaining our Hold rating on BMI shares, even though the stock has declined into the a range in our trading guide where we would be whipping up new positions. Indeed, the stock appears to be oversold at the current price level. However, we noted that it would be a more prudent trading strategy to wait for some recovery in upward momentum before adding to positions. Unfortunately, our analysis suggests investors might have to wait a bit. One very helpful indicator is Moving Average Convergence/Divergence (MACD), which at this time suggests the stock could continue its march southward for several more trading sessions.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.