Ten Clean Energy Stocks For 2014: June Update

Tom Konrad CFA

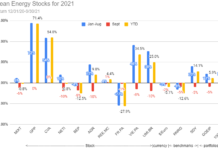

While the major market indexes were hitting new highs in May, small capitalization stocks and clean energy stocks (most of which are small cap) continued to lag. The broad market benchmark IWM gained just 0.2% and is down 2.3% for the year, while my clean energy benchmark PBW fell 3.2% cutting its gains for the year to a slim 1.2%. Meanwhile my 10 Clean Energy Stocks for 2014 model portfolio managed to eke out a 0.3% gain. All of that gain was in the form of dividends paid, without which it would have been flat for the month. For the year to date, the model portfolio has edged ahead of both benchmarks with a total return of 2.8%.

The key to this relative out-performance has been my focus on income and value stocks. Growth stocks had a particularly painful two months in April and June, and growth stocks dominate the clean energy indexes and most clean energy mutual funds. The trend can also be seen in my model portfolio, as I pointed out last month when I contrasted the first six income oriented stocks with the remaining four, which I lumped together as “growth.”

I was a little too casual about calling Power REIT (PW) and Alterra Power (MGMXF, TSX:AXY), “growth” stocks, however. While both do have expansion plans, the main reasons they are in the list are Alterra’s low valuation compared to the value of its assets, and Power REIT’s potential for a large legal windfall. Hence, if I were to categorize the investment theses more precisely, I would call Power REIT a “special situation” and Alterra a value stock. I make these distinctions because it re-emphazies the pummeling growth stocks have taken recently- Ameresco (AMRC) is down 33% and MiX Telematics (MIXT) is down 17% so far this year. These two are the only stocks in the portfolio which are down at all. The other eight picks are up an average of 10%, as you can see in the chart below:

Individual Stock Notes

(Current prices as of June 2nd, 2014. The “High Target” and “Low Target” represent my December predictions of the ranges within which these stocks would end the year, barring extraordinary events.)

1. Hannon Armstrong Sustainable Infrastructure (NYSE:HASI).

12/26/2013 Price: $13.85. Low Target: $13. High Target: $16. Annualized Dividend: $0.88.

Current Price: $14.03. YTD Total US$ Return: 2.9%

Sustainable Infrastructure REIT Hannon Armstrong announced first quarter normalized earnings of $0.20 a share, slightly lower than analyst expectations, but re-affirmed full year guidance. The main cause of the temporarily lower earnings was the timing of maturing investments and the issuance of HASI’s first “Sustainable Yield Bond” (SYB) at the end of December. By issuing the fixed-rate SYB, HASI reduced its exposure to the interest rate fluctuations on the balance of its bank line of credit, better matching the interest rate profile of its assets and liabilities. This comes at the cost of higher interest payments and lower earnings in the short term.

HASI also announced the purchase of a $107 million portfolio of land under wind and solar farms, along with the associated leases to the renewable energy facilities.

2. PFB Corporation (TSX:PFB, OTC:PFBOF).

12/26/2013 Price: C$4.85. Low Target: C$4. High Target: C$6.

Annualized Dividend: C$0.24.

Current Price: C$5.25. YTD Total C$ Return: 10.7%. YTD Total US$ Return: 8.8%

Green building company PFB announced a loss of C$0.27 per share for the first quarter compared to an adjusted loss of $0.12 a year earlier. The first quarter is always weak for the building industry, and the icy winter exacerbated that effect this year. PFB operates mostly in the northern US and Canada, and all of the decline came from its Canadian operations. Nevertheless, the company’s backlog “remained robust” and it paid its regular C$0.06 quarterly dividend.

3. Capstone Infrastructure Corp (TSX:CSE. OTC:MCQPF).

12/26/2013 Price: C$4.05. Low Target: C$3. High Target: C$5.

Annualized Dividend: C$0.30.

Current Price: C$4.46. YTD Total C$ Return: 29.9% . YTD Total US$ Return: 27.6%

Independent power producer Capstone Infrastructure reported very strong first quarter performance, with adjusted funds from operations up 46% from a year earlier due to the additions to its wind portfolio. This and the financings for its Skyway 8 and Saint-Philémon wind power developments underline Capstone’s successful diversification away from reliance on its Cardinal gas cogeneration facility. While Cardinal is currently immensely profitable, its copious cash flow will be greatly reduced under the recently finalized agreement with the Ontario Power Authority, which commences at the start of 2015. Knowing this was coming, management has spent the last couple years investing the profits from Cardinal in renewable energy development. That strategy is now beginning to pay off for investors.

Capstone insiders seem to think these investments will continue paying off. Three of them bought a total of 15,300 shares in May, while another sold C$29,000 worth of (safer) preferred shares and bought $42,000 worth of (riskier but with higher potential for gain) common shares.

4. Primary Energy Recycling Corp (TSX:PRI, OTC:PENGF).

12/26/2013 Price: C$4.93. Low Target: C$4. High Target: C$7.

Annualized Dividend: US$0.28.

Current Price: C$5.17. YTD Total C$ Return: 12.5% . YTD Total US$ Return: 5.7%

Waste heat recovery firm Primary Energy fell back a bit after the initial enthusiasm last month over the recontacting of its Cok

energy facility and dividend increase to US$0.07 quarterly. It paid its first 7¢ dividend on May 30.

5. Accell Group (Amsterdam:ACCEL, OTC:ACGPF).

12/26/2013 Price: €13.59. Annual Dividend €0.55 Low Target: €11.5. High Target: €18.

Current Price: €13.70. YTD Total € Return: 4.9% . YTD Total US$ Return: 3.0%

Bicycle manufacturer and distributor Accell Group went ex-dividend for its 2013 annual distribution of €0.55. The dividend is set on an annual basis based on last year’s profits. Since sales have been better so far this year, I expect next year’s distribution to be higher.

6. New Flyer Industries (TSX:NFI, OTC:NFYEF).

12/26/2013 Price: C$10.57. Low Target: C$8. High Target: C$16.

Annualized Dividend: C$0.585.

Current Price: C$12.30. YTD Total C$ Return: 18.7% . YTD Total US$ Return: 16.6%.

Leading transit bus manufacturer New Flyer announced its first quarter results, with sales, cash flow, and earnings all increasing strongly from prior year numbers on both an absolute and per share basis. The company continues to work through a backlog of lower-priced orders placed during the downturn, but sees prices for new contracts normalizing in many markets.

7. Ameresco, Inc. (NASD:AMRC).

12/26/2013 Price: $9.64. Low Target: $8. High Target: $16. No Dividend.

Current Price: $6.43 YTD Total US$ Return: -33.3%.

The stock of energy performance contracting firm Ameresco stabilized after two months of bad performance following investors’ disappointment with management’s first quarter outlook. Insiders maintain faith in the company’s long term prospects, and bought 48,000 shares in May. One reason the company’s growth prospect may pick up will be the likely inclusion of energy efficiency as a compliance mechanism for the EPA’s proposed rules for new carbon pollution standards from existing power plants.

8. Power REIT (NYSE:PW).

12/26/2013 Price: $8.42. Low Target: $7. High Target: $20. Dividend currently suspended.

Current Price: $9.23 YTD Total US$ Return: 9.6%

Solar and rail real estate investment trust Power REIT filed its first quarter results. Legal expenses fell from the previous year to the point where the company declared a small profit of 3¢ per share. The company also declared the first quarterly dividend on its preferred shares (NYSE:PW-PA), payable to holders as of June 7th.

Hannon Armstrong’s purchase of land underlying solar and wind farms mentioned above validated Power REIT’s own business plan, but also introduces a larger and much better funded competitor. That said, the value of land underlying wind and solar farms is an order of magnitude larger than either company’s enterprise value, so I expect the validation of the concept will be more helpful in allowing Power REIT to find investment opportunities than the competition will be in taking them away.

9. MiX Telematics Limited (NASD:MIXT).

12/26/2013 Price: $12.17. Low Target: $8. High Target: $25.

No Dividend.

Current Price: $10.09. YTD Total ZAR Return: -14.4%. YTD Total US$ Return: -17.1%

The stock of global provider of software as a service fleet and mobile asset management, MiX Telematics continued to decline along with the other stocks in the industry and growth stocks in general. But unlike competitors such as Fleetmatics (NYSE:FLTX), most of MiX’s costs are denominated in South African Rand, while revenues are in a broad range of global currencies. Where MIXT was already trading at a much more attractive valuation than FLTX, the recent currency movement should increase its relative attractiveness as its results are boosted by currency changes. Results for the period ending March 31st will be announced on June 5th.

I added to my position when the stock fell to $9.95 during the month.

10. Alterra Power Corp. (TSX:AXY, OTC:MGMXF).

12/26/2013 Price: C$0.28. Low Target: C$0.20. High Target: C$0.60. No Dividend.

Current Price: C$0.31 YTD Total C$ Return: 10.7% . YTD Total US$ Return: 7.0%.

Renewable energy developer and operator Alterra Power announced first quarter results. Revenue and EBITDA increased due to lower repair costs and currency fluctuations. Construction continues on its Jimmie Creek run of river hydropower plant in British Colombia.

Two Speculative Clean Energy Penny Stocks for 2014

Ram Power Corp (TSX:RPG, OTC:RAMPF)

12/26/2013 Price: C$0.08. Low Target: C$0.00. High Target: C$0.22. No Dividend.

Current Price: C$0.035 YTD Total C$ Return: -56% . YTD Total US$ Return: -57%.

Geothermal power developer Ram Power reported the results of the stabilization period and performance test of its marquee San Jacinto-Tizate project after an extensive remediation program. In the company’s words, the results “did not meet our expectations.” The company is “now in technical default of the… loan agreements for failure to achieve a minimum MW output.”

I included Ram as a speculative pick on this list because I hoped the remediation program would produce better results. Since it did not, I feel the best course of action is to cash in this lottery ticket rather than taking on a new gamble.

The new gamble in question is the hope that, as a reader put it, “potential suitors will bid gener

ously for the company.”

That’s not a gamble I’m interested in taking, although there is a case to be made for letting the much money ride. At the current price of C$0.035, the market capitalization is only C$13 million (US $11.7 million). The company recently received $6.4 in cash for its Geysers Project from US Geothermal (NYSE:HTM.) Given the low valuation, it would not be hard to see the stock price multiply if management can capture any value from San Jacinto or Ram’s early stage projects.

Finavera Wind Energy (TSX-V:FVR, OTC:FNVRF).

12/26/2013 Price: C$0.075. Low Target: C$0.00. High Target: C$0.22. No Dividend.

Current Price: C$0.09 YTD Total C$ Return: 20% . YTD Total US$ Return: 17%.

Shares of wind project developer Finavera gave back some of their gains on a lack of news. Now that the sale of its Meikle wind project to Pattern Energy Group (NASD:PEGI) has closed, investors expected an update on the company’s strategic plan last month. This lottery ticket still seems to have a lot more upside than downside, so I continue to wait. But given the repeated delays and disappointments, that business plan will have to be very attractive to persuade me to vote for anything other than a return of the company’s capital to shareholders.

Disclosure: Long HASI, PFB, CSE, ACCEL, NFI, PRI, AMRC, MIXT, PW, AXY, FVR, PEGI. Short PEGI calls.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.