Tom Konrad CFA

Anew report written by Nathaniel Bullard at Bloomberg New Energy Finance highlights the difficulties large institutional investors would have divesting from fossil fuels. What it does not specifically discuss is that these difficulties could lead to large financial losses for investors who see the difficulty of divesting as a reason to delay.

Just as we can’t easily fill up our cars with solar power instead of gasoline, the report points out that there is no asset class that can directly substitute for oil and gas in large institutional portfolios.

A person with a short commute can simply ditch gasoline for renewable fuel by riding a bike, and small investors can easily divest from fossil fuels without sacrificing growth or yield by using small capitalization stocks and yield cos.

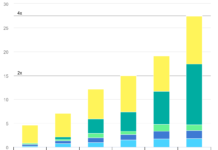

The relatively high yield of oil and gas stocks is the most difficult to replicate, even at its level of 2.41%, which the report describes as “not enormous.” According to the report, the only sector with a higher average yield is REITs (at 4.55%). REITs have a total market capitalization of less than a third of oil and gas stocks, so it would be impossible for more than a fraction of large investors to replace their oil and gas holdings with REITs.

The Instructive Case of Coal

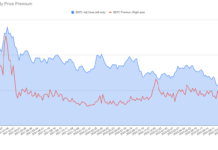

In contrast to oil and gas, the report makes the point that because the market capitalization of coal companies is much smaller, divesting from coal alone is much easier than divesting from oil and gas. The report states that “Coal equities are less than 5% the total value of oil and gas equities, and have already trended down nearly 50% in the past five years… as a result, divesting from coal would be much easier then divesting from oil and gas.”

The report’s author Nathaniel Bullard, told me in an interview that divesting from coal would have been more difficult just three years ago. He says, “US coal has had clear indicators of future change in place for a while. … Some coal equities have lost 90% of their value since 2011… This much diminished size means that… the same number of shares will represent a much smaller portion of an investor’s overall portfolio relative to 2011.”

Hold High, Sell Low?

To put it more bluntly, investors who have already lost their shirts in coal stocks will have a much easier time selling their much-diminished holdings today than they would have when coal stocks were at their peak. Ironically, it’s easier to sell low and buy high than vice-versa, especially for investors who manage large pools of money.

It does not take a multi-million dollar salary to know that waiting until your stocks have fallen by half before you sell is a suboptimal investment strategy. Despite past “clear indicators of future change” and lower estimates of future coal demand due to air pollution regulations in the coal industry, institutions like Stanford are only now beginning to divest from the sector. Most have not yet budged.

Are Oil and Gas Next?

The report begins with a quote from an executive who describes the divestment movement as “one of the fastest-moving debates I think I’ve seen in my 30 years in the markets”. If this fast-moving debate leads to fast-moving divestment, the sheer size of institutional oil and gas holdings would lead to a scale of the selling that could easily drive down prices of oil and gas stocks as fast as coal stocks have fallen over the past few years.

The divestment movement was only in its infancy when coal stocks peaked in 2011, so divestment has been only a minor contributor to their decline. Bullard attributes most of the decline to fundamental factors, such as low gas prices and (to a limited extent) wind power in the US, and concerns about air pollution in China.

That said, the long term fundamentals of oil and gas are not favorable. Industry costs are rising as producers shift towards unconventional sources such as tar sands and tight oil and gas which are extracted with relatively expensive techniques such as hydraulic fracturing (“fracking”). Meanwhile, high fuel prices are beginning to reduce average driving distances in mature markets such as the US and Europe while the declining costs of efficiency technologies such as hybrid and electric vehicles further lower demand. In the fastest growing vehicle fuel market, China, air pollution concerns have led the government to aggressively promote “new energy” vehicles, particularly hybrids and EVs.

Natural gas faces increasingly inexpensive competition in electricity markets from wind and solar generation. That, combined with technologies such as storage, smart grid, demand response, and better transmission which make it easier and cheaper for these variable sources to supply a larger portion of electricity demand with less reliance on dispatchable generation such as natural gas, hydropower, and biomass-fired electricity.

The fundamentals of all fossil fuels will be further undermined if the world ever makes a concerted effort to rein in carbon emissions. At the moment, the prospects for large scale regulatory moves seem dim, but at some point the increasing costs in terms of falling crop yields, widespread and severe heat waves and droughts, ocean acidification and the like will lead to political action. At this point it will almost certainly be too late to avoid significant economic and human costs from climate change, but that does not mean that it will not help us avoid even greater damage. And the longer we delay taking substantive actions to curb greenhouse gas emissions, the more draconian those actions will have to be. Drastic moves to curb carbon emissions will have even more drastic effects on the fundamentals of fossil fuel industries.

Conclusion

In part because it is so hard for large investors to exit fossil fuels, it is unlikely that a majority of such investors will move to divest before they have lost a large portion of their current holdings to price declines driven by the fundamental factors outlined above and selling from more motivated investors.

Some of the factors listed above, such as concerted political action to curb carbon emissions, may take a long time to be felt. Other factors, such as the declining cost of renewable energy and efficiency technologies and the increasing costs of fossil fuels are moving energy markets today.

When these factors will begin to hurt oil and gas stocks is unclear, but the coal industry shows that, although divesting is hard, it does not pay to wait too long.

This is where the analogy to replacing fossil fuels in your commute by buying an electric car breaks down. With electric cars, the more people own them, the easier and cheaper they will be to use: growth in charging infrastructure will rise with the adoption of plug-in vehicles, while higher volumes should help bring down their initial cost.

In contrast, it pays to be first rather than last when divesting from fossil fuels. While it is possible to be too early, at some point the worsening fundamentals

of fossil fuel industries and/or a large scale divestment movement will undermine the value of all fossil fuel stocks. Those who divest sooner will have much more money to invest elsewhere than those who delay because divesting is just too hard.

Fortunately, small investors have it easy. Divesting, for once, is a place where the small investor has the advantage on Wall Street.

This article was first published on Renewable Energy World, and is republished with permission.