by Debra Fiakas CFA

The last post “Man Makes Mother Nature Look Like a Lazy Maid” featured the work of Harvard scientists who have developed a breakthrough ‘bionic leaf’ system that uses sunlight to split water into hydrogen and then combine it with carbon to make isopropanol, an alcohol that can be used as fuel. It is very much like reverse combustion. Kudos to Harvard! However, the good folks at Harvard are not alone in their quest to outsmart Mother Nature.

In the late 1990s, the U.S. National Renewable Energy Laboratory in Golden, Colorado had reported progress with an artificial leaf that achieved 12% efficiency. This an efficiency level well in excess of leaves in nature that only store 1% of the sunlight it receives as biomass. Unfortunately, the Colorado artificial leaf was expensive, producing fuel that cost more than twenty-five times competing fuels. That artificial leaf needed a great deal more work to reduce costs and achieve scale and efficiency over time.

At the California Institute of Technology or Caltech there are several dozen scientists working on similar artificial leaf technology, trying to build on the Colorado laboratory’s earlier successes. Caltech is one of five Energy Innovation Hubs created by the Department of Energy to solve the critical energy and environmental issues facing the U.S. A grant valued at $116 million has been provided to Caltech to support their experiments.

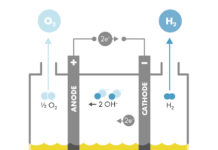

Caltech is trying to reduce costs by perfecting the photovoltaic element. As proven in Colorado over fifteen years ago, electricity from a solar panel can be used to split water into hydrogen and oxygen. A membrane is also used to keep the hydrogen gas separate. Caltech is working with a more efficient configuration of electrodes with special semiconductor materials coated with a catalyst. Iridium has been found to be the best catalyst for the oxygen electrode, but cost could be an issue. High purity iridium sells for more than $4000 per 100 grams. Thus the group is experimenting with various mixes of cheaper materials such as titanium, nickel, iron, cobalt and cerium oxide to find the best combination for light absorption and stability. After analyzing over 5,000 different combinations the group has settled on silicon with a coating of titanium dioxide for the oxygen electrode.

Caltech has claimed the potential for up to 20% energy efficiency. Even with such effective conversion of sun power to fuel, cost will be an issue. Titanium is not free and silicon is expensive. There is considerable more work that has to be done before investors will get a crack at even investment in privately held company not to mention shares of stock in a public company.

HyperSolar, Inc. (HYSR: OTC/QB) in California claims it has found solutions for the cost issues that have plagued hydrogen to fuel developers. HyperSolar describes its system as a ‘solar hydrogen generator’ that integrates the electrolysis function directly into a solar cell. Its system combines a photoabsorber and a catalyst in a transparent water-filled plastic bag. The company calls it a ‘baggie system.’ The bag inflates when exposed to sunlight as the hydrogen and oxygen form inside. In December 2014, the company announced it has achieved 1.25 volts in its electrolytic element, which is sufficient to split water molecules into hydrogen and oxygen.

HyperSolar is using nano- and micro-particles to cut down on materials costs. Since the electrolysis takes place at a nano-level fewer photovoltaic elements are required and this reduces over-all cost. Before HyperSolar’s recent achievements only photovoltaic cells using expensive silicon and titanium had been able to meet the voltage requirements.

HyperSolar shares are priced at pennies, making it a stock unsuitable for all expect the most risk tolerant. About 10% of the float changes hands each day, but even with good trading volume, the bid-ask spread is wide. At the end of December 2014, the company had $62,222 in cash on its balance sheet, bringing into question the company’s capacity to execute on the business plan. Management has foregone compensation, keeping the cash usage at about $40,000 per months to keep the company going. A small capital raise at the beginning of January 2015, should tide the company over for another month or two. Agreements with the University of Iowa and the University of California at Santa Barbara help keep working moving forward.

As a fully reporting public company it is relatively easy to follow HyperSolar’s progress. It after recent accomplishments it is a company well worth watching despite its weak balance sheet.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.