By Tom Konrad, Ph.D. CFA

Community solar is gaining traction in many states. The concept, also known as shared solar or solar gardens, originated in the mid-2000s as a way to allow broader participation in the ownership of solar photovoltaic (PV) systems, while also encouraging local development.

Community solar broadens access to solar beyond homeowners with suitable roofs. A National Renewable Energy Laboratory report from 2015 estimated that 49 percent of households cannot own solar because they do not own their own home, or they live in high-rise buildings with insufficient roof space. Rooftop solar is impractical for many more because of shading, homeowners’ association rules, or aesthetic concerns.

But now there’s another way to invest in solar projects in the public market: YieldCos.

Which is a better investment for homeowners looking to support the build-out of new clean energy projects?

Financial benefits of community solar

Like residential solar, the financial benefits of community solar subscriptions have been improving over time as the price of solar equipment falls and electricity prices have mostly risen.

I interviewed Tom Sweeney, chief strategic markets officer at community solar developer Clean Energy Collective (CEC), to gauge the current and future marketplace. CEC has developed many community solar farms in its native Colorado, as well as Massachusetts, Rhode Island, Wisconsin, Washington and Kansas. The company is also developing community solar projects in New York, which recently passed enabling legislation.

Sweeney says that CEC’s typical subscribers are educated baby boomers who are motivated both by financial benefits and by a desire to promote renewable energy. But, like residential solar installations, improving economics are likely to draw in a rising number of shareholders motivated purely by financial benefits.

Over the past few years, solar installers have moved from needing an upfront payment to offering solar leases and loans that allow the homeowner to begin saving money immediately. In Massachusetts, a combination of high electricity prices and robust incentives allow CEC to offer a pay-as-you-go (PAYG) model requiring no upfront payment. The subscribers pay only for the credits to their bills, at a cost of 85 percent to 90 percent the value of the credits. The company plans to offer similar subscriptions to its first projects in New York, as well as to introduce the PAYG model in Colorado.

The low risk and immediate financial benefits of the PAYG model are likely to broaden the market for community solar subscriptions, just as first-year savings have broadened the market for residential rooftop solar beyond environmentalists and early adopters.

YieldCos as an alternative to community solar?

As the motivation to buy community solar subscriptions becomes increasingly financial, it makes sense to start comparing them to a purely financial investment, such as renewable energy YieldCos. YieldCos are publicly traded companies that own clean energy assets and use the income to pay dividends to shareholders.

Many community solar subscribers (Including Ms. Ostrom) consider comparing a stock market investment to a solar subscription to be “apples and oranges.” The main grounds for these objections seem to be the assumptions that:

- Community solar is not an investment in the same sense as Yieldcos are.

- Buying a Yieldco on the secondary market does not help build new solar farms

- Community solar is a hedge against rising electricity prices in a way that Yieldcos are not.

Taking each of these in turn, it is true that community solar subscriptions are not an investment according to the IRS or Securities Exchange Commission (SEC.) Community solar has exemptions from the rules governing investment so long as the subscriptions only offset electric bills, and they are not being held with the intent to resell at a profit. On the other hand, the Supreme Court has defined an investment as a contract “whereby a person invests his money in a common enterprise and is led to expect profits solely from the efforts of the promoter or a third party.” Except for the “expectation of profits” this sounds exactly like a solar subscription, and, even there, offsetting an electric bill seems very similar. I can imagine a person buying a Yieldco, and using the dividend checks solely for paying her electric bill. In short, the main difference between a solar subsription and a Yieldco is that a Yieldco investment is more flexible in terms of what the dividend can be used for.

On the other hand, buying a Yieldco on the secondary market (as opposed to during a primary or secondary offering direct from the company) does help new solar or wind farms get built. Currently, most Yieldco prices are very low. In fact, they are so low that few Yieldcos can issue new shares to invest in new facilities without reducing the dividend to existing investors. Yieldcos have in fact stopped issuing new shares and buying solar and wind farms. Buy buying Yieldco shares, investors help to increase the share prices, and will eventually raise them to the point where the Yieldcos can again issue shares in a secondary offering and invest in new wind and solar farms again.

This connection may seem tenuous, but the connection between a solar subscription and building a particular solar farm is tenuous as well. If the subscription is purchased after the farm is built, it clearly was not essential to the construction of that solar farm. If the subscription was purchased earlier, it still may not have been essential: Most solar subscriptions sell out quickly, and another subscriber would have been found to buy the subscription in any case.

While community solar subscriptions are

a much better hedge against rising electricity local prices than Yieldco dividends, Yieldco dividends also have value as a hedge. Long term increases in electricity prices will make it easier for Yieldcos to renew their power purchase agreements on favorable terms, making Yieldcos more valuable over time. Falling electricity prices would hurt both community solar subscribers and Yieldco investors as well. Hence, while a Yieldco investment is not as good at hedging a particular electricity bill, it is still a hedge, and it makes sense to compare the two.

It’s also worth noting that Pay As You Go solar subscriptions have little hedging value against electricity prices, since the cost of the solar subscription will increase or decrease along with those prices.

Reasons To Invest

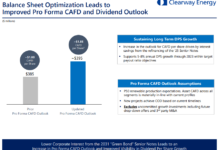

Many YieldCos invest in both clean energy and conventional generation, but a few have only clean energy investments. 8point3 Energy Partners (CAFD), TerraForm Power (TERP), and TerraForm Global (GLBL) all invest almost entirely in solar. Pattern Energy Group (PEGI) is almost entirely invested in wind, Brookfield Renewable Energy Partners (BEP) is mostly invested in hydropower, with some wind and solar, while Hannon Armstrong Sustainable Infrastructure (HASI) invests in a broad range of efficiency, wind and solar investments. I will focus on these six for the most accurate comparison.

For a fair comparison to community solar, I asked two community solar subscribers homeowner Jacquie Ostrom and renewable energy expert Joe McCabe why they made the leap. Below are their reasons, in the rough order of importance they assigned to each:

- Fighting climate change

- Supporting renewable energy

- Supporting innovative local companies

- Financial returns

- Supporting local jobs

- Helping to educate the local utility about the benefits of solar

- More complicated to sell a house with solar on it

Since a YieldCo’s assets are almost never local, they cannot compete with community solar on the basis of supporting local companies and jobs. But they have a number of advantages over community solar subscriptions.

Anyone can buy shares in a YieldCo. So far, only 14 states and the District of Columbia have adopted legislation enabling community solar. YieldCos also do not sell out (as community solar almost always does), and they can even be held in a tax-preferred retirement account such as an IRA.

Investors also have a broad range of YieldCos to choose from that support a variety of clean energy technologies with different risk and reward profiles. Many potential community solar subscribers (including McCabe) have been waiting for years for the opportunity to subscribe to just one.

Let’s look at a few of the reasons that Ostrom and McCabe gave for investing in community solar and then compare them to YieldCos.

Fighting climate change

Investments in different clean energy technologies can have wildly different climate impacts, and solar is seldom the most effective. In fact, the most important factor in determining the climate impact of a solar farm is the carbon intensity of the electricity it displaces. While community solar farms and wind farms in the coal dependent Midwest are very effective at reducing greenhouse gas (GHG) emissions, community solar farms in California are much less effective at reducing GHGs, since California’s grid is already very clean.

The other question to ask is how much electricity generation an investment in a solar subscription of Yieldco creates. According to its annual report, Pattern Energy sold 5.1 million MWh in 2015, or about 1.6 MWh for every $1000 invested in the company. A typical solar farm at $2/W after incentives would produce between a third and a half as much electricity per dollar invested. Hence, unless the community solar installation feeds power to a very carbon-intensive utility, investing in Pattern seems like a much more effective way to fight climate change than a similar investment in a community solar farm.

Supporting renewable energy

An investment in any of the YieldCos listed above is as much an investment in clean energy (when including energy efficiency) as a community solar subscription. If we drop energy efficiency from consideration, that still leaves five viable YieldCos.

Ease of transactions

According to Sweeney, CEC’s subscribers have never had problems selling their subscriptions. Community solar projects are mostly sold out, and CEC has been able to find a buyer at the price the seller wanted the 20 or so times the company has been asked to step in. That said, selling community solar subscriptions is not as easy as selling YieldCo stock, where buyers are available whenever the market is open.

Financial returns

While YieldCos cannot offer anything like the reliable and safe returns of a PAYG community solar subscription, the size of those returns is limited by a subscriber’s electric bill. If, for example, a subscriber pays CEC $0.90 for every dollar of bill credit, and her monthly electric bill is $100, then the savings will be no more than $120 per year.

According to Sweeney, CEC’s solar subscriptions in Colorado that had upfront payments have typically repaid 5 percent to 8 percent of the subscription cost in the first year. This number rises and falls with the price of electricity. The comparable number will be 6 percent to 9 percent in New York.

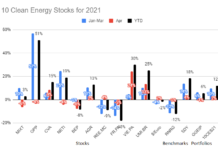

This number is roughly comparable to the dividend yield for YieldCos. At the end of February, the YieldCos listed above offered the following dividend yields at the market close on April 1st:

| CAFD | TERP | GLBL | PEGI | BEP | HASI |

| 6.2% | 14.2% | 47% | 8.2% | 5.9% | 6.3% |

In general, current YieldCo dividends are in the same range as returns from solar subscriptions. The dividend yields from 8point3 (CAFD), Pattern (PEGI), Brookfield (BEP), and Hannon Armstrong (HASI) all fall neatly into the 6 percent to 9 percent range that CEC expects to offer subscribers in New York.

The much higher yields at TerraForm Power (TERP) and TerraForm Global (GLBL) reflect uncertainty around the bankruptcy of their sponsor and controlling shareholder, SunEdison (SUNE). This puts the two YieldCos’ dividends in danger, and the much higher yields are the consequence of the greater risk.

Yieldco dividends (excluding the TerraForms) are likely to grow faster than the growth of electricity prices, making the YieldCos much more compelling at current prices than upfront investments in community solar.

Risks

YieldCos are currently much more attractive than community solar subscriptions particularly when it comes to financial returns, greenhouse gas reductions and ease of transactions. The exceptions are benefits to the local economy provided by community solar.

The factor that has so far prevented the widespread comparison of community solar and YieldCos is the perception of risk. After all, the reason most YieldCo yields are high enough to compare favorably to community solar is that their prices have fallen drastically since a year ago.

It is true that YieldCo prices could drop even further, although I am on record predicting that the bottom of the YieldCo market was reached in September of last year. I stick by that call. YieldCos invest in the same types of assets as community solar, and the cash flows that underlie their dividend carry the same sorts of risk. Most community solar subscribers purchase their subscriptions with no intent to ever sell. A YieldCo investor who does the same should, on average, outperform the subscriber because of the higher current dividend and expectation of dividend growth.

Conclusion

While YieldCos currently seem more attractive than community solar subscriptions in many respects, they cannot match the potential of local development or the minimal risk of a PAYG subscription.

Hence, the best option would be to invest in both. Take the no-money-down PAYG subscription and save a little on your electricity bill while helping the planet and your local economy. Then, take any money you were thinking of investing in community solar and buy a YieldCo or three.

Disclosure: Tom Konrad owns CAFD, TERP, GLBL, PEGI, BEP, and HASI. He does not yet own a solar subscription, but he plans to subscribe as soon as one is available for his utility.