Tom Konrad, Ph.D., CFA

So far, the broad stock market seems to like the idea of a tax and regulation-cutting and infrastructure spending Trump administration and Republican controlled Congress. The bond market is less pleased at the rapidly growing deficits such a “borrow and spend” policy will inevitably entail. While the S&P 500 advanced 3.4% in November, bond funds fell in the face of rising interest rates. The iShares 20+ Year Treasury Bond (TLT) fell 8.4%.

Clean energy stocks were also hurt by the incoming President’s climate change skepticism and his promises to undo environmental regulations put in place by the Obama administration. While the PowerShares WilderHill Clean Energy ETF (PBW) fell only 0.1%, clean energy income stocks such as Yieldcos were hit by the double-whammy of rising interest rates and anti-environmental rhetoric. The Global X YieldCo ETF (YLCO) fell 5.6%.

Against this backdrop, my income-heavy Ten Clean Energy Stocks for 2016 model portfolio fared relatively well. While the seven income stocks matched YLCO’s 5.6% losses, the three growth stocks shot up 9.6% (one for little apparent reason.) This kept the overall portfolios’ losses to a modest 1.0% for the month.

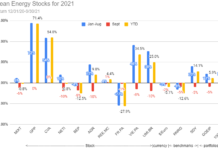

For the year, the model portfolio, its income and growth sub-portfolios, and the Green Global Equity Income Portfolio (GGEIP) which I manage all widened their large leads against their benchmarks. (The benchmarks are PBW for the growth stocks, YLCO for the income stocks and GGEIP, and a 30/70 blend of the two for the Ten Clean Energy Stocks model portfolio, as specified in the original 2016 article.)

Detailed performance is shown in the chart below.

How Trump Will Affect Yieldcos

While rising interest rates are bad for all income stocks, a roll-back of environmental regulations such as Obama’s Clean Power Plan and a withdrawal from the Paris Climate Agreement should have little if any financial impact on Yieldcos. This is because Yieldcos own existing renewable energy generation assets which have already received their subsidies. Even if the last year’s solar and wind tax credit extensions were to be rolled back (which most observers think is unlikely), existing solar and wind farms would almost certainly be unaffected.

In fact, a decrease in incentives to future wind farms could even help the owners of existing farms, since it would reduce competition from new, less subsidized, solar and wind when existing Power Purchase Agreements (PPAs) expire (in 10-20 years) and Yieldcos need to find new buyers for their power production.

Despite this reality, investors who are increasingly worried about coming regulatory changes and increasing interest rates are likely to use any minor hiccup at Yieldcos and other clean energy companies as an excuse to sell.

The chart below and the following discussion gives detailed performance for the individual stocks, and the reasons for it. Click for a larger version.

Income Stocks

Pattern Energy Group (NASD:PEGI)

12/31/15 Price: $20.91. 12/31/15 Annual Dividend: $1.488 (7.1%). Beta: 1.22. Low Target: $18. High Target: $35.

11/30/16 Price: $19.63. YTD Dividend: $1.17. Expected 2016 Dividend:$1.58 (8.0%) YTD Total Return: -0.8%

Wind Yieldco Pattern Energy released its third quarter earnings on November 7th. Power production was good, and the company increased its dividend to $0.408 per share, but the investor reaction was hijacked by the statement that the company had found a material weakness in its internal controls.

“Management believes that the Company’s internal control over financial reporting was not effective as of September 30, 2016 , due to the aggregation of internal control deficiencies related to the implementation, design, maintenance and operating effectiveness of various transaction, process level, and monitoring controls. These deficiencies largely have arisen during fiscal 2016 because of growth of the Company, increases in employee headcount to support growth, and frequent changes in organizational structure were not adequately supported by elements of its internal control over financial reporting. However, management has concluded that the consolidated financial statements present fairly, in all material respects, the Company’s financial position, results of operations and cash flows for the periods disclosed in conformity with U.S. generally accepted accounting principles (GAAP). Management has developed a plan to remediate the material weaknesses. Management expects the remediation plan to extend over multiple financial reporting periods; therefore, the Company will receive an adverse opinion on its internal control over financial reporting as of December 31, 2016 .”

In other words, while something could go wrong with financial reporting, they are confident that nothing has so far, and they have a plan to fix the problem over several months. They’re telling us now because this is not the type of thing you should try to cover up, and the company’s auditors will also be saying something in the annual report, anyway.

While I never like to see any questions about accounting, it seems like Pattern caught this one early before any harm was done, and they are working to fix it. I consider the current sell-off a buying opportunity, and have added to my position.

Enviva Partners, LP (NYSE:EVA)

12/31/15 Price: $18.15. 12/31/15 Annual Dividend: $1.76 (9.7%). Low Target: $13. High Target: $26.

11/30/16 Price: $28.20. YTD Dividend: $2.025 Expected 2016 Dividend: $2.025 (7.2%) YTD Total Return: 69.1%

Wood pellet focused Master Limited Partnership (MLP) and Yieldco Enviva Partners has been my biggest winner for the year, and it is potentially more vulnerable to the fallout of a Trump Presidency than most of the other companies in this list. Like most Yieldcos, its revenue comes from long term contracts with investment grade utilities, so those operations should be safe.

Most of Enviva’s potential growth prospects are with existing coal plants which want to convert to much less carbon intensive wood pellets, which Enviva supplies. Coal plants convert to wood because it is one of the most cost effective ways to comply with greenhouse gas and other emissions rules. In the US, Trump promises to roll back these Obama era regulations, and his promise to abandon the Paris Climate agreement may lead to Europe (the home of the majority of Enviva’s current customers) taking a les

s aggressive stance on greenhouse gasses.

I would not see any of this as a problem if Enviva were yielding more than the current 7.5%. I expect a higher yield from MLPs than other companies, because their special tax structure makes it difficult for many investors to own them. I sold my entire holdings of Enviva the morning after the election. I will continue watching the stock for opportunities to buy back in at a lower level.

Green Plains Partners, LP (NYSE:GPP)

12/31/15 Price: $16.25. 12/31/15 Annual Dividend: $1.60 (9.8%). Low Target: $12. High Target: $22.

11/30/16 Price: $18.25. YTD Dividend: $1.638. Expected 2016 Dividend: $1.638 (9.0%) YTD Total Return: 24.5%

Ethanol production MLP and Yieldco Green Plains Partners may or may not benefit from a Trump administration. The oil industry hates the EPA’s Renewable Fuel Standard (RFS), which requires a minimum volume of ethanol to be blended with gasoline, and Trump has strong ties and large investments in the industry.

On the other hand, ethanol is a domestic fuel source which reduces imports and (gallon for gallon) creates more jobs, especially in the Midwest. In 2013, the ethanol industry created 387 thousand jobs and sold 13.3 billion gallons, or one job for every 34 million gallons. According to industry numbers, an increase of 1.2 million barrels per day would be associated with an increase of 394 thousand US jobs. 1.2 million barrels/day equates to 15.3 billion gallons per year, or one job for every 39 million gallons per year. If Trump’s main goal is to increase domestic jobs, he will favor ethanol over his friends in the oil industry.

The EPA recently released its RFS targets for 2017-18, and for the first time in a long time, the ethanol industry felt that the EPA had released a standard in accordance with the law. Trumps pick to head the EPA, Myron Ebell is not only a climate change denier, but also a critic of ethanol. His libertarian Competitive Enterprise Institute often released reports critical of the ethanol mandate, so I think we can be fairly confident that future EPA ethanol mandates will be more to the satisfaction of oil refiners, even if the 2017-18 targets are not watered down.

GPP is also less protected from policy changes and market forces than other Yieldcos, because it only has long term contracts with its parent, ethanol producer Green Plains (GPRE). Green Plains’ ability to honor these obligations depends on its ability to remain solvent, which in turn depends on the ethanol market.

With this in mind, I have sold most of my shares of GPP.

NRG Yield, A shares (NYSE:NYLD/A)

12/31/15 Price: $13.91. 12/31/15 Annual Dividend: $0.86 (6.2%). Beta: 1.02. Low Target: $11. High Target: $25.

11/30/16 Price: $14.59. YTD Dividend: $0.695. Expected 2016 Dividend: $0.945 (6.5%) YTD Total Return: 10.1%

The only likely impact on Yieldco NRG Yield’s (NYLD and NYLD/A) prospects due to a Trump administration is a rise in interest rates. Given the recent decline of the stock, I’ve been increasing my holdings of the company’s A shares.

Terraform Global (NASD: GLBL)

12/31/15 Price: $5.59. 12/31/15 Annual Dividend: $1.10 (19.7%). Beta: 1.22. Low Target: $4. High Target: $15.

11/30/16 Price: $3.78. YTD Dividend: $0.275. Current Expected 2016 Dividend: $0.275 (7.3%). YTD Total Return: -24.7%

Yieldco Terraform Global released an investor update on November 29th. The company expects to be back in compliance with NASDAQ reporting requirements in advance of its extended March 2017 deadline, but they are still negotiating with bondholders about failure to meet covenants, including timely reporting requirements. It expects to be fully operationally independent by January.

Underlying the company’s long term viability are the fact that its portfolio of solar and wind projects continue to perform well, and a hefty cash pile. Some of this cash was used to pay down corporate level revolving debt. Unrestricted cash at the company level was $583 million at the end of the third quarter, or approximately $3.38 per share (including both A and B shares.) This should allow the company operational flexibility while negotiating with bondholders.

The company released a number of preliminary financial estimates for 2016, but did not include CAFD, which measures the company’s ability to pay dividends to shareholders.

If we compare these to the first quarter estimates on which I based my July 20th valuations of the stock, we can see how the numbers have changed:

As we can see, owned operational solar and wind farms have increased by 57 MW (part of which I knew about when writing the July article), power production has increased by 15% to 22% from the numbers I used for that article, capacity factor, revenue, and revenue per MWh have all also improved. In July, I put the company’s net debt at the holdco level at $461 million. In the third quarter, net debt increased by $52 million, or by $0.91 for every new owned MW.

Plugging these numbers into the same spreadsheet as I used for the July valuation, I revise the more conservative asset based valuation down to a range of $4.12 to $5.19 per share. Given the lack of CAFD estimate, I can’t revise the CAFD based estimate of $4.00 to $8.50, except to say that CAFD should probably have fallen slightly along with the Adjusted EBITDA estimate, which fell from an annualized $168-$192 million to the current $150-180 million.

In short, resolving Terraform Global’s problems is taking longer and costing more than I had hoped, but I’m still comfortable that the company is worth well over $4, which is in turn above the current $3.78 stock price. I continue to hold my shares but do not regret having sold a number of covered calls with a $5 strike price.

Hannon Armstrong Sustainable Infrastructure (NYSE:HAS

I).

12/31/15 Price: $18.92. 12/31/15 Annual Dividend: $1.20 (6.3%). Beta: 1.22. Low Target: $17. High Target: $27.

11/30/16 Price: $19.88. YTD Dividend: $0.90. Expected 2016 Dividend: $1.24 (6.2%). YTD Total Return: 9.6%

Clean energy financier and REIT Hannon Armstrong has fallen due to rising interest rates and concern that it might lose its status as a REIT.

I feel the risk of a potential loss of REIT status has been overblown. REIT expert Brad Thomas provides a good summary: The short version is, don’t panic!

I added slightly to my Hannon Armstrong position after it dipped below $20.

TransAlta Renewables Inc. (TSX:RNW, OTC:TRSWF)

12/31/15 Price: C$10.37. 12/31/15 Annual Dividend: C$0.84 (8.1%). Low Target: C$10. High Target: C$15.

11/30/16 Price: C$13.73. YTD Dividend: C$0.8063 Expected 2016 Dividend: C$0.88 (6.4%) YTD Total Return (US$): 45.4%

Canadian listed Yieldco TransAlta Renewables’ fell sharply after the US election, as did many Canadian income stocks, which in general fell more than their US brethren. I’m not sure why this is other than the fact that Canadian stocks had been trading at higher valuations than US stocks in the run-up to the election. The stock has begun to recover from its sharp fall since November 14th.

Given TransAlta’s relatively rich valuation compared to my other Yieldco holdings, I sold most of my position on November 9th, and only bought a little of that back after the stock fell 10% over the next couple days.

Growth Stocks

Renewable Energy Group (NASD:REGI)

12/31/15 Price: $9.29. Annual Dividend: $0. Beta: 1.01. Low Target: $7. High Target: $25.

11/30/16 Price: $9.75. YTD Total Return: 5.0%

Advanced biofuel producer Renewable Energy Group, like ethanol producers (see the Green Plains Partners discussion above), is potentially more vulnerable to action by an administration skeptical of renewable energy than are Yieldcos. That said, the company remains very attractively valued, and I don’t know if I made the right move in selling most of my holdings in response to the election.

MiX Telematics Limited (NASD:MIXT; JSE:MIX).

12/31/15 Price: $4.22 / R2.80. 12/31/15 Annual Dividend: R0.08 (2.9%). Beta: -0.13. Low Target: $4. High Target: $15.

11/30/16 Price: $5.83 / R3.28. YTD Dividend: R0.08/$0.138 Expected 2016 Dividend: R0.08 (2.4%) YTD Total Return: 42.3%

Software as a service fleet management provider MiX Telematics is a significant potential beneficiary of a Trump administration. First, many of MiX’s largest clients are part of the global oil and gas industry. The drilling revival that Trump hopes to bring about should lead these customers to buy more vehicles, and they pay MiX for fleet management on a per-vehicle basis.

Even if the oil market continues to revive, this South Africa based company’s stock price is vulnerable to a flight to safety triggered by the greater global uncertainty which an unprecedented and relatively unpredictable Trump administration may bring.

Ameresco, Inc. (NASD:AMRC).

Current Price: $6.25. Annual Dividend: $0. Beta: 1.1. Low Target: $5. High Target: $15.

11/30/16 Price: $5.95. YTD Total Return: -1.7%

Energy service contractor Ameresco is the company in this list which I deem most vulnerable to action by a Trump administration. This is because the company’s bread and butter is energy service contracts with federal government agencies. In recent years, these contracts have been driven by increasingly ambitious targets for energy saving in Federal buildings set by the Obama administration. These targets are among the executive actions which Trump could easily reverse with the stroke of a pen.

Such energy saving initiatives save money and create jobs, so it would be irrational for Trump to reverse these particular executive actions. That said, I do not have a lot of confidence he will do (or refrain from doing) anything just because it makes sense. The market seems to think otherwise, as Ameresco rallied 24% in November. Perhaps investors are simply buying stocks of companies that do a lot of business with the Federal government because of the expected surge in infrastructure spending? I’m open to your ideas.

Sneak Peek: 10 Clean Energy Stocks for 2017

I and the owners of AltEnergyStocks.com are considering launching a premium service for paying subscribers. This would include early or exclusive looks at my most actionable investment ideas, like the one I recently wrote about Seaspan Worldwide. It will also likely include more timely comments on news events as they affect the stocks I follow. The details will depend on what you tell us you want and are willing to pay for. The people I’ll pay the most attention to are those who have demonstrated a willingness to pay for my writing in the past.

To that end, I’m offering an opportunity to see next year’s list of 10 Clean Energy Stocks one trading day before it’s published, but only to people who think my writing is worth paying something for. If you are one of those people, please send $5 to me at ![]() , and I will email you a draft version of the article a full trading day before it is published on AltEnergyStocks.com. If you don’t use PayPal, send me a note and I will respond with the address for a check.

, and I will email you a draft version of the article a full trading day before it is published on AltEnergyStocks.com. If you don’t use PayPal, send me a note and I will respond with the address for a check.

I don’t usually decide on the stocks in my annual list until after Christmas, since last minute changes in valuation sometimes make a difference as to how well I think a stock will do in the following year. With that caveat, this year’s list looks likely to include at least one thinly traded energy efficiency stock that, like MiX Telematics, should benefit from an revival of the oil and gas industry but which is too small to be on most investors’ radar.

If you think an early look at next year’s list is not worth $5, but think some of my future writing might be worth paying for, just PayPal me (your) two cents, and I’ll add you to the list of people who get to have input into what might be included in future AltEnergyStocks premium content, and how much it should cost.

Final Thoughts

Last month, I was optimistic for the chances of a Clinton victory, and saw the market’s sell-off in the months running up to the election as an opportunity to buy relatively cheap names like Hannon Armstrong and Pattern which have good prospects not matter who is in the White Ho

use. I still like these names, but I am deeply puzzled that one stock I thought could really benefit from a Clinton victory, Ameresco, has advanced the most.

Disclosure: Long HASI, AMRC, MIXT,, RNW/TRSWF, PEGI, GPP, NYLD/A, REGI, GLBL, TERP, GPRE

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.