Tom Konrad Ph.D., CFA

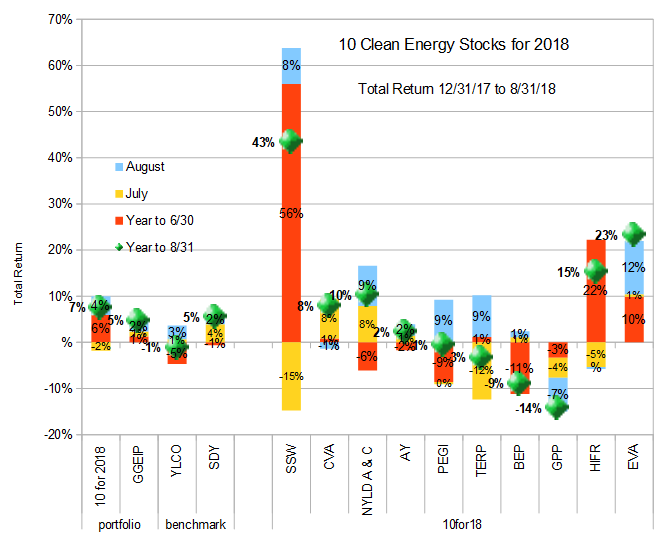

July and August saw some mild recovery for the stock market after a difficult first half of 2018. Clean energy income stocks continue to lag the broader market, but my Ten Clean Energy Stocks model portfolio has managed to maintain its lead over its broad market benchmark.

Through August 31st, the model portfolio is up 7.5%, compared to its broad dividend income benchmark SDY, which is up 5.3%. Its clean energy income benchmark YLCO is down 1.2, even after dividend income. The private portfolio I manage, the Green Global Equity Income Portfolio (GGEIP), is slightly behind the broad market of income stocks at 4.6%, but well ahead of YLCO.

Over the two months, most of these companies announced their second quarter earnings, and for most of them, there were few surprises, which no doubt contributed to the steady performance of most of the portfolio.

Details of the stocks’ performance are shown in the chart below.

Top Picks

In July, I highlighted Brookfield (BEP), Covanta (CVA) and Atlantica (AY) as my top short term picks. These three stocks were up 2.4%, 7.1%, and 3.9% over the last two months. This average increase of 4.5% was solidly above the portfolio as a whole at 2.3%. I currently think CVA, GPP and TERP have the best prospects for short term gains. Not that these prospects are great; I am taking an increasingly cautious approach towards the market as a whole and increasing my allocation to cash.

Stock discussion

Below I describe each of the stocks and groups of stocks in more detail. I include with each stock “Low” and “High” Targets, which give the range of stock prices within which I expect each stock to end 2018.

Seaspan Corporation (NYSE:SSW)

12/31/17 Price: $6.75. Annual Dividend: $0.50 (7.4%). Expected 2018 dividend: $0.50 (7.4%). Low Target: $5. High Target: $20.

8/31/18 Price: $9.22 YTD dividend: $0.375 (5.56%) YTD Total Return: 43.3%

Leading independent charter owner of container ships Seaspan’s gave back a little of its gains from earlier in the year. The second quarter earnings call was “steady as she goes,” so I see the decline as mostly profit taking after the earlier large gains. I took some gains myself.

Covanta Holding Corp. (NYSE:CVA)

12/31/17 Price: $16.90. Annual Dividend: $1.00(5.9%). Expected 2018 dividend: $1.00 (5.9%). Low Target: $15. High Target: $25.

8/31/18 Price: $17.65 YTD dividend: $0.50 (2.96%) YTD Total Return: 7.8%

Covanta, the US leader in the construction and operation of energy from waste (EfW) plants reported second quarter earnings in July. The company is seeing improvements in profitability in most parts of its operations, and now expects full year results to come in at the high end of its previous guidance.

In August, the company reported several financial transactions that should improve overall profitability. It sold a small (13MW) hydroelectric project in Washington state to Atlantic Power (AT), and assumed the operation and maintenance of two EfW facilities in Florida. Since Covanta already operates six other EfW facilities in Florida, it should be able to achieve synergies in these operations that were not possible for the hydroelectric plant in Washington.

The company also enlarged and lengthened the term of its senior loans, and refinanced a number of tax exempt bonds leading to a reduction in interest expense. Given the company’s size, the move is likely to only result in a $0.01 per share improvement in annual earnings, but every improvement is good to see.

Clearway Energy, Inc (NYSE: NYLD and NYLD/A)

12/31/17 Price: $18.90 / $18.85. Annual Dividend: $1.133(6.0%). Expected 2018 dividend: $1.26(6.7%) Low Target: $14. High Target: $25.

8/31/18 Price: $18.50/$18.44 YTD dividend: $0.927 (4.90%) YTD Total Return: 10.1%

Yieldco NRG Yield announced that Global Infrastructure Partners (GIP) had completed the purchase of NRG’ Energy’s (NRG) controlling stake in the Yieldco and had become its new sponsor. NRG Yield has changed its name to Clearway Energy, Inc, and will be holding a conference call to discuss its plans for the future on September 11th. GIP is also acquiring NRG’s renewable energy assets and development platform.

Clearway’s stock has been advancing since the announcement, most likely in anticipation of renewed growth under its new sponsor.

Atlantica Yield, PLC (NASD:AY)

12/31/17 Price: $21.21. Annual Dividend: $1.16(5.6%). Expected 2018 dividend: $1.39 (6.6%). Low Target: $18. High Target: $30.

8/31/18 Price: $20.64 YTD dividend: $0.97 (4.57%) YTD Total Return: 2.2%

Atlantica Yield’s new sponsor, Algonquin Power (AQN) has been in place since early this year, and the Yieldco has been taking advantage of the stronger sponsor to refinance its debt at lower interest rates while continuing to pay down existing debt with retained cash flow. The aftermath of Atlantica’s former sponsor Abengoa’s (ABG.MC, ABGOY, ABGOF) bankruptcy led to Atlantica focusing on paying down debt rather than growth for the last two years, but now that looks ready to change. The company states that it is in discussions for the acquisition of $200 million in equity worth of accretive investments.

That would represent an approximate 10% increase in the company’s size if all the deals were consummated. If we assume cash flow margins 20% to 30% above returns to current equity, we could see cash flow per share growth of 2 to 3 percent from these transactions. I expect a return to even such modest growth will be welcomed by shareholders.

Pattern Energy Group (NASD:PEGI)

12/31/17 Price: $21.49. Annual Dividend: $1.688(7.9%). Expected 2018 dividend: $1.70(7.9%). Low Target: $20. High Target: $30.

8/31/18 Price: $20.38 YTD dividend: $0.844 (3.93%) YTD Total Return: -0.7%

Yieldco Pattern Energy Group’s stock is starting to recover from lows earlier this year as the company’s path to renewed dividend growth becomes clearer. The company had been paying out nearly 100% of cash flow available for distribution (CAFD) in 2017, and has a goal of bringing this nearly unsustainable payout ratio down to 80%. To do that without a dividend cut requires growing CAFD by approximately 25% over 2017.

Strong second quarter results increased CAFD by 8% in the first half of 2018 over the same period in 2017, despite a decline in the first quarter. 8% is a far cry from the 25% needed before Pattern is likely to resume dividend increases, but it does give the company breathing room. Combine this with the completed sale of PEGI’s Chilean assets and the acquisition of higher yielding assets in Japan and Quebec and investors seem ready to put their fears of a dividend cut to rest.

I do not expect any dividend increases for the next year or two as Pattern brings down its payout ratio towards its 80% target, but at a current yield over 8%, increases are not necessary to make the stock an attractive investment.

Terraform Power (NASD: TERP)

12/31/17 Price: $11.96. Annual Dividend: $0. Expected 2018 dividend: $0.72 (6.0%) Low Target: $10. High Target: $16.

8/31/18 Price: $11.18 YTD dividend: $0.38 (3.18%) YTD Total Return: -3.4%

Yieldco Terraform Power completed its acquisition of European Yieldco Saeta Yield, and is now turning its focus on improving the operations at its fleet to improve profitability. Terraform’s former sponsor, the now bankrupt SunEdison, operated the Yieldco’s fleet of wind and solar farms. With the distraction of bankruptcy proceedings, such operations were doubtlessly neglected over the last two years. Now, with a new operations agreement with General Electric (GE), TERP plans to invest in its existing fleet (which now includes Saeta’s as well) to improve operations.

The Yieldco says that these plans, along with the Saeta acquisition, give it a clear path to meeting its 5 percent to 8 percent dividend growth target through 2022 while maintaining its payout ratio below 85%. Such a long term growth target is rare among Yieldcos, especially one which already has a 6.8% yield.

Brookfield Renewable Partners, LP (NYSE:BEP)

12/31/17 Price: $34.91. Annual Dividend: $1.872(5.4%). Expected 2018 dividend: $2.02(5.8%). Low Target: $28. High Target: $45.

8/31/18 Price: $30.77 YTD dividend: $0.98 (2.81%) YTD Total Return: -9.0%

Brookfield Renewable Partners reported a weak second quarter results because of low production from hydropower. The stock sold off as a result, and now looks quite attractive. Brookfield’s large base of hydropower and limited partnership structure (you get a K-1 but it is safe to hold in a retirement account because it does not produce UBTI.)

In other words, BEP is a great diversifier in a Yieldco-heavy portfolio, and now looks like a good time to add it to that portfolio if you have not already.

Green Plains Partners, LP (NASD: GPP)

12/31/17 Price: $18.70. Annual Dividend: $1.84(9.8%). Expected 2018 dividend: $1.90(10.2%). Low Target: $13. High Target: $27.

8/31/18 Price: $15.20 YTD dividend: $0.945 (5.05%) YTD Total Return: -14.3%

Ethanol MLP and Yieldco Green Plains Partners has been selling off in large part due to the Trump EPA’s attacks on the ethanol industry. These include diluting the Renewable Fuel Standard, and granting waivers to oil refiners who don’t really need those waivers. In other words, it is tough times for GPP and its parent GPRE.

At this point, however, I think much of the bad news is priced in, and there is some “good” news in the form of higher gas prices, as well as the tariffs that China and others are putting on corn. This bad news for corn growers is good news for corn users, like Green Plains. China has also put a tariff on ethanol, but since ethanol can be substituted for gasoline (to a point), the price of gas should put a floor on the price of ethanol. That is not true for the price of corn.

There are definitely risks with this stock, but the 12%+ yield is some very healthy compensation for those risks.

InfraREIT, Inc. (NYSE: HIFR)

12/31/17 Price: $18.58. Annual Dividend: $1.00(5.4%). Expected 2018 dividend: $1.00 (5.4%). Low Target: $16. High Target: $30.

8/31/18 Price: $20.89 YTD dividend: $0.50 (2.69%) YTD Total Return: 15.2%

Electricity transmission REIT InfraREIT reported much improved income and cash flow per share over the year earlier due to asset acquisitions. The company is maintaining its $1 annual dividend while it re-evaluates its corporate structure. It lost most of the advantages it gained by being a REIT as a result of the 2017 Republican tax bill. At this point, the company could decide to become a normal corporation, be sold, or combine with another corporation. There is also uncertainty around restructuring various long term lease transactions with its parent, Hunt Corporation so that they work with any new corporate structure and the new tax laws.

Earlier this year, the speculation about a possible go-private transaction drove the stock into the mid-$22 dollar range, at which point I wrote that I was “selling calls to lock in some profits in InfraREIT.” Now that the stock has pulled back a bit, I’m happy to hold at the current price, collect my dividends, and see what happens. I expect that there is more upside profit potential in a possible future transaction than downside risk, and I like the improving earnings numbers. Finally, the company reached a beneficial tax settlement with the State of Texas, which was also good news. With this positive backdrop, investor uncertainty about the company’s future corporate structure is likely leading to some current undervaluation.

Enviva Partners, LP. (NYSE:EVA)

12/31/17 Price: $27.65. Annual Dividend: $2.46(8.9%). Expected 2018 dividend: $2.65 (9.6%). Low Target: $25. High Target: $40.

8/31/18 Price: $32.00 YTD dividend: $1.875 (6.78%) YTD Total Return: 23.2%

Wood pellet Yieldco and Master Limited Partnership Enviva reported another strong quarter, with new long term contract signed for additional wood pellet supplies to both Europe and Japan. Although the stock is up significantly this year, I am not ready to start taking profits, given its strong growth and and prospects.

Final Thoughts

While I’m happy that this model portfolio and GGEIP are both now comfortably up for the year, stock market valuation and political turmoil are making me increasingly cautious about the market going forward. Although there are a few stocks here that I think are good values, I believe caution is increasingly warranted. I see this as a great time to wait and see, while holding a healthy allocation in cash.

Disclosure: Long PEGI, NYLD/A, CVA, HIFR, AY, SSW, SSW-PRG, TERP, BEP, EVA, HIFR, GPP, AQN, GE.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.