Renewable Energy Group’s New CEO: C.J. Warner

by Jim Lane

In Iowa, white smoke has emerged from the Renewable Energy Group (REGI) conclave: Tesoro EVP and former Sapphire Energy CEO C.J. Warner has been named chief exec of Renewable Energy Group, at a pivotal moment for biodiesel in Washington and around the world and amidst a boom for renewable diesel like the world has never seen.

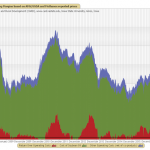

REG has been making good progress with Wall Street under interim CEO Randy Howard and its share price has been on the rise, and the plants have been humming along nicely churning out hundreds of millions of gallons of biodiesel and the liquid gold...

EPA’s 2018 Renewable Fuel Targets Disappoint Producers

In Washington, the Environmental Protection Agency released its final Renewable Fuel Standard renewable volume obligations for 2018. The agency finalized a total renewable fuel volume of 19.29 billion gallons , of which 4.29 BG is advanced biofuel, including 288 million gallons of cellulosic biofuel.

As the Renewable Fuels Association explained: “That leaves a 15 BG requirement for conventional renewable fuels like corn ethanol, consistent with the levels envisioned by Congress in the 2007 Energy Independence and Security Act. The 2018 total RFS volume finalized today represents a minor increase (10 million gallons) over the 2017 standards, and a modest increase...

REG Buying European Biodiesel From Used Cooking Oil Producer

Jim Lane US biodiesel leader heads for the EU – what’s up with used cooking oil, and what is REG’s path forward with the German-based biodiesel producer? In Iowa, Renewable Energy Group and IC Green Energy announced that REG will acquire ICG’s majority equity ownership position in German biodiesel producer Petrotec AG (XETRA: PT8). Closing of the transaction is expected before year end. REG CEO Dan Oh Last month, REG CEO Dan Oh told The Digest, “We’re not done growing, that’s for sure! We’ve done something of...

Insider View on REGI

by Debra Fiakas CFA Insider buying is not one of my regular screening criteria in selecting long plays in the small cap sector. However, to learn a chief executive officer has taken out his/her check book to buy shares in their company is influential. In November 2016, the CEO of biofuel producer Renewable Energy Group (REGI: Nasdaq) reported an increase in his stake in the company in recent months. With REGI shares just above the prices paid by the CEO just three months ago, it is timely to look more closely from the outside. In...

EPA increases US Renewable Fuel Standard Volumes, But Only Slightly

Jim Lane In Washington, the U.S. Environmental Protection Agency announced final volume requirements under the Renewable Fuel Standard program today for the years 2014, 2015 and 2016, and final volume requirements for biomass-based diesel for 2014 to 2017. This rule finalizes higher volumes of renewable fuel than the levels EPA proposed in June, boosting renewable production and providing support for robust, achievable growth of the biofuels industry. “The biofuel industry is an incredible American success story, and the RFS program has been an important driver of that successcutting carbon pollution, reducing our dependence on foreign oil, and sparking...

FutureFuel Profits Preview

by Debra Fiakas CFA Biodiesel and biochemical producer FutureFuel Corporation (FF: NYSE) will report fourth quarter 2015 financial results after the market close today. No conference call will be held due to low attendance on recent calls. The single published estimate for FutureFuel is for $0.28 in earnings per share on $122.5 million in total sales. Despite an increase in this estimate in the last week, the number still represents a significant decrease in earnings compared to the prior-year period. The Company has missed the consensus estimate in both of the last two quarters and we do not...

Biodiesel’s Nightmare: Renewable Diesel

Until algae farms move from the research and demonstration stage, biodiesel usage is going to be tightly constrained by available feedstock. The feedstocks for biodiesel are oils and fats, which naturally occur in quantity only in animals or the seeds of plants. As such, the quantity of oil available is much smaller than the sugars, starches, and cellulose which occur not only in the seeds and fruits of plants, but also in the stems and leaves, and can be used to make ethanol. Because sugarcane contains the best ethanol feedstock, sugar in the stem (not just the...

DAR the Rins Blow!

by Debra Fiakas CFA Last week the management of Darling Ingredients (DAR: NYSE) staged a webinar on its opportunities in biofuels. Darling produces biodiesel in Kentucky and Canada and is in a renewable diesel joint venture with Valero Energy (VLO: NYSE) in Louisiana. As a recycler of wastes and excess from the food production processes, the production of energy with organic feedstock is a logical extension of Darling’s collection and aggregation infrastructure. The event did not do much for Darling’s share price, but the presentation triggered a few questions about RINs - shorthand for...

3 Alternative Energy Stocks You Need to Know

In the face of a declining overall energy market today, three of our favorite alternative energy stocks posted strong gains on high volume. The Oil Services HOLDRs ETF (OIH) was down 2% and the PowerShares WilderHill Clean Energy ETF (PBW) was down 1.7%. Indeed, the vast majority of the energy stocks that we track were in the red. But bucking the trend were two energy stocks that we have profiled in the recent past and a third company that we will begin covering today. First on the list is our favorite wind energy play, Welwind Energy International...

Will Petrosun’s Algae Biodiesel Grow on Investors?

by Tom Konrad Celluslosic Ethanol is all the rage. A less noticed, but significant "Biofuel 2.0" is biofuel based on algae. Follow the Biomass As I have consistently argued (see these recent articles on John Deere, Biogas, Cellulosic Ethanol vs Biomass Electricity, and Renewable or Green Diesel) the people most likely to make money from biofuel are not the processors and distributors (who compete directly with petroleum or other fossil fuel-based products, and so have little pricing power), but the producers of feedstock, which, like oil, is in very limited supply, and so they will have pricing power....

Ten Solid Clean Energy Companies to Buy on the Cheap: #7 Deere & Co....

The first and last word in any discussion of biofuels should always be "Feedstock." Feedstock is the "Bio" out of which biofuels will eventually be made, whether it be corn, sugar, jatropha, algae, palm oil, switchgrass, forestry waste, or municipal solid waste. Before the era of peak oil, we lived in a world of plenty, which meant that we could squander energy, not only by driving Hummers, but by feeding energy intensive products such as corn crops to livestock, and by dumping "free" sources of energy such as garden waste and used cooking oil into landfills. The era of...

Betting On Renewable Diesel: Valero or Darling?

Valero Energy (VLO: NYSE) recently disclosed ongoing discussions to expand its renewable diesel production to a second plant that would be built and managed by its Diamond Green Diesel joint venture with Darling Ingredients (DAR: NYSE).

The proposed plant that would be located in Port Arthur, Texas and turn out 400 million gallons of renewable diesel and 40 million gallons of naptha per year. As a food by-products processor Darling has easy access to low-cost used cooking oils and animals fats that serves as the feed stock for Diamond Green’s renewable diesel production.

Valero management has cited increasing global demand for low- to no-carbon...

Aemetis: Indian Breakthrough, California Expansion

Aemetis, Inc. (AMTX: NasdaqCM) just announced sales of biodiesel to gas stations in India. The sales follow on the heels of a significant ruling in November 2018, by the Bombay High Court to remove restrictions on biodiesel that had barred direct to consumer sales by biofuel manufacturers. The breakthrough into the India market is significant for the company, which has been operating a 50-million gallon integrated chemicals and fuels facility in Kakinada, India for several years.

Demand for renewable fuels has been strongest among fast growing economies like India, where decision makers fear dependence upon imported fossil fuels. India produces only about 1% of global...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

Fretting Over FutureFuel

by Debra Fiakas CFA Earlier this week FutureFuel Corporation (FF: NYSE) reported financial results for the second quarter ending June 2015. Sales of the company’s biodiesel and specialty chemical products increased 53.7% to $104.6 million compared to the prior-year quarter when reported revenue was $68.0 million. The company delivered a profit as usual, but traders appeared unimpressed. The stock gapped lower on the news and two days later set a new 52-week low price. Granted net income was lower year-over-year by 30.9%, coming in at $3.8 million or $0.09 per share. A closer look...

Renewable Fuels’ Dunkirk

by Jim Lane

It’s been a very busy week in Washington DC, the high point being a letter to seven senators sent late Thursday by EPA Administrator Scott Pruitt, who took significant (and as of a few days ago, unexpected) steps toward strengthening the foundation for ethanol and renewable fuels.

The truth? It’s a Trump Administration back-down. EPA overreached on de-clawing the Renewable Fuel Standard on behalf on some grumpy oilpatch donors (known as GODs), and the Trump Administration managed to revive a Grand Alliance around renewable fuels — one that now includes almost 40 members of the United States Senate,...