Biodiesel’s Big Comeback

Jim Lane Filling up with Biodiesel in 2007. Photo source: Tom Konrad Darling of the mid-2000s, still beloved by its many fans biodiesel is increasingly a key to delivering advanced biofuels volumes now and even more so between now and 2022. Presentations by NBB CEO Joe Jobe and REG CEO Daniel Oh at ABLC 2013 explained the how and why. In the excitement over cellulosic biofuels and drop-ins, it is easy to forget that the backbone of advanced biofuels in the US and around he...

Fortunately, Unfortunately: The Spring Saga of American Ethanol

by Jim Lane

The ethanol signals from Washington DC are more inexplicably mixed than cocktails with names like Sex on the Beach. Let’s parse through the wigwagging over the future of American biofuels supply and demand — ethanol and otherwise.

Fortunately: Trump backs year-round E15 ethanol blends

In Washington, President Trump endorsed year-round E15 ethanol availability as an emerging compromise between oil refiners and US farm sector.

The Renewable Fuel Standard is a federal program that requires transportation fuel sold in the United States to contain a minimum volume of renewable fuels. The RFS originated in a bi-partisan Congress with the Energy Policy Act...

Another Biodiesel Plant Gets The Axe. Here’s Why.

by Jim Lane

In another small but sharp blow to the Trump Administration’s strategy for American manufacturing revival, news arrives from Texas of a second smaller biodiesel shuttering owing to “ challenging business conditions and continued federal policy uncertainty,” as Renewable Energy Group (REGI) phrased it in announcing the closure of its15 million gallons per year New Boston, Texas biorefinery. The company is currently working with plant employees on relocation opportunities within the production network.

The tax credit issue

The forces impacting the US biodiesel industry at present are complex, but REG in this case is pointing the blame at the biodiesel tax...

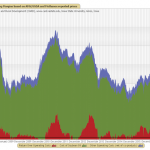

REG Sells More Biodiesel, Earnings Drop, Acquisitions Are Future Wild Cards

Jim Lane Biodiesel giant Renewable Energy Group (REGI) is up on gallons, down on dollars as market prices weigh on results. In Iowa, REG announced net income of $10.8 million for the second quarter on revenues of $332.9M, a drop from its Q2 2013 net income of $19.6 million, and a 13% drop in revenue despite an 11% lift in gallons produced. The company noted that net income was boosted by a tax benefit of $11.9 million, recognized primarily from the release of a valuation allowance resulting from recording deferred tax liabilities related to the...

Insider View on REGI

by Debra Fiakas CFA Insider buying is not one of my regular screening criteria in selecting long plays in the small cap sector. However, to learn a chief executive officer has taken out his/her check book to buy shares in their company is influential. In November 2016, the CEO of biofuel producer Renewable Energy Group (REGI: Nasdaq) reported an increase in his stake in the company in recent months. With REGI shares just above the prices paid by the CEO just three months ago, it is timely to look more closely from the outside. In...

Renewable Fuel Producers Score A Win

Despite Trump’s vow to roll back all measures endorsed by Obama, his Environmental Protection Agency head Scott Pruitt is backing off plans to scuttle the U.S. biofuel policy. The Trump administration had planned to change regulatory standards to reduce the amount of renewable fuel that must be blended with conventional fossil fuel for gasoline and diesel supplies. In the third week in October 2017, Pruitt sent a letter to Congressional leadership indicating the renewable fuel volume mandates for 2018 would remain unchanged.

Most analysts saw the about face as a win for ethanol and renewable diesel producers such as Green Plains (GPRE: Nasdaq), FutureFuel...

FutureFuel Profits Preview

by Debra Fiakas CFA Biodiesel and biochemical producer FutureFuel Corporation (FF: NYSE) will report fourth quarter 2015 financial results after the market close today. No conference call will be held due to low attendance on recent calls. The single published estimate for FutureFuel is for $0.28 in earnings per share on $122.5 million in total sales. Despite an increase in this estimate in the last week, the number still represents a significant decrease in earnings compared to the prior-year period. The Company has missed the consensus estimate in both of the last two quarters and we do not...

FutureFuel: Still Future, Less Fuel

by Debra Fiakas CFA The last post “From Fuel to Fudge” discussed how the old Solazyme developer of algal-based renewable fuel has been transformed into a new company called TerraVia, (TVIA) which is pursing algal-based food and personal care products. Solazyme is not the only renewable fuel company to make an about face. Granted FutureFuel Corporation (FF: NYSE) has not changed its name or stock symbol like Solazyme. However, its ability to produce specialty chemicals has given FutureFuel an alternative to biofuels and its early plans to build a plant that could eventually produce 160 million gallons of...

3 Alternative Energy Stocks You Need to Know

In the face of a declining overall energy market today, three of our favorite alternative energy stocks posted strong gains on high volume. The Oil Services HOLDRs ETF (OIH) was down 2% and the PowerShares WilderHill Clean Energy ETF (PBW) was down 1.7%. Indeed, the vast majority of the energy stocks that we track were in the red. But bucking the trend were two energy stocks that we have profiled in the recent past and a third company that we will begin covering today. First on the list is our favorite wind energy play, Welwind Energy International...

EPA Reneges on Trump’s Biofuels Deal

by Jim Lane

“EPA Reneges on Trump’s Biofuels Deal”, said the Iowa Renewable Fuels Association in reacting to the US Environmental Protection Agency’s new plans for fulfilling federal renewable fuel requirements. EPA released a proposed supplemental rule for the Renewable Fuel Standard today, and the bioeconomy is up in arms, and the outrage is centered in farm country, once a Trump bastion of support.

“IRFA members continue to stand by President Trump’s strong biofuels deal announced on Oct. 4, which was worked out with our elected champions and provided the necessary certainty that 15 billion gallons would mean 15 billion gallons, even after...

List of Biodiesel Stocks

Biodiesel stocks are publicly traded companies whose business involves producing biodiesel made from oils and fats for use as a fuel diesel engines, either alone or blended with petroleum derived diesel. Common feedstocks include soybean oil, palm oil, and waste oils from the food industry. Biodiesel is the most widely produced and used advanced biofuel, and all biodiesel stocks are also biofuel stocks.

This list was last updated on 7/20/2022.

China Clean Energy Inc. (CCGY)

FutureFuel Corp. (FF)

Green Star Products, Inc. (GSPI)

Greenshift Corporation (GERS)

Methes Energies International (MEIL)

Neste Oil (NEF.F)

PetroSun, Inc. (PSUD)

RDX Technologies, Inc. (RDX.V)

If you know of any biodiesel stock that is...

Renewable Energy Group’s New CEO: C.J. Warner

by Jim Lane

In Iowa, white smoke has emerged from the Renewable Energy Group (REGI) conclave: Tesoro EVP and former Sapphire Energy CEO C.J. Warner has been named chief exec of Renewable Energy Group, at a pivotal moment for biodiesel in Washington and around the world and amidst a boom for renewable diesel like the world has never seen.

REG has been making good progress with Wall Street under interim CEO Randy Howard and its share price has been on the rise, and the plants have been humming along nicely churning out hundreds of millions of gallons of biodiesel and the liquid gold...

REG Buys Imperium Renewables

Jim Lane The biggest US biodiesel, renewable diesel producer Renewable Energy Group (REGI), or "REG" buys the biggest US facility in asset deal. The fully-operational 100-million gallon nameplate capacity biorefinery will be renamed REG Grays Harbor. The facility includes 18 million gallons of storage capacity and a terminal that can accommodate feedstock intake and fuel delivery on deep-water PANAMAX class vessels as well as possessing significant rail and truck transport capability. REG will pay Imperium $15M in cash and issue 1.5 million shares of REG common stock in exchange for substantially all of Imperium’s assets. In addition to...

Renewable Fuels’ Dunkirk

by Jim Lane

It’s been a very busy week in Washington DC, the high point being a letter to seven senators sent late Thursday by EPA Administrator Scott Pruitt, who took significant (and as of a few days ago, unexpected) steps toward strengthening the foundation for ethanol and renewable fuels.

The truth? It’s a Trump Administration back-down. EPA overreached on de-clawing the Renewable Fuel Standard on behalf on some grumpy oilpatch donors (known as GODs), and the Trump Administration managed to revive a Grand Alliance around renewable fuels — one that now includes almost 40 members of the United States Senate,...

New Biodiesel Vehicles and Emissions Reduction Estimates

The makers of the world’s favorite advanced biofuel — a/k/a the biodiesel industry — descended upon Texas to mingle, make and renew ties at the 2018 National Biodiesel Conference. And, to champion new ideas and find new supply chain and distribution partners.

Bummer that there wasn’t a biodiesel tax credit extension on offer. (UPDATE: The new budget includes the biodiesel tax credit.) Bummer that diesel’s getting a bad rap in the press. Bummer that Tom Petty isn’t with us any more to sing:

“I’ll Stand My Ground, I Won’t Back Down,

I know what’s right, got just one life

in a world’s that keeps on...

REG Buying European Biodiesel From Used Cooking Oil Producer

Jim Lane US biodiesel leader heads for the EU – what’s up with used cooking oil, and what is REG’s path forward with the German-based biodiesel producer? In Iowa, Renewable Energy Group and IC Green Energy announced that REG will acquire ICG’s majority equity ownership position in German biodiesel producer Petrotec AG (XETRA: PT8). Closing of the transaction is expected before year end. REG CEO Dan Oh Last month, REG CEO Dan Oh told The Digest, “We’re not done growing, that’s for sure! We’ve done something of...