Advantage Biodiesel

By Tom Konrad, Ph.D., CFA

Because of rising fertilizer prices, farmers are planting more soybeans than corn. Soybeans are a legume, meaning that they can fix their own nitrogen in the soil, meaning that they need less nitrogen fertilizer, the price of which is spiking due to rising natural gas prices. Corn, in contrast, needs more nitrogen than most other crops.

High gas prices are rising because of Putin’s war on Ukraine, which is also preventing Ukrainian farmers from planting this year’s wheat crop, while sanctions are likely to disrupt wheat supplies from Russia as well.

Corn and (to a lesser extent,...

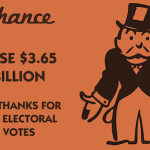

Did Trump’s EPA Cost Corn Growers $3.65 Billion In 2017?

by Jim LaneIn Washington, new evidence has appeared that a Trump Administration shift on US low carbon fuel policy may have cost US corn growers an estimated $3.65 billion.

The mechanism? A secretive effort by Administration officials installed at the US Environmental Protection Agency that destroyed an estimated 1.37 billion gallons of annual demand for low-carbon renewable fuels, in favor of fossil fuels.

Officials at the agency exploited a loophole in US low carbon fuel legislation that allows small oil refineries to gain hardship waivers in cases of severe distress from complying in full with US low carbon fuel laws. Now, evidence...

Earnings Round-Up: ADM, Green Plains, Syngenta

Jim Lane Green Plains In Nebraska, Green Plains (GPRE) announced net income for the quarter was $42.2 million compared to net income of $25.5 million for the same period in 2013. Revenues were $829.9 million for the fourth quarter of 2014 compared to $712.9 million for the same period in 2013. Net income for the full year was $159.5 million compared to $43.4 million for the same period in 2013. Revenues were $3.2 billion for the full year of 2014 compared to $3.0 billion for the same period in 2013. Fourth quarter 2014 EBITDA was $90.7 million compared to...

List of Ethanol Stoccks

This Post was updated on 8/16/21.

Ethanol stocks are publicly traded companies whose business involves producing ethanol alcohol (C2H5OH) made from biomass for use as a fuel in gasoline blends. Common feedstocks include corn and sugar cane. Ethanol is the most widely produced and used biofuel, and all ethanol stocks are also biofuel stocks.

Aemetis, Inc. (AMTX)

Andersons Inc (ANDE)

Archer Daniels Midland (ADM)

Bluefire Renewables (BFRE)

Cosan Ltd (CZZ)

Green Plains Partners LP (GPP)

Green Plains Renewable Energy (GPRE)

MGP Ingredients (MGPI)

Pacific Ethanol (PEIX)

Raízen S.A. (RAIZ4.SA)

REX American Resources Corp. (REX)

SunOpta (STKL)

If you know of any ethanol stock that is not listed here and should be, please let us know...

Codexis: a 5-Minute Guide

Jim Lane Address: 200 Penobscot Drive Redwood City, CA 94063 Year founded 2002 Annual Revenues: $107 million (2010) Company description: Codexis serves major worldwide markets where clean technology can make a positive economic and environmental impact. Codexis CodeEvolver ™ directed evolution technology accelerates development of high value sustainable products. Our focus is on the cost-effective conversion of renewable resources into transportation fuels, pharmaceuticals and biobased chemicals, and on the development of new technologies for effective air and water treatment. Stock: CDXS; NasdaqGS Type of Technology(ies): Directed evolution – CodeEvolver™ directed evolution...

Green Plains Nabs 3 Ethanol Plants On The Cheap

Jim Lane In Nebraska, word has arrived from Green Plains (GPRE) that it will purchase the Madison, Ill., Mount Vernon, Ind. and York, Neb. ethanol facilities from Abengoa (ABGOY) Bioenergy with combined annual production capacity of 236 million gallons per year, for approximately $237 million in cash, plus certain working capital adjustments. The company said it was the successful bidder on three ethanol plants for sale conducted under the provisions of the U.S. Bankruptcy Code. Upon completion of the acquisitions, Green Plains will own and operate 17 dry mill ethanol facilities with combined production capacity of nearly 1.5...

EPA Slashes Corn Ethanol Targets Under Proposed Renewable Fuel Standard

Renewable Diesel Takes Smaller Cut Jim Lane “EPA continues to assert authority under the general waiver provision to reduce biofuel volumes based on available infrastructure,” says BIO. “This is a point that will have to be litigated. It goes against Congressional intent.” In Washington, the EPA released its proposed standards for 2014, 2015, and 2016 and volumes for renewable fuels. The volumes, as widely expected, include substantial reductions from the statutory standards in the original 2007 Energy Independence & Security Act. The EPA also released a 2017 proposed standard for biomass-based diesel. Yet, while attracting significant...

Trump Takes Down Ethanol in Pincer Move

by Debra Fiakas, CFA

The Trump Administration is using tariffs on China goods as a trade war tactic to pressure China into relenting to U.S. trade policy demands. Unfortunately, the fallout has been heavy and widespread. Farmers have taken the heaviest hits as China has dropped orders for corn and soybeans. Ethanol producers have been ensnared in the trade war skirmish as well and in recent weeks have been caught an uncomfortable ‘pincer-like’ squeeze by the Trump Administration.

Trump’s Environmental Protection Agency has continued its practice of granting waivers to oil and gas refiners, eliminating the requirement to blend biofuel with the refiners’ petroleum...

What I Sold: Pacific Ethanol (NASD:PEIX)

This entry continues a series on companies I sold as part of a portfolio cleanup prompted by the mess on Wall Street. In the first entry I describe what I plan to do with the cash, and the second was about Carmanah Technologies. UQM Technologies was one I didn't sell. In May of last year, I took a look at competitive forces in the corn ethanol industry. While I was rather negative on the industry at the time, when ethanol stocks fell in the summer and fall of 2007, I called the bottom much too soon, and...

Dyadic: a 5-Minute Guide

Jim Lane Dyadic International, Inc. is a global biotechnology company that uses its patented and proprietary technologies to conduct research, development and commercial activities for the discovery, development, manufacture and sale of products and solutions for the bioenergy, industrial enzyme and biopharmaceutical industries. Address: 140 Intracoastal Pointe Drive Suite 404 Jupiter, Florida 33477 Year founded: 1979 Stock Ticker: Pink Sheets: DYAI Type of Technology(ies) Patented and proprietary C1 platform technology based on a unique fungal microorganism which is programmable and scalable in producing enzymes and proteins in large quantities ...

Butamax and Gevo: Bio’s Montagues and Capulets get it on, and on, and on

The 2-Minute Guide to Butamax vs Gevo, and vice-versa

Fulcrum Bioenergy’s $115M IPO: The 10-Minute Version

Jim Lane The first zero-cost feedstock biofuels company comes to the public markets with its IPO. Like to see how this “Back the the Futuresque” technology unlocks value by converting household garbage into transportation fuel? Here’s our 10-minute version of the IPO from Fulcrum Bioenergy. In California, Fulcrum Bioenergy has filed an S-1 registration statement for a proposed $115 million initial public offering. The number of shares to be offered and the price range for the offering have not yet been determined. The company proposes to list under the symbol FLCM. UBS Investment Bank...

Solar Headwinds, Part I

How Solar PV is like Ethanol Tom Konrad, CFA High levels of competition in the the solar photovoltaic (PV) industry mean that buy-and-hold investors should look elsewhere. In May 2007, I published a competitive analysis of the corn Ethanol industry based on Michael Porter's classic Five Competitive Forces model. At the time, Ethanol stocks were flying high, but my conclusion was that "the prospective ethanol investor should be very careful about investing in corn ethanol producers at random." If anything, I understated the case. This chart shows three ethanol stocks that have survived since 2007. As...

DowDuPont To Exit Cellulosic Biofuels

by Jim Lane

In Delaware, DowDuPont (DWDP) announced that it intends to sell its cellulosic biofuels business and its first commercial project, a 30 million gallon per year cellulosic ethanol plant in Nevada, Iowa. The Nevada project is still going through start-up.

In an official statement, the company said:

As part of DowDuPont’s intent to create a leading Specialty Products Company, we are making a strategic shift in how we participate in the cellulosic biofuels market. While we still believe in the future of cellulosic biofuels we have concluded it is in our long-term interest to find a strategic buyer for our...

Kaydon: Profits Behind the Scenes

Debra Fiakas Most investors when they consider the alternative energy sector think about the big solar photovoltaic manufacturers or the ethanol producers. Engineering firms like Kaydon Corporation (KDN: NYSE) rarely come to mind. With special expertise in fluid processes, Kaydon is an indispensable partner in a variety of alternative energy projects such as wind, renewable diesel and ethanol plants. The company earned a 12% net profit margin on $4645 million in total sales in the year 2010. As impressive as that might be the really bright spot in Kaydon’s financial picture is its ability to generate cash ...

Enzyme Breakthroughs From The Majors

by Jim Lane

Three big product announcements just in…

DSM (e) breaks through on yield, efficiency with new yeast, enzyme offerings for corn fiber conversion.

Novozymes (Copenhagen:NZYM-B; OTC:NVZMY) launches breakthrough techs “Fortiva” and “Innova Force”.

DuPont (DD) extends with corn oil extraction tech.

In Indiana, DSM leads the news out of the Fuel Ethanol Workshops with their latest yeast and enzyme offerings, eBOOST GT and eBREAK 1000F.

Up to 60 percent GA reduction

We’ve seen the eBOOST brand over the past year — so here’s a significant cost savings opportunity in the form of a line extension. eBOOST GT, which has been tested and qualified at commercial...