GE’s Ecomagination: A Panacea?

Last Thursday, General Electric's (NYSE: GE) CEO, Jeffrey Immelt, reported on the progress to date of the company's Ecomagination project. Ecomagination seeks to position GE as a global environmental technology heavyweight, and Immelt is confident that this initiative will contribute substantially to the eventual emergence of GE's share price from the funk it's been over the past seven years. The Globe & Mail ran an interesting piece on Ecomagination the following day. Rob Day at Cleantech Investing also briefly touched on on the topic on Monday. The jury is still out - will Ecomagination be GE's...

Alternative Energy: The Paradigm is the Problem

Tom Konrad CFA Can We Afford Alternative Energy? Most serious critiques of alternative energy boils down to, "it costs too much." True, detractors of wind power sometimes point to the number of birds and bats killed, and some people worry that electric vehicles (EVs) are so quiet that they pose a danger to blind pedestrians. While such critiques are legitimate in that they are real problems, they can also be alleviated. Avian fatalities can be greatly reduced by more sensitive siting of wind turbines, and even painting turbines purple. Nissan has installed an...

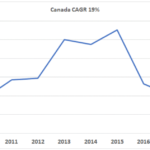

Insiders Are Buying These Five Canadian Cleantech Stocks

Tom Konrad CFA In the US insider trades are easily found on the SEC website, stock exchange websites, and financial aggregation sites. No so in Canada. A search for insider trades for a Toronto-listed stock on Google will turn up all the financial aggregation websites, but they don’t have any data. The TSX has more clean technology listings than any other exchange worldwide, many of which are truly international. I follow several, so I was thrilled when I came across CanadianInsider, where anyone can peruse recent insider trades for Canadian listed companies. Of the 14...

The MacArthur Foundation Invests In Climate Solutions- And In Fossil Fuels

By Marc Gunther.

Eighteen months ago, the people who manage the endowment at the John D. and Catherine T. MacArthur Foundation got some bad news: Investments they had made in funds managed by EnerVest, a Houston-based private equity firm that operates more than 33,000 oil and gas wells across the US, had plummeted in value to almost nothing.

The losses were small, relatively speaking — roughly $15 million, a fraction of the foundation’s $7 billion endowment — but they were unwelcome, if only because they called attention to the fact that MacArthur, whose mission is, famously, to build a “more just, verdant and peaceful world,” had...

Transmission – The Bottleneck We All Saw Coming

by Paula Mints

Transmission and distribution is the process of getting electricity from the point of generation to the point of use. Unfortunately, upgrades, maintenance, and the need to extend the electricity infrastructure from point a to point b are often ignored. Also ignored are infrastructure designs that support a distributed grid with renewable energy sources of electricity.

Transmission bottlenecks are the utterly foreseeable consequence of accelerated solar and

wind deployment. As countries worldwide were announcing RE goals, holding auctions, and providing incentives, system operators everywhere were warning about the need to add new and upgrade existing infrastructure while also warning about...

A Sign Of The Times

Alt energy investors figured out early on in this crisis that a widespread shut-down of credit markets coupled with a substantial re-pricing of risk would not bode well for the industry. That's why alt energy stocks have outdone the overall market to the downside over the past year, with the iShares S&P Global Clean Energy Index (ICLN) down more than 60% Vs. the S&P 500 loosing a little under 40% over the same period. Much of this carnage occurred before any real impacts on alt energy had been felt (current prices in equity markets are generally forward- rather...

Alternative Energy Investing Unfazed By Defeat of Proposition 87

Proposition 87 sure got a lot of attention in the past few months, not least because high-profile venture capitalist (and clean tech enthusiast) Vinod Khosla threw his full weight behind it. Proposition 87 would have created a tax set at between 1.5% and 6% (depending on the price of the barrel of oil) on producers of oil extracted in California, and would have established, with the proceeds, a $4 billion fund to invest in alternative energy. Unfortunately for Khosla and his bunch, California voters defeated Proposition 87 at the ballot box on Tuesday. Unsurprisingly, this had no impact...