Alternative Energy Investing for 2013

By Harris Roen 2013 is poised to be an exciting year for alternative energy investors. Despite the conflagration solar had in 2012 we see opportunities there, as well as in wind and energy efficiency. This article also reveals why 2013 is shaping up to be a good year for the stock market in general, and alternative energy in particular. ________________________ Solar If 2011 was a bad year for solar, with the bankruptcy of Solyndra, tariff wars with China, and other damaging events, then 2012 was a disaster. The Ardour Solar Energy Index (SOLRX) lost 35% in...

T. Boone Pickens on Larry King Live Thursday

In the past 24 hours, there have been a flurry of opinions coming out on what a commanding Obama victory would mean for people's portfolios. Alt energy investors certainly have reasons to be cautiously optimistic. T Boone Pickens, the famous Texas oilman turned clean energy cheerleader, and his Pickens Plan, are likely to have some influence on where President-elect Obama goes with his energy plan and alt energy policies. Pickens has been campaigning for his plan nearly as hard as the candidates have been campaigning for the White House, and his recent rapprochement with the Democratic Party...

Clean Tech Investing and the Democrats’ Victory

What are the implications of the Democrats' electoral victory for the clean tech industry? That probably won't become clear for a few more months. In the meantime, Red Herring, one of my favorite technology magazines, just published this short piece on the topic: "U.S. election a mixed bag for Cleantech". The early conclusion of industry insiders interviewed for the article is the same as ours - namely that the defeat of Proposition 87 won't be a signficant event in the long-run...and that the future looks overall bright. Happy reading!

Why Oil & Shipping Firm A.P. Moller-Maersk and Steelmaker POSCO Are ‘Green’ Investments

by Bill Paul There's no such thing as an "experienced" alternative energy investor. The sector simply is too new. Also, like an iceberg, most of it lies hidden beneath the surface. To succeed in these uncharted waters, I believe that alternative energy investors (a group that eventually will include all investors) need to follow a particular set of guidelines that I've started identifying in recent articles. The first guideline is that you must be a long-term investor with a time horizon of at least three to five years. Otherwise, you'll miss out on most of the incredible financial payoff...

Can Public Equity Investing Have Impact?

by Garvin Jabusch There’s an argument in the world of impact investing that goes something like, "impact happens only through private investments; there is no real impact, apart from shareholder engagement efforts, in public equity investing." An associated perception is that investment impact means capitalizing an enterprise beyond what would happen otherwise, meaning private equity alone has the power to provide real impact. But is this true? Publicly traded corporations are the largest and most visible social and environmental bellwethers of the global economy, and the high allocation to public equities in most investor portfolios means public equity...

Richard Rhodes, “Energy: A Human History”

Richard Rhodes has written an amazing book. He aspired to tell the tales of energy transitions over the past 400 years. His Energy: A Human History accomplishes that task.

The book is daunting in size for non-required reading. It is filled with brief stories of this or that device or discovery or development, and almost overwhelming in both scope and detail. I wondered, at times, when the payoff would come.

My advice: If you are at all interested in the topic, stick with it.

To my economics-trained mind the book lacks analytical structure. One story after another, linked together by fuel source or technology, layer...

Getting in on Early-Stage Companies

Question from a Reader: (links mine, in case you have not read the articles I think he's referring to) Hi, I'm a very small time investor and I have a strong longterm belief in the alt energy sector. I have one gripe with the sector, though - the fact that it's hard to get in all the way at the bottom, ie: from the birth of companies. I have a feeling that much more growth will happen at that level, and investing in something like ICLN gets me into mature companies that have much less growth potential. ...

Keynes Meets Carson, And How You Can Invest It (Part 1)

I'm not sure whether John Maynard Keynes, the father of Keynesian economics and an ardent proponent of government interventionism during hard economic times, and Rachel Carson, the mother of modern environmentalism and the author whose work is credited for the eventual creation of the EPA, ever met during their lifetimes. But if current voter sentiment holds until November 4, their ideas could soon converge and form the basis of government policy for at least the next four years. Let me explain. First, John Maynard Keynes. There is no doubt that the deliberate and coordinated nationalization of financial services...

2013 Alternative Energy Stock Predictions

Will Natural Gas Crush Alternative Energy in 2013? By Jeff Siegel Swami photo via Bigstock In 2004 a hotshot Wall Street type cornered me after I spoke at a private luncheon in New York. He told me I had a lot of balls wasting his time talking about alternative energy declaring he was an “important man” who didn't find it amusing that some tree hugger in a suit (yes, that's what he called me) would lecture him about a coming boom in solar... I never forgot that...

Roadway Revolution: Meet the Smart Highways of the Future

by Giles Kirkland

Even though many states seem to enter the “construction season” every spring, there’s still a significant backlog of vital repairs and improvements needed for state roads, interstates and bridges – around $420 billion worth as of 2017.

Not only are our roads falling apart, there are greater numbers of people in more vehicles on them. But what if, instead of simply following same repaving or rebuilding formula that never seems to catch up, municipalities get “smarter” with their fixes?

Smart cars use the newest technologies to save energy, improve safety, and assist in navigation. Missing from many of the...

2006 & Alt Energy Investing: 6 Key Points to Remember from a Great Year

It is customary, at the dawn of a new year, to reflect back on the past year’s highlights. This exercise is generally conducted immediately before the new year, so you could say I’m a little late. However, this time around, instead of creating my own list of key things to remember from 2006, I decided to see what the heavy hitters in the alt energy and clean tech spaces had to say. I picked 3 sources that I read religiously and that all published such a list for '06. They are: Clean Break, Cleantech Blog and Red Herring....

Clean Energy Stocks to Fill the Nuclear Gap

Tom Konrad, CFA If the Japanese use less nuclear power, what will take its place? I'm astounded by the resilience and discipline of the Japanese people in response to the three-pronged earthquake, tsunami, and nuclear disaster, perhaps in large part by my cultural roots in the egocentric United States, where we seem to have forgotten the virtue of self-sacrifice for the greater good. Yet while Japanese society has shown itself to be particularly resilient, the Japanese electric grid is much less resilient. According to International Energy Agency statistics, Japan produced 258 TWh of electricity from...

Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

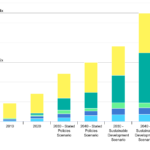

Supply and Demand

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

Report: US Re-takes Lead In Clean Energy Race from China… But Not For Long

Tom Konrad CFA According to the just-released report "Who's Winning the Clean Energy Race?" from the Pew Charitable Trusts, the United States invested the most in Clean Energy of any country in 2011, retaking the lead from China, which had held the top sport for the last two years. But the US's resurgence is more likely to be a blip than a trend. The United States' investments in Clean Energy were up 42% in 2011 over 2010, reaching $48.1 Billion. Meanwhile, Chinese investments were basically flat at $45.5 Billion. The US maintains a firm...

Cheap Oil: Nemesis Or Sideshow?

by Garvin Jabusch Next economics posits that for the global economy and earth's tolerances/carrying capacities to run in a mutually tolerable equilibrium, we must continue to make rapid advances in economic efficiencies in all sectors. For 7.3 billion of us (and counting) to thrive on finite resources and avoid the worst effects of climate change, we have to drive more and more economic output from less and less input. Fortunately, energy is one of the areas where we can quickly make huge strides in this respect but not with fossil fuels in the mix. On the contrary,...

Apologies For The Lack Of Posting

We wish to apologize for the lack of posting in the past few days. Tom has been on holidays and I have been very busy with work. We will be back with our normal posting schedule tomorrow. Best, Charles