January Performance: 10 Clean Energy Stocks for 2021

You can find the original list here. I'll be doing commentary on individual stocks as there is news. The first of these is on MiX Telematics (MIXT) earnings, first published for my Patreon subscribers on January 28th and copied below. A note on Scorpio Bulkers (SALT) from February first will be published here tomorrow.

MiX Earnings

MiX Telematics (MIXT) reported earnings this morning . The numbers showed improvement over the previous quarter, but a decline over the previous year due to the covid crisis which was exacerbated by the strengthening dollar.

The results were pretty much what I expected when I added...

Ten Clean Energy Stocks: Past Performance And Predictions For 2015

Tom Konrad CFA The last two months have not been kind to clean energy stocks. Most commentators attribute the weakness to declining oil prices and the Republicans' strong showing in the midterm elections. Whatever the cause, my 10 Clean Energy Stocks for 2014 model portfolio was dragged into a loss for the year where it had previously looked to return a small gain. A large part of the decline was in the dollar's strength. Measured in local currency, the average stock was flat, but the 8% decline in...

AAER: Tailwinds Or Hot Air?

Charles MorandLast week, I added a little to my position in AAER (AAERF.PK). I first took a long position in AAER, the Canadian-based MW-size wind turbine maker, over two years ago. I've since pared down it significantly, both because I wanted to take some profit after a meteoric rise in share price in Q4 2007 and later because of the company's seeming inability to get orders for more than a couple of turbines at a time. Although there was, before the credit crisis hit, a severe shortage of wind turbines and wind turbine components, barriers to...

Trading Alert: EarthFirst Canada (ERFTF.PK or EF.TO)

A few weeks ago, I wrote an article on the upcoming Clean Power Call in the Canadian province of British Columbia (BC). In a nutshell, the Clean Power Call consists of an auction conducted by the government-owned integrated power company to award long-term power purchase agreements (PPAs) to private wind developers. This is the model that has dominated in Canadian wind power so far. The notable thing about this model is that the PPA facilitates access to financing significantly for successful bidders, since the counterparty is a proxy of a credit-worthy government. EarthFirst Canada (EF) (ERFTF.PK or EF.TO)...

Trade Like It’s 2008

Tom Konrad CFA Three stocks I sold recently, and why. Three years later, I'm still kicking myself that the severity of the 2008 financial crisis and stock market collapse took me by surprise. Not that I wasn't in good company. If a majority of investors had been prepared for the crisis, it would never have happened in the first place: The overpriced CDOs and other securities which were a large part of the cause would never have become overpriced. But making excuses for past mistakes is not useful. Learning from them...

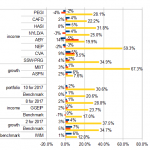

Ten Clean Energy Stocks For 2017: Fall Forward

Tom Konrad Ph.D., CFA

Yieldco Buyouts

A Canadian Yieldco Invasion sent clean energy stocks running up in October and November. My Ten Clean Energy Stocks model portfolio benefited from the purchase of 25% of Yieldco Atlantica Yield (NASD:ABY) by Canadian utility and renewable power generation conglomerate Algonquin Power and Utilities (TSX:AQN or OTC AQUNF), which was one of my Ten Clean Energy Stocks for 2009.

Rumors had circulated that the Atlantica stake would be purchased by Brookfield (NYSE:BAM) and its Yieldco Brookfield Renewable (NYSE:BEP). If there were discussions, Brookfield must have decided that it had enough on its plate with the recently...

Questions about DayStar Technologies

I received an e-mail from a reader that had questions about holding DSTI. I had some concerns about DSTI. I was wondering if you still believe investment in this company or alternative energy stocks is worth it. If crude oil drops further (let say mid 50s) do you think it will have negative impact on alternative energy stocks particularly ENER and DSTI. I was very happy with the holding a couple days ago, but the performance of DSTI in last 2 days without any news has got me concerned. Let me answer your question with first a...

Ten Clean Energy Stocks: A Rocky Start To 2015

Tom Konrad CFA 2015 got off to a rocky start for both the broad market in general, as well as clean energy. My Ten Clean Energy Stocks for 2015 model portfolio dd not fare any better, since the main bright spots for the portfolio were its three Canadian stocks, but these were dragged down by the 9% decline in the Canadian dollar for the month. For the month, the model portfolio was down 3.6% in local currency terms, but fell 7.2% in dollar terms. For comparison the broad universe of US small cap stocks was...

Ten Clean Energy Stocks for 2012: 10% more than other top-10 lists

Tom Konrad. CFA A "bonus" stock pick this year. Also, notes on New Flyer Industries and Finavera Wind Energy. Maybe it was because Seeking Alpha did not carry my annual list of 10 Clean Energy Stocks for 2012 this year, but no one seems to have noticed that there were actually 11 stocks in the list. Call it the Spinal Tap of top-ten lists. If anyone did notice the extra pick, they didn't leave a comment. What happened was that I have two number 8 stocks, but there is enough text...

Ten Clean Energy Stocks For 2016 Spring Forward

Tom Konrad CFA March and April were months of recovery for the broad market and for clean energy income stocks, but most clean energy stocks failed to participate in the rally. By design, my Ten Clean Energy Stocks for 2016 model portfolio is heavily weighted towards income, recovering 9% in March and 6% in April so that it is now back in the black, up 0.8% year to date. This puts it ahead of its benchmark, which is down 0.8% through the end of April. I want to thank Aurelien Windenberger...

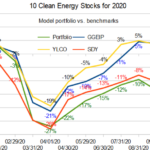

10 Clean Energy Stocks for 2020: Spooked in October, but Trading Anyway

by Tom Konrad, Ph.D., CFA

Two of the cash covered puts in the 10 Clean Energy Stocks for 2020 model portfolio have now expired, and I am left with a difficult decision as to what to replace them with.

As I discussed last month, I feel the market is overvalued given the economic impact of the pandemic and little prospect of fiscal stimulus before January. Yes, the market is not the whole economy, and large tech firms and high income workers and the wealthy are doing great while people on the bottom half of the income ladder are being crushed. With...

Ten Clean Energy Stocks For 2016: August Earnings

Tom Konrad, Ph.D., CFA My Ten Clean Energy Stocks for 2016 model portfolio continued to coast upward in August after five months of blistering performance since February, while clean energy sector benchmarks and real managed portfolio, the Green Global Equity Income Portfolio (GGEIP), pulled back slightly. The following chart shows the performance of the model portfolio and its sub-portfolios against their benchmarks. The portfolio, its growth and income subportfolios, and GGEIP all remain far ahead of their benchmarks. Second quarter earnings announced this month were neutral or positive for the income...

Q2 Performance Update: 10 Clean Energy Stocks for 2009

The Obama Effect continues to make my annual ten picks shine. Tom Konrad, Ph.D., CFA This is the second performance update on my 10 Clean Energy Stocks for 2009. In the first quarter, the model portfolio was up a tiny 1.6%, but still managed to beat the benchmarks handily (by 8% and 9%), since they were both down significantly. In the last three months, the market has turned around, logging significant gains, but my ten picks have continued to outperform. Company Ticker Change 12/27/08 to 7/2/09 Dividend & Interest The...

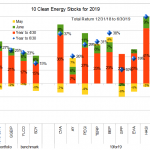

Ten Clean Energy Stocks For 2019: Sell The Peaks

I missed my regular monthly update in early June because of vacation.

In hindsight, early June looks like it was a good buying opportunity. The broad market of dividend stocks (represented by my benchmark SDY) falling six percent in May, only to rebound a similar amount in June. At the time, I would have continued to advise caution: “Sell the peaks” rather than “Buy the dips.”

Particularly volatile stocks like European autoparts supplier Valeo (FR.PA) from this list would have generated even greater short term gains. But it would take more than a six percent market decline to transform this bear...

Ten Clean Energy Stocks For 2017: Earnings Season

Tom Konrad Ph.D., CFA Earnings season began in earnest in February. My Ten Clean Energy Stocks model portfolio gave back a little of its large January gains because a mix of good and bad earnings mostly offset each other. One pick (Seaspan Preferred) gave back its large January gains. Neither the original gain nor the loss were driven by news. Instead, they seemed driven by investors changing expectations for global trade in an uncertain political environment. For the year to March 17th, the portfolio and...

Wind Developers For Sale: 11 Clean Energy Stocks for 2012, October Update

Tom Konrad CFA September Overview September was another quiet month for my Clean Energy model portfolio and the stock market in general, with the exception of Finavera Wind Energy (TSX:FVR, OTC:FNVRF), which put itself up for sale last Monday (see below.) Since my last update, my model portfolio rose a modest 4.5%, shadowing my broad market benchmark, the Russell 2000 index (^RUT), also up 4.5%. Although my clean energy picks rose in line with the broader market, the clean energy sector as...