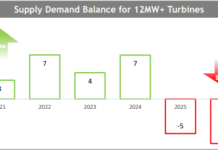

What is a good indicator of whether something is “hot”? When the top weekly in the world runs at least one article about it in every edition it publishes. That is what has been happening with The Economist and alternative energy over the past few months. This week’s piece was dedicated to the economics of wind power. Citing studies conducted in the Netherlands and Denmark, two wind power markets that are comparatively more developed than most North American markets (barring maybe Texas), the piece argues that, once a significant part of its initial costs have been paid off, wind power can reduce average power prices significantly because the marginal cost of producing it is close to 0 (the fuel is free). This is consistent with a report released in January by Emerging Energy Research that found that, under a scenario where carbon emissions are priced at €30 ($41) per metric tonne, “the cost of energy production from land-based wind turbines would be well below the cost of natural gas and coal plants at today’s levels” in Europe. Contracts for one metric ton of carbon for phase 2 of the EU ETS (Europe’s emissions trading program) are currently trading at around €21. I need not remind you that cap-and-trade for greenhouse gases may be here soon. As our regular readers know, I have been a wind enthusiast for some time now, and I continue to believe that wind has some of the strongest fundamentals of all forms of renewable generation. In the context of rising fuel costs and the imminent pricing of carbon emissions in the US, the ability of wind to create savings for customers may one day prove to be the strongest argument in its favor. Investment Ideas Of course there are the issues of grid stability and transmission bottlenecks which could slow growth in the wind sector. However, as we have pointed out in the past, we believe that both of these apparent limitations may actually provide good investment opportunities. On the topic of frequency regulation, two stocks in particular are worth watching: Beacon Power (NASDAQ:BCON) and VRB Power Systems (TSE:VRB.V or VRBPF.PK). We have written in the past about opportunities in transmission and inverters. The other major problem facing the wind industry is chronic shortages of wind turbines. Here again, however, this means that turbine manufacturers should do very well in the next few years. Some of the top stocks in this space are:Vestas (VWSYF.PK), Gamesa (GCTAF.PK), GE (NYSE:GE) and Suzlon (SZEYF.PK). The Pink Sheets listings are ADRs – all of these firms have proper listings in their home countries. DISCLOSURE: The author is long Beacon Power.