The carbon markets are an area of keen interest for me personally and professionally, so it is always frustrating that the mainstream media largely refuses to learn the details. In general, layman and media who don’t understand the details of the carbon markets attack carbon offsets in two areas, first, questioning whether the credits are for a project that would have occurred anyway (a concept known in carbon as “additionality”), and second questioning whether there are checks and balances to ensure the environmental standards are adhered to and the abatement actually happens (in carbon known as the validation and verification processes). The frustrating part for anyone in the industry is that the entire of the carbon credit process set up under Kyoto is all about ensuring the answers to those two questions. Leading certification firms and carbon project developers have been dealing with the details behind those questions for years. The biggest weakness of the carbon offset process to date has been that the high level of oversight and protection, while working, has led to higher costs and fewer projects getting done, rather than too many. Bottom line, the carbon markets ARE working, and are pouring billions of dollars into fighting global warming, just like the NOx and SOx trading markets helped reduce air pollution faster and cheaper than anyone expected. Now it’s time to figure out how to make them REALLY scale. I caught up with a friend of mine, Marc Stuart, to give us a little teach in about the real story in carbon offsets, what matters, what does not, what works, and what still needs to be tweaked. Marc should know, he’s one of the founders of EcoSecurities plc (ECGUF.PK or ECO.L), one of the first, and still the leader in generating and monetizing carbon credits. Marc, thanks for joining us, we appreciate the time and the teach in. 1. Even for those who don’t know much about carbon offsets, many people have heard about the concept of additionality, and almost everyone intuitively understands it at some level. But it is devilishly complicated in practice. I’ve always described it to people as “beyond business as usual”. Can you explain additionality and give us some insight into the details? Additionality is the core concept of the project-based emissions market. In a nutshell, it means that a developer cannot receive credits for a project that represents “business as usual” (BAU) practices. A classic and often cited example is that industrial forest companies should not be able to get credits simply for replanting the trees that they harvest from their plantations each year, since that is already part of their business model. A utility changing out a 30 year old, fully depreciated turbine would not be able to claim the efficiency benefits, though a utility that swapped out something only five years old might be able to under certain circumstances. Additionality is easy to definitively prove in cases where there is zero normal economic reason to make an investment, such as reducing HFC-23 from the refrigeration plants or N2O from fertilizer plants. Such projects easily pass a “financial additionality” test, since it’s clear that as a cost without a benefit, they wouldn’t have been economically feasible under a BAU scenario. It gets far more complex though, with assets that contribute to both normal economic outputs and the development of carbon credits, in particular in renewables and energy efficiency. Sometimes these projects are profitable without carbon finance, but there may be other barriers preventing their execution that make them additional. The UN has developed a very structured and rigorous process that projects must undergo to prove additionality. It is essentially a regulatory process with multiple levels of oversight, in which a body called the Executive Board to the UN’s Clean Development Mechanism (The CDM is the international system for creating carbon offsets called CERs) ultimately makes a binary decision about whether a project is eligible to participate or not. Anchored in the middle of that oversight is an audit process run by independent, licensed auditors, the largest of which is actually a multi-national nonprofit called Det Norske Veritas (DNV). However, many projects don’t even make it to that decision point before they are dropped in the process. 2. One of the benefits of carbon offsets often touted by those who support them is the idea that they provide compliance flexibility and liquidity in the early years of a compliance cap and trade system. What are your thoughts on how that works? The simple reality is that many assets that emit carbon have a long lifetimes and that legitimate investment decisions have been taken in the past that rightfully did not take into account the negative impact of carbon emissions. For an easy example, think about somebody who is a couple of years into a six-year auto loan on a gas guzzlercan policy just force that person to immediately switch to a hybrid, especially since the used car market for his guzzler has now completely disappeared? Even if society says yes, how long would it take for the auto industry to ramp up its production of hybrids? Now look at infrastructurefor example, most power plants and heavy industry facilities have lifetimes of thirty years plus. Even if we were economically and politically able to affect a radical changeover, simply put, the physical capacity for building out new technology is limited, even in a highly accelerated scenario. So, like it or not, GHG emissions from the industrial world are going to take quite a while to stabilize and reduce. The point of offsets is that, in fairly carbon efficient places like California or Japan, availability of low cost reductions within a cap-and-trade system is quite limited, meaning there is an incentive to look beyond the cap for other, credible, quantifiable, emissions reductions. Reductions in GHGs that are uncapped (either by sector, activity, or geography), such as are found in the CDM, are thus a logical way to achieve real GHG reductions and accelerate dissemination of low carbon technologies. In effect, the past helps subsidize changeover to the future as buyers of emission rights subsidize other, cheaper, GHG mitigation activities. As caps get more restrictive over time, capital changeover occurs. Offsets allow this to occur in an orderly and cost-effective manner. 3. There have been a number of studies questioning whether offsets are just “hot air” and whether carbon offset projects actually achieve real emission reductions. What is your response to these accusations? As noted in the first question, the CDM in particular is a market that is completely regulated by an international body of experts supported by extensive bureaucracy to ensure that real emission reductions and sustainable development are occurring. The first and foremost requirement of that body is to rule on whether each individual project is additional. Each project is reviewed by qualified Operational Entity, the Executive Board Registration and Issuance Team, the UNFCCC CDM Secretariat and the CDM Executive Board itself. Plus, there are multiple occasions for external observers to make specific comments, which are given significant weight. So, while there is always the chance something could get through, there are a lot of checks and balances in the system to prevent that. That said, determining an individual emission baseline for a project – the metric against which emission reductions are measured – is a challenging process. The system adjusts to those challenges by trying to be as conservative as possible. In other words, I would argue that in most CDM projects, there are fewer emission reductions being credited than are actually occurring. It is impossible for a hypothetical baseline to be absolutely exact, but it is eminently possible to be conservative. Is it inco

nceivable that the opposite occasionally occurs and that more emission reductions are credited to a project than are real? We’ve never seen it in the more than 117 projects we’ve registered with the CDM, but I suppose it’s possible. 4. What about the voluntary carbon market in the US, where there have been accusations that many projects would have happened anyway? How is this voluntary market different from what EcoSecurities does under the Clean Development Mechanism? The voluntary market has had more of a “wild west” reputation compared to the compliance market. In some ways, that is deserved, but in some ways it is unfair. For a number of years, the voluntary market was the only outlet for project developers in places like the United States and in sectors like avoided deforestation that were not recognized by the CDM. However, because there were virtually no barriers to entry and no functional regulation other than what providers would voluntarily undertake, it was difficult for consumers and companies to differentiate between legitimate providers and charlatans. For EcoSecurities, while the voluntary market has been a very small part of our overall efforts, we always qualified projects according to vetted additionality standards such as the CDM and the California Climate Action Registry, and always used independent accredited auditors. With the emergence of stand-alone systems like the Voluntary Carbon Standard (Editors note: Marc Stuart sits on the board of the VCS), and the growing demand for offsets from the corporate sector, I believe the “wild west” frontier is drawing to a close. [Editors note: Other voluntary carbon standards we watch closely include Green-e Climate, put out by the people who certify most of the renewable energy credits (RECs) in the US] It is also important to note that while the voluntary market has recorded very explosive growth, it is still a very small fraction of the regulatory market, comprising a few tens of millions of dollars of transactions, versus the potential tens of billions of dollars of value embedded in the highly regulated and supervised CDM. The fact that many observers still equate the occasional problems in the fringes of the voluntary market (which are increasingly history) with the real benefits being created in the Kyoto compliance market is a misperception we’d like to correct. 5. What about these projects we’ve heard about in China, where the sale of carbon credits generated from HFC-23 capture is far more valuable than production of the refrigerant gas that leads to its creation in the first place? How is this being addressed in the CDM and how can future systems ensure that there are not perverse incentives created like this? HFC-23 projects are the epitome of what is often referred to as “low hanging fruit.” In this case, most of the fruit might have actually been sitting on the ground. While there is no doubt in anybody’s mind that the market drove the mitigation of HFC-23 globally, the extreme disparity between the costs of reducing those gases and the market value those reductions commanded invariably led to questions whether there were more socially efficient ways to have reduced those emissions. In all likelihood, there were. But to catalyze an overall market like this, it is probably important to get some easy wins at the outset to create broader investment interest and this certainly accomplished that. Moreover, Kyoto created a mechanism for engaging these kinds of activities. It would have sent a much worse signal to the market to have changed the rules in the middle of the game. The CDM has subsequently adjusted the rules to make sure that no one can put new factories in place simply for the purposes of mitigating their emissions. I don’t see too many other situations like HFCs in the future, simply because there are no other gases where the disparity of mitigation costs and market value is so severe. 6. Given that the majority of CDM projects currently under development are located in China and India, how can we ensure that these countries eventually take on the binding targets we will need to reach the scientifically determined reductions in GHGs? Doesn’t the CDM simple create an incentive for these countries to avoid binding targets as long as possible? It is clearly in the world’s interest to get as much of the global economy into a low carbon trajectory as quickly as possible. However, it is politically unrealistic to expect these countrieswhose emissions per capita are between one fifth and one tenth the per capita of the United Statesto make an equivalent commitment at this juncture, particularly considering that they are in the midst of an aggressive development trajectory. The CDM provides a way for ongoing engagement with these countries, developing the basic architecture of a lower carbon economy. And there is no doubt that China’s emissions in 2012, 2015 or 2020 will be measurably lower than they otherwise would have been, simply because of the current accomplishments of the CDM. Over time, the use of project based mechanisms will contribute to accelerating the development and dissemination of low carbon technologies, which will make those negotiations for binding caps from all major economies far more tenable. 7. It is widely believed that to address the climate crisis on the scale necessary to avert dangerous global warming, significant infrastructural and paradigm shifts must occur at an unprecedented scale. Some people are concerned that offsets provide a disincentive for making these shifts, since companies can just offset their emissions instead of making the changes themselves. Is this something you saw under the EU ETS at all, and if so, how can it be addressed in a US system? Virtually all of the macroeconomic analysis that has been done of Phase I of the ETS shows that there were real emission reductions undertaken within the system, despite the fact that many companies were also actively seeking CDM CERs. Clearly the fact that both Kyoto and the EU ETS system place quantifiable limits on the use of CDM and Joint Implementation (JI) credits guarantees that emission reductions will also be made in-country as well, so pure “outsourcing” of emissions compliance is not possible. This also appears to be the model being pursued in most US legislation. 8. Many have complained that the CDM system is too administratively complex, unpredictable, and that the transaction costs of the system are so significant that they could almost negate any possible benefits. What lessons can be learned about structuring an offset system in a simpler, but still environmentally rigorous way? What steps is the CDM EB taking to address these issues? The CDM treads a very fine line between ensuring environmental integrity of the offsets that it certifies and the need to have some kind of efficient process within an enormous global regulatory enterprise. To date, one has to think that they have gotten it about right, as business has complained about inefficiency and environmentalists have complained about environmental integrity. However, it is becoming increasingly clear that the project by project approval approach is creating logistical challenges as the system graduates from managing dozens, to hundreds, to now, quite literally, thousands of projects in all corners of the world. Ironically, it is the success of the CDM in terms of its very broad uptake by carbon entrepreneurs that is causing problems for the current model. We believe the benefits of the CDM can be maintained by moving many project types into a more standardized approach, whereby emission reduction coefficients are determined “top-down” by a regulatory body, as opposed to being undertaken individually for every project by project proponents. For example, there are dozens of highly similar wind energy projects in China that all have microscopically different emission baselines. A conservative top down baseline set by the regulator (in this case, the CDM Executive Board) would enable projects to get qualified by t

he system in an efficient manner with far less bureaucratic overhang. This is how California’s Climate Action Reserve deals with project based reductions and we think that it could work well for many sectors. 9. Is there any difference between a renewable energy certificate (REC) and a carbon offset? Does EcoSecurities support the concept of selling RECs to offset carbon emissions? While renewable energy clearly helps lower the carbon intensity of the electrical grid, there are a great number of other incentives for development of renewables in the US, including significant Production Tax Credits, and in most states, RECs or Green Tags. For EcoSecurities, this makes it extremely problematic to claim that these assets are additional, despite their obvious benefits to the global environment and decarbonization of the economy. Acknowledging this, EcoSecuritiesalong with many other companieshas steered clear of developing REC projects for VERs in the voluntary market. There are other firms that have chosen other approaches, which again highlights the need for standardized approaches like the VCS. That said, we are very active in helping create carbon value for RE projects throughout the developing world via the CDM, where incentives such as RECs are almost universally non-existent. 10. There has been a lot of concern about “carbon market millionaires” profiting from selling offsets, and that the only “greening” going on is in the lining of peoples’ pockets. As a carbon market millionaire yourself, what do you think about this concern? Capital markets exist to reward innovation and punish underperformance. EcoSecurities has existed for more than 11 years and the founders – of which I am one – have devoted more than 15 years to building up various aspects of the carbon market. For many of those years, as we watched friends and colleagues flourish in other markets like internet and biotech, our decision to stay in this seemed fairly quixotic. But we understood enough of the science of climate change to recognize that a fundamental policy response had to be forthcoming, or we would be heading to a global catastrophe. Now those policies have come into focus and the overriding recognition is that society will need to mobilize trillions of dollars of capital to decarbonize the global economy. As part of the proverbial “bleeding edge” for many years, we were ironically well positioned to take advantage when early movers in the capital markets recognized the capabilities and brand that we had built up over a decade. As for whether that is the only greening – well, I can tell you that given the very conservative and difficult aspects of qualifying projects for the CDM, I am 100% certain that our activities contribute solidly to that decarbonization trajectory and that real emission reductions have occurred all over the world because of our efforts. 11) What lessons have you learned personally about the market as a cofounder of the leading CDM project developer in the world? You must have some interesting lessons learned for the US as you are probably unique amongst your competitors in having been based here in the US for over 10 years. Thanks for the compliment but actually, I’m not that unique. I started in the market in the early 1990’s when the US was the epicenter of a future carbon trading regime, and Europe and Japan looked at it with suspicion and distaste. Quite a number of us from that era did not give up, but instead spent a fair bit of time since then getting our US passports stamped regularly to search the world for projects. It’s nice to see that we may finally be getting back to where we thought we would be a decade agowith the US as a driving force for innovation in decarbonizing the world’s economy (coincidentally in a recent report produced by the UNFCCC, the US along with Germany, the UK and France provided over 70% of the clean technology currently being utilized in CDM projects). The US is in a perfect position to learn from the both the successes and mistakes within the first Kyoto iteration and I am looking forward to being part of that next stage as well. 12) What do you say to popular press who don’t seem to believe that Kyoto works? Honestly, you haven’t seen what I have seen. I’ve traveled all over the world and seen the results of Kyoto, where “carbon entrepreneurs” – ranging from divisions within multinationals to garage inventors on their ownare seeking ways to cost effectively reduce GHG emissions. That simply would not have happened without the market signal that Kyoto created. The fact that the CDM has registered more than 1000 projects and has a backlog of several times that – despite the incredible bureaucratic requirements – shows an uptake several magnitudes beyond what anybody predicted when Kyoto was negotiated. When the managing director of a West African oil refinery is proudly detailing to you the steps he’ll be ordering his engineers to take to help save some 250,000 tonnes of CO2 emissions to the atmosphere, that’s when you realize that you’ve tapped into something significant. And having had the same basic conversation in Mumbai, Jakarta, Sao Paulo and Beijing, you realize that people really want to do something, but that you need a little push from a market. That said, we are still in the first tentative moments of what is probably a century long issue and there are doubtless many improvements that can and will be made. But we have undoubtedly proven that the basic premise works. Thanks Marc. A pleasure to chat as always. Keep up the good fight.

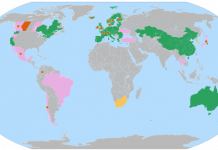

Neal Dikeman is a founding partner at Jane Capital Partners LLC, a boutique merchant bank advising strategic investors and startups in cleantech. He is founding contributor of Cleantech Blog, a Contributing Editor to Alt Energy Stocks, Chairman of Cleantech.org, and a blogger for CNET’s Greentech blog. He is also the founder of Carbonflow, a provider of software solutions for the carbon markets.