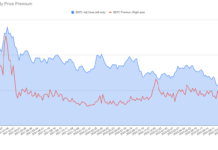

It wasn’t long ago that people still believed the price of energy commodities – and crude oil in particular – had a greater impact on alt energy stocks than did general movements in equity markets or even fundamental factors. The logic went something like this: even though oil and most of the sub-sectors that make up the broad alt energy space (e.g. solar) are not in direct competition with one-another, expensive oil is the number one driver behind governments searching for alternatives to the way we currently meet our energy needs. For a time, this theory may have held true as far as short-term movements in the prices of alt energy stocks went – but is it still the case? About a quarter of the way through the book Technical Analysis for Dummies, there were no doubts left in my mind that technical analysis wasn’t my cup of tea. Nevertheless, I do like data and enjoy looking at charts as far as general trends are concerned. I therefore thought I’d take a look at a few basic charts to see if, at least visually, there appeared to be any relationship between movements in energy markets and movements in alt energy equities. The analysis I did was not especially sophisticated, but interesting nonetheless. For the market as a whole, I took the S&P 500 as a general indicator of performance for US equities, and the Russell 2000 for small-cap equities. For alt energy, I used the ECO index and the CELS index, both of which underlie popular alt energy ETFs. I picked these two indices because: (a) they are focused on energy technologies and not cleantech more broadly, and (b) they both track US equities. For energy, I used the Dow Jones-AIG Commodities Index (DJ-AIGCI), which is far from a perfect proxy for energy prices. The DJ-AIGCI tracks a broad basket of commodities, which tends to tame the impact of any one component. I used this index nonetheless because I wasn’t trying to achieve anything too fancy, and because the data was readily available and usable in the way I needed it, which isn’t the case for an energy-focused index like the DJ-AIG Energy sub-index (DJ-AIGEN) (made up of crude oil, heating oil, natural gas and unleaded gasoline).

The first chart I looked at is a three-year chart. For one year and under, the DJ-AIG tracks the DJ-AIGEN fairly closely, but for three years the picture is a little different. The main thing missing from this graph is a big spike in the energy sub-index in late 2005 followed by a large fall throughout 2006 and until the begging of 2007. The ECO peaked in mid-2006, months after the energy sub-index had begun to fall, and seemed to track the S&P 500 and Russell 2000 fairly closely until mid-2007, when it began to pull apart and seemed to be trending up with energy as broader equity markets were flattening out and begging to fall. The thing that struck me most about this chart is the ability of a deep-seated correction to wipe months of gains. Take the S&P 500. If your portfolio had been tracking the index perfectly starting in early July, 2005, you would’ve been up about 25% by the same time two years later, which isn’t bad for taking no more risk than the market as a whole and not having spent any time or resources picking stocks. However, hang on for another year and you’d be almost right back to where you started. This comes back to the concept of managing risk, which I discussed in a previous article. Without attempting to actively time the market, which can be challenging at best and futile at worst, it is probably reasonable to occasionally take some money off the table to protect gains.

The second chart I looked at is a one-year chart. As mentioned above, the DJ-AIGCI index followed the DJ-AIGEN fairly closely within a one-year timeframe, so I am more confident in this one. From this chart we see that ECO and CELS pulled away from the equity indices and seemed to follow energy prices during November ’07, even peaking in December as the credit crisis was begging to take its toll on equity markets. But soon after, movements in ECO and CELS began following the equity indices fairly closely, dipping as energy prices peaked in early March and again in late June.

The final chart is a three-month chart. This chart makes it relatively clear that ECO and CELS are more in line in equity markets than with energy, as evidenced by the fact that they joined in to the small rally of the past few days as oil prices fell. Of course, nothing conclusive can be drawn from this small exercise, and since I am a bottom-up stock picker I only partially care about what makes the market move in the near-term. My primary interest in doing this was to see if, should we enter into a period of energy price correction, I should keep my eyes open for promising companies that may trade at a discount due to non-fundamental factors (i.e. supply and demand in the market). From this brief analysis it seems as though I might be better off with continued troubles in equity markets as a whole for finding alt energy bargains.

DISCLOSURE: The author does have not a position in any financial products tracking the indices discussed here

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

You’re not the only one to reach this conclusion, Charles. Historically commoditiy based equities have been a poor proxy for direct commodity investment. The main problem, in my opinion, is that commodity booms lead to large increases in the inputs (think of drilling rigs for oil) of producing the commodity, as well as the price of the commity itself.

This is why I often focus on the companies which provide the equipment to alt=e producers, rather than the producers themselves.