Dedicated legislations have been at the core of some of the most impressive regional growth stories in alternative energy, most notably in Germany with the Renewable Energy Sources Act or in California with the various legislative solar initiatives. On Monday, the Canadian province of Ontario became the latest jurisdiction to join the fray as lawmakers introduced the Green Energy and Green Economy Act. Why should investors care? Because such legislations have been at the core of some of the most impressive regional growth stories in alternative energy.

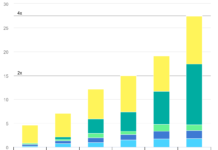

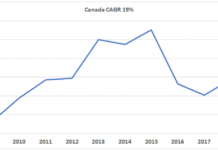

As a bit of a backgrounder on Ontario, there is currently about 800 MW of installed renewable power capacity (~95% wind) in the province with around 2,500 MW under power purchase agreement (PPA) and scheduled to be brought into commercial operations in the next few years. In late 2006, the province introduced a renewable power feed-in tariff incentive, the first one in North America. This incentive was suspended in May 2008 due to transmission constraints. By then, there were about 500 MW of solar capacity under PPA linked to the incentive, including one of the world’s largest solar PV farms.

To put these numbers into perspective, California, the largest solar PV market in the US by quite a stretch, had around 500 MW of PV installed by the end of ’07. Next came New Jersey at 69 MW and New York at 32 MW. None of the 500 MW under PPA in Ontario has yet reached commercial operation, and at least some of it will probably be cancelled given current credit conditions. Nevertheless, these figures provide a good idea of the market’s potential is. The Canadian Solar Industries Association estimates that Ontario could install up to 16,000 MW of solar PV by 2025, with the potential on Toronto’s rooftops alone estimated at 3,600 MW.

The Green Energy and Green Economy Act

The Act targets three main areas: (1) renewable power generation; (2) energy efficiency; and (3) the smart grid.

1) Renewable Power Generation

Perhaps the most significant measures here are aimed at removing what had proven to be critical barriers to renewable energy projects reaching commercial operation in the province:

- Renewable energy projects meeting certain criteria will be guaranteed a connection to transmitters and distributors’ networks and will be given priority access over other forms of power generation

- Transmitters and distributors will have to make the necessary network upgrades to allow for the connection of renewable power projects and the eventual expansion of renewable power capacity

- Renewable power projects will be exempt from all forms of municipal permit requirements to counter a growing trend of NIMBY groups lobbying their municipal councils to block renewable energy projects

- A new office of Renewable Energy Facilitation has been created to help speed up the permitting process (e.g. environmental assessments, etc.)

On the revenue side, the legislation does the following:

- The feed-in tariff that had been suspended in May 2008 will be reintroduced once new rules have been designed (no timeline provided but Q2 2009 has been thrown around)

- A system of PPA auctions for large-scale renewable power projects that has been in operation since 2004 will be maintained

Analysis

The measures aimed at removing barriers to renewable projects are significant. However, until the new rules around the feed-in tariff are released (e.g. pricing, eligible fuels, etc), the exact impact of the law will remain unclear. My own guess is that the government will be very aggressive with ramping up renewable energy installed capacity over the next five years as, as its name indicates, this law is also about the economy. If you believe the government, this bill is as much about creating a counter-cyclical effect as it is about cleaning up the environment. If my thesis is correct and this turns out to be a boon for developers, the following stocks should be watched:

| Name | Ticker | Description | Potential Upside Related to Legislation |

| Algonquin Power Income Fund | AGQNF.PK | Ontario-based renewable power developer with exposure to Ontario (income trust) | V. High |

| Boralex | BRLXF.PK | Canadian renewable power developer with exposure to Ontario | V. High |

| Canadian Power Developers | CHDVF.PK | Canadian renewable power developer with significant exposure to Ontario | V. High |

| Great Lakes Hydro Income Fund | GLHIF.PK | Ontario-based hydro power developer (income trust) | V. High |

| Innergex Renewable Energy Inc. | INRGF.PK | Canadian renewable power developer with exposure to Ontario | V. High |

| Macquarie Power & Infrastructure Income Fund | MCQPF.PK | Ontario-based renewable power developer (income trust) | V. High |

| ARISE Technologies Corporation | APVNF.PK | Ontario-based silicon and PV cell manufacturer with a module installation segment. The module installation segment is focused on the Ontario residential market | V. High |

| Northland Power Income Fund | NPIFF.PK | Ontario-based power developer with some exposure to renewables (income trust) | High | Brookfield Asset Management | BAM | Infrastructure development firm with exposure to Ontario renewables | Medium |

| FPL | FPL | FPL Energy unit is one of the world’s largest wind park owners and has exposure to Ontario wind | Low |

2) Energy Efficiency

The Act introduced a number of energy efficiency measures with a focus on building efficiency:

- No real property can be sold or leased for an extended period of time without undergoing an energy audit

- Public agencies will be required to come up with an energy conservation and demand management plan

- Public agencies will be required to consider energy efficiency when making capital investments or when acquiring goods and services (although the devil will be in the details here with more precise rules to come)

- Energy distributors will be required to meet efficiency and demand management targets (see the brackets above about the devil)

- The Building Code will be reviewed to include stronger efficiency measures

Analysis

Energy efficiency measures are clearly targeted at the building stock. There aren’t really any good direct plays on this, and won’t be until the government releases further information on what it intends to do with its own buildings. Building efficiency firms such as Johnson Controls (JCI) could benefit, although its unclear whether this would be needle-moving.

3) The Smart Grid

Ontario has been somewhat of a leader in smart grid, with legislation passed back in 2005 requiring every home and business in the province to be equipped with a smart meter by 2010. Hydro One, the largest transmitter, has also begun smartening its network by embedding communication equipment from RuggedCom (RUGGF.PK). The Act contains provisions to expand smart grid capex. The Ontario Smart Grid Forum estimates that C$1.6 billion could be spent on a smart grid ramp up in Ontario over the initial five years of such a program. As I mentioned in a past article, while the absolute amount isn’t huge, it is still a fair chunk of change for this emerging industry.

The smart grid measures are:

- A timeline for rolling out the smart grid and apportioning spending responsibilities to different players (e.g. transmitters, distributors, retailers) will be released

- Communication standards and other technical aspects will de defined through regulation

- The regulator (called the Ontario Energy Board, the equivalent of a PUC in the US) will be directed to take actions related to the implementation of the smart grid, although these actions aren’t yet defined

Analysis

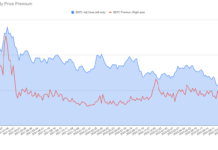

Once all the rules are released, the legislation will have the effect of formalizing a patchwork of initiatives already underway. In my view, significant smart grid capex can be expected in Ontario over the next few years with a focus on the transmission and distribution infrastructure (rather then end consumers). There are several companies large and small entering the world of smart grid. My personal favorite play on this legislation is RuggedCom (RUGGF.PK): (1) it has already won contracts here; (2) it is part of the home team (based in Ontario); (3) it already generates EBITDA; and (4) even though its stock has withstood the latest storm in equity markets, it’s still trading at a reasonable trailing PE compared to peers.

Conclusion

Many people in the investment world loathe government intervention into anything. However, alt energy has been and continues to be primarily driven by regulation and government policies. In the absence of government support schemes, industry growth rates would be a fraction of what they currently are, and solar PV would not be on the steep cost decline curve it’s currently on. It is therefore critical to keep an eye on the policy side to know where growth opportunities will emerge next.

With this new Ontario legislation, my favorite play is the Canadian clean power IPP sector (stocks listed above). The smart grid initiatives will also be worth watching, although more clarity on the rules is required before potential winners can be identified.

DISCLOSURE: Charles Morand does not have a position in any of the stocks discussed above.

DISCLAIMER: I am not a registered investment advisor. The information and trades that I provide here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.