Tom Konrad, Ph.D.

The intense and growing investor interest in Clean Energy Investing can be seen in the recent growth of new clean energy mutual fund and Exchange traded fund issues. Although competition for investors’ money is heating up, and I’ve noticed a slow decline in fund fees, those fees are still quite high, with expense ratios ranging from 1% to 2.75% for Clean Energy mutual funds and 0.5% to 0.85% for Clean Energy ETFs.

The intense and growing investor interest in Clean Energy Investing can be seen in the recent growth of new clean energy mutual fund and Exchange traded fund issues. Although competition for investors’ money is heating up, and I’ve noticed a slow decline in fund fees, those fees are still quite high, with expense ratios ranging from 1% to 2.75% for Clean Energy mutual funds and 0.5% to 0.85% for Clean Energy ETFs.

For many investors, that leaves a lot of room for cost savings by investing in individual stocks. Nearly all the benefits of diversification can be achieved with a 20-50 stock portfolio, if those stocks are chosen to minimize internal correlations. An investor who decides to place 20% of his portfolio in Clean Energy should only need 4-10 stocks in the sector to achieve most of the benefits of diversification.

For example, an investor with $20,000 in a diversified IRA might decide that this year’s $5000 contribution should go into Clean Energy. He could buy $1000 worth of five Clean Energy stocks to achieve a 20% allocation to clean energy without significantly reducing his overall diversification, and resolve to purchase another $1000 worth of a single clean energy stock each subsequent year, to maintain that approximate diversification. The table and graph below show how his costs would compare to investing the same amount in sector mutual funds or ETFs, assuming a moderate $13 brokerage commission. Many brokers offer much better commissions, which make stocks look even better in comparison to funds.

These calculations assume no price appreciation. If price appreciation were included, ETF and mutual fund costs would be higher than those given, because these costs are based on a percentage of assets under management.

|

Cumulative commissions & expenses |

||||

| Year | Total invested | Stocks | lowest cost ETF | lowest cost mutual fund |

| 1 | $5,000 | $ 65 | $ 37 | $ 65.50 |

| 2 | $6,000 | $ 78 | $ 79 | $ 144.10 |

| 5 | $9,000 | $ 117 | $ 233 | $ 458.50 |

| 10 | $14,000 | $ 182 | $ 586 | $ 1,244.50 |

The stock investor following this strategy will save money in the first year compared to even the least expensive mutual fund available (the Winslow Green Growth Fund), and by the second year compared to the least expensive clean energy ETF (the iShares S&P Global Clean Energy Index.)

A Quick Way to Choose Clean Energy Stocks

All this assumes the investor has the time to spend to pick appropriate stocks. For a small investor like the one in the example, the time required will need to be minimal. With literally hundreds of clean energy stocks to choose from

, the task seems monumental. It doesn’t have to be.

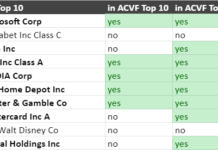

One simple way is to look at the top holdings of a few clean energy mutual funds, and pick your stocks from among those. By making sure to spread your holdings over different alternative energy sectors (Wind, Solar, Efficiency, etc.), you’ll be able to maximize your diversification. Our CleanTech Stocks page shows stock categories in the right-hand column.

The goal of this strategy would be to approximately replicate the performance of the funds, but to do so at much lower cost. If this were done outside of a tax advantaged account such as an IRA, after-tax performance could be enhanced further by selling losing stocks in order to shield capital gains or even a little ordinary income from taxation, and replacing them with similar companies.

Tomorrow I’ll take a look at Clean Energy mutual fund holdings to see what this portfolio might look like. (The link will be broken until then.)

DISCLOSURE: None.

DISCLAIMER: The information and trades provided here are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

Tom: I think you hit it on nail when you identify the main problem with stock picking as “All this assumes the investor has the time to spend to pick appropriate stocks.”

Even if the universe of available picks was scaled down to 5 to 10 stocks from the top holdings of alt energy ETFs/MFs, this would still represent a monumental research task for the person whose day job is not investment-related, or even who has no background whatsoever in alt energy.

Because of the nature of alt energy (i.e. comparatively “risky”, or volatile), even ETFs/MFs top picks require a fair bit if research to determine firm-level risk, especially in the current environment.

While there is a cash cost to investing in products such as ETFs/MFs, one of the key benchmarks for investors I believe should be the opportunity cost of conducting investment research (i.e. Assuming I can only match but not beat the returns of the ETF/MF I am interested in, what else would I be doing with my time if were not pouring over annual reports and other company data, and what is that worth to me?).

A major flaw in the argument Tom is making is that most green funds are far more diversified than simply green energy.

Wggfx, the fund used as an example, holds only 26% in clean energy. Green building products, water management, environmental services, resource efficiency, pharmaceuticals & medical products, software, sustainable living, & transportation make up the rest of the portfolio. Other green funds — e.g., Portx, Pgrnx, and the other Winslow Fund, Wgslx, take the same diversified approach. Portx, for example typically owns less than 5% energy – it’s a resource efficiency fund, not an energy fund.

In sum, this article does not make the case it sets out to because it uses a straw-man argument, at least for mutual funds. I would have thought the author would have checked the holdings of the fund he used to set up his argument.

Derek,

This article is for investors who want to invest in clean energy. From this perspective, being more diversified is a problem, not an advantage. The rest of the portfolio can be used for diversification, at much lower cost.

I define what I mean by “Clean Energy” in my article comparing clean energy funds from last week. It very much includes efficiency.

In that article, I found at approximately 75% of WGGFX’s holdings are clean energy by my definition. The other funds you mention do not meet my definition, and were not discussed in this article.

I’m sorry if you found the title of the article misleading, but the funds I was discussing were not the ones you are discussing.

Charles,

You’re right that the procedure I outline would probably take a novice investor more time than it took me. The article I will publish today where I go through the procedure took me three hours to write, about one hour of which was the research. You would not need a lot of familiarity with cleantech, but you would have to have some familiarity using Morningstar or Yahoo! finance to identify the stocks… I’m guessing this would take 4 hours the first year, and 1 hour each subsequent year.

With a savings over 10 years vs. ETFs of $400/13 hours = $30/hour (tax free), high earners might not find it worth while, but the savings on mutual funds over 10 years would be about $80 an hour after tax. I call that good money.

Readers who still think it’s too much time can just read the article which follows this one, where I do everything for them.

I’m a novice investor who doesn’t know how to read company reports, so I find Charles’ comments to be a valuable warning about the danger I’m courting.

I’ve been trusting writers here and elsewhere to help me pick stocks or ETF’s that have good prospects without undue risk.

I’m not a high earner and I enjoy stock picking as a new hobby. I would find the savings you note Tom to be very worthwhile–assuming this strategy is likely to match fund returns.

D_Lane: In terms of matching fund returns, I expect that the portfoilio I outline will fall in the range of the 6 mutual funds I used… but we’ll see. I do have hopes that the strategy of picking previously poor performers may give this portfolio an edge.