Stocks seem expensive now, but that may not last. Here are two Landfill Gas stocks and three Geothermal stocks I’m hoping to buy if the market falters.

Tom Konrad, Ph.D., CFA

This article continues my Clean Energy Stocks Shopping List series. So far I’ve brought you:

- Five clean transport stocks,

- I looked at why it makes sense to wait for better prices,

- Five Energy Efficiency stocks (always my favorite sector), and

- Five Electric Transmission Stocks.

This article takes a look at two of the most economical clean electricity generation technologies, landfill gas and geothermal.

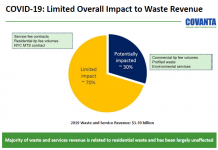

Kilowatts from Trash

As I discussed in my recent article on Advanced Biofuels, I expect that advanced biofuels are likely to have to compete with electricity generation for feedstock, and electricity generation is likely to take a large part of the pie. More importantly, the most likely companies to gain are the ones that control the feedstock. I like waste management companies because they already have contracts and experience in dealing with local governments. As those governments adopt broader recycling measures, waste-to-energy, and even mandatory composting, waste management companies that have the skills to process waste effectively will be able to provide these additional services. This should increase their revenues and profits from the same amount of trash, and may lead to new opportunities to sell byproducts such as recycled materials and electricity.

#1 Waste Management Inc. (WMI). Waste Management not only collects trash, but also does recycling and waste-to-energy services. Over the last few years, they have been aggressively expanding their methane gas recovery facilities at existing landfills, and often works under contract with governmental entities. To me, this portfolio of skills seems ideal for exploiting future opportunities to find value in the stuff that we throw away.

WMI has a rock solid balance sheet, with almost $1 billion in cash, strong cash flow, and low debt-to-equity and current ratios. A modest forward P/E of 13, and a dividend yield of over 4% makes this company attractive to cautious investors, even at current prices. This is fortunate, since the low Beta means that the stock is unlikely to decline much in response to a general market decline.

#2 Veolia Environnement (VE) Also provides world-wide waste management services, but is a much broader company with an expertise in government contracting. In addition to solid waste, they offer a large range of environmental management services, from water and wastewater treatment (there are also opportunities to generate electricity from methane produced at wastewater treatment plants.) They’re also involved in several of my other favorite sectors: energy efficiency through their energy management services, and clean transportation through their transit and rail services.

The company is much more highly leveraged than Waste Management, however, and had a very thin profit margin in 2008. This makes the company much more riskier than Waste Management, with a Beta of 1.8 compared to Waste Management’s 0.5. However, a market downturn may provide the opportunity to buy this company at a dramatically reduced valuation.

Geothermal Stocks

Hot rocks are a hot industry these days, and geothermal electricity has a lot going for it. First, electric utilities are very comfortable with it, since geothermal plants are baseload and are very reliable, and costing only about 6 to 11 cents per kWh. Geothermal also has strong support on Capitol Hill, gaining explicit mention and ($350 million) in the Recovery Act.

#3 Ormat (ORA), a vertically integrated geothermal company works with almost all the players in the industry. Many of the exploration companies, such as US GeoThermal (HTM), contract with Ormat to build their power plants. They also do their own exploration, construction, and operation of geothermal plants world wide.

Although I consider the company a core geothermal holding, I recently sold much of my position because the recent rally carried the company to very high valuations, with a forward P/E and dividend yield of 25 and 0.4%. Given that the stock price has almost doubled since early March, I expect to be able to get back in at much better prices.

#4 Raser Technologies (RZ) is a sharp contrast to Ormat, being the industry upstart with a disruptive business model. Raser is leveraging cheap, off-the-shelf technology from United Technologies Corp. (UTX) in order to greatly decrease exploration costs and time. This modularity means that Raser can start building a power plant before they have fully explored a geothermal resource. If they later find that the resource can support a larger plant, they can simply add units. Their first plant in Thermo Utah was completed in less than a year, on a known low temperature resource that had been previously been considered too cool to generate power, meaning that exploration was not necessary.

The company recently completed a $25.5 million offering at a 22.5% discount to the stock price at the time. The stock promptly sold off more than 30%. With the company rapidly burning through cash, the raise was necessary in order to continue their rapid expansion plans. I would not have touched the company before the raise (although I listed it as one of Ten Clean Energy Gambles for 2009. With Raser down almost 30% since then, and some fundraising out of the way for the short term, the odds of the gamble are looking a lot better.

#5 Nevada Geothermal Power (NGPLF.PK) is a more conventional exploration and development company with a few high quality projects. This company now expects their first producing project at Blue Mountain

to be fully operational in October 2009. The shift from an exploration company to a power producer should bring a whole new class of investors to the stock, although the recent doubling of the stock price has quite possibly discounted most of these gains. But with thinly traded stocks such as NGP, any change in investor sentiment could easily drop the price significantly and provide new buying opportunities in the meantime.

DISCLOSURE: Tom Konrad and/or his clients own WMI, VE, ORA, HTM, RZ, UTX, and NGLPF.

DISCLAIMER: The information and trades provided here and in the comments are for informational purposes only and are not a solicitation to buy or sell any of these securities. Investing involves substantial risk and you should evaluate your own risk levels before you make any investment. Past results are not an indication of future performance. Please take the time to read the full disclaimer here.

About time we talking Nevada Geothermal considering the most advanced Ormat designed and built plant coming online ealier than expected and this will allow refi of loan and expansion of Faulkner I for more megawatts

It certainly would have been better timing if I had mentioned NGP when you wanted me to; right before the the stimulus funds were announced. But I’m not John Petersen… I do a little of everything, so I can’t write about any company more than a few times per year; there are a lot of great companys out there.

Nevada Geothermal with 40 mw Faulkner coming on line this fall looks very promising.

Has anyone done the numbers for the possible net cash flow from the plant? Or return on investment?