The Department of Energy (DOE) released a report Wednesday which undertook a strategic review of the use of critical metals in the emerging clean energy space. “Critical Materials Strategy” is a 170 page report which provides a useful overview of the possible metal bottlenecks – and hence investment opportunities – in clean technologies.

The investment thesis which can best benefit from shortages is called “Strategic Positioning“. Developed by Patrick Wong, former CIO of Dacha Capital, this thesis “basically looks at parts/processes in the building of any product and looks for ones that are a small % of the overall value yet are critical and cannot be substituted easily.” One prominent example is the 50-100g of dysprosium used in hybrid and electric vehicles’ motors to allow reliable operation at the 180-200C temperatures reached during driving. 50g dysprosium oxide will set you back $15, a trifling 2,000th of the retail price of a $30k hybrid.

Demand is thus highly inelastic, which bodes well for price in the event of a shortage. Another example is the 4-20kg of gallium and 16.5-110kg of indium required per megawatt of Copper-Indium-Gallium-diSelenide (CIGS) thin film solar. At current prices, these elements make up less than 2% of the installed cost of this flavour of solar thin film. Other examples are the use of terbium in high efficiency linear fluorescent lamps (LFL) and compact fluorescent lamps (CFL) or the use of indium in indium tin oxide (ITO) coatings on LCD screens.

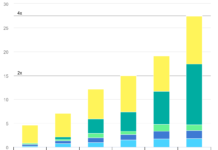

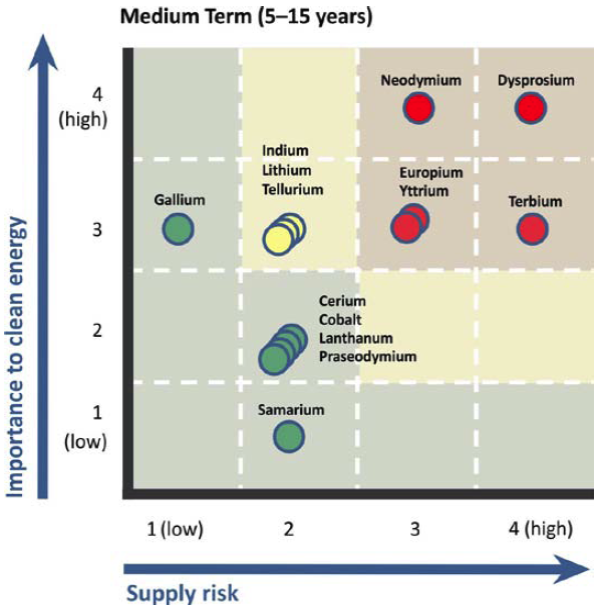

The DOE has helpfully constructed a clean energy criticality matrix to reflect the supply demand balance in the medium term:

Trying to place large bets on these elements is difficult, because so little is produced annually – only around 200 tonnes of gallium, 250 tonnes of terbium, 480 tonnes of indium and 1,300 tonnes dysprosium. There are no futures markets. Hence Dacha Capital’s strategy to store them physically. Dacha currently holds some 200 tonnes of the elements in red in the above chart.

Due to their often small proportion of end product cost, it’s not pricing but long term security of supply which is of great concern to OEMs. If security of supply can’t be guaranteed, then demand may not materialise. Another important point to bear in mind is that to a large degree, these elements are not indispensible. You can listen to Steve Duclos, Chief Scientist for Materials Sustainability, General Electric Global Research, at the DOE report launch here (45 mins in). He sounds quite sanguine: “How does an OEM address this issue? The good news is there are a lot of solutions….often times there’s more than one way to serve a customer’s needs, and some of those may use rare earths while others may not”.

There are technologies coming down the pipeline, such as Organic Light Emitting Diodes (OLEDs), or dysprosium-free permanent magnets, which require no rare earths. Additionally much of the demand growth will be in clean tech, which is subject to substantial regulatory risk. Solar and wind have encountered something of a perfect storm the past year or two – lower electricity demand, lower natural gas prices, and higher cost of capital. As a result they are likely to require government incentives for the forseeable future. The renewable industry was lucky to have secured a year’s extension on tax breaks this week. Next year it might not be so fortunate.

From the current perspective investing in critical metals appears a no brainer, but there are many moving parts.