Tom Konrad CFA

The Pew Charitable Trusts just released the 2011 edition of their report, “Who’s Winning the Clean Energy Race?”

This is the second year I’ve written about their findings, and I wonder what the question really means. In particular,

- Who are the competitors? (Pew looks at countries)

- How do we judge the winner? (Pew looks at total investment)

I write about Pew’s winner (and why its lead won’t last) here, but there are other winners, perhaps even more significant ones, depending on how we judge the race and who’s running.

And the Winners Are…

#5 Largest Investment Sector: Solar

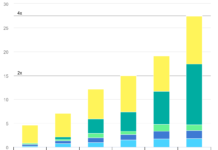

Solar manufacturing stocks were lousy investments in 2011. That was mainly a consequence of rapidly falling solar module prices. Those same falling prices led to a boom in solar deployments. Solar attracted more than half of all Clean Energy investments in 2011, at $128 billion, up 44% from 2010.

Solar deployment was up 54%, to 29.7 GW in 2011. This was particularly notable in Italy, where solar has hit grid parity. Grid parity means that power from solar panels now costs the same as grid electricity, and is a consequence of Italy’s high electricity prices and good solar resource. Italy added almost 8GW of distributed photovoltaic capacity, more than half of all distributed capacity added in 2011. 8GW of solar is about the same capacity as six large nuclear reactors, and (due to lower capacity factors) produces almost as much energy as two such reactors.

Italy’s rapid solar deployment in the midst of a financial crisis should finally prove that solar can scale as quickly as any traditional electricity generation technology.

Solar investments also surged in the United States (where developers rushed to take advantage of the expiring incentives, and Japan, in the wake of the Fukushima nuclear disaster.

#4 Most Rapid Transition Towards a Clean Energy Economy: Italy

The ultimate goal of the Clean Energy Race is to transition the world economy off its unhealthy and resource-constrained dependence on fossil fuels to a sustainable economy based on the efficient use of renewable resources. To measure progress towards that goal, we need to evaluate not total investment, but rather how significant the investment is relative to a country’s economy.

The ultimate goal of the Clean Energy Race is to transition the world economy off its unhealthy and resource-constrained dependence on fossil fuels to a sustainable economy based on the efficient use of renewable resources. To measure progress towards that goal, we need to evaluate not total investment, but rather how significant the investment is relative to a country’s economy.

By this measure, Italy is the clear winner. Italy grew its investments in clean energy at a compound annual rate of 89% over the past five years, producing 24-fold growth over that period, and clean energy investment now accounts for 1.58% of the country’s GDP.

For skeptics who worry that Italy is wasting money on clean energy at a time it can least afford to, it’s important to note that solar, which accounts for virtually all Italian investments in Clean Energy, has reached grid parity in Italy. In other words, Italian solar investments are profitable investments.

Italian solar power also reduces future imports of natural gas to produce electricity, improving the long term balance of trade in a country with too much debt.

#3 Sector Finally Getting Some Respect: Efficiency

Energy Efficiency has long been the under-appreciated but hardworking sibling in the Clean Energy family. Energy Efficiency is far more cost effective than renewable (or even conventional) energy generation, and has the capacity to meet at least half of our future energy needs.

In addition, the arguments that Clean Energy creates jobs are the strongest (and the criticisms the weakest) for Energy Efficiency. Those who argue that Clean Energy will destroy jobs base their arguments on the relatively high costs of some clean technologies relative to conventional energy. While these arguments are weakening as Solar and Wind deployment gets cheaper, they have never been true for Energy Efficiency, which has always been cheaper than coal.

Efficiency is getting respect in the sense that Venture Capital and Private Equity(VC/PE), are increasingly flowing to the sector. In 2011, the energy efficiency and other low carbon technologies accounted for 40% ($3.6 Billion) of VC/PE investment. With luck, other types of investment will follow (as they often do) where VC/PE investment leads.

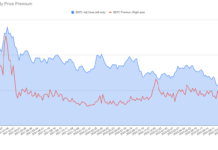

#2 Economic Winner: Energy Consumers

The most notable change in Clean Energy during 2011 were the rapid price drops. With Wind and especially Solar power cheaper, the big winners are Clean Energy consumers. As discussed above, Italians are already saving money by investing in solar to displace electricity from the grid.

World Clean Power capacity additions in 2011 were 83.5 GW, 59% more than in 2010, at a cost of $141 billion, up only 12% from 2010 levels. In other words, we’re getting a lot more energy by only spending a little more. The $59 billion dollars extra that the same amount of capacity would have cost at 2010 prices is pure gain for consumers.

#1 Winner of the Clean Energy Race: Our Children

At some level, it’s not important which country invests the most in Clean Energy, which sector comes out ahead, which country is moving most quickly towards sustainability, or even who benefits the most economically.

What is important is that we make the transition as quickly as possible, so that fewer resources are wasted digging stuff out of the ground and burning it, scarring the landscape, polluting the air, and messing with our planet’s delicate ecological balance.

With investments in Clean Energy we get what we pay for. The up-front cost has often been more (although that’s rapidly changing), but that’s typically the whole cost. With fossil fuel investments, we’ve long been getting more than we paid for, but now the difference is coming back in the form of deferred, hidden costs. Our children and our children’s children will be paying these costs in the form of depleted resources and a less hospitable (if not downright hostile) environment for generations to come.

We’re even paying for our previous use of fossil fuels today. This mild winter may seem like less of a cost than a benefit of Global Warming (unless you are a skier or a maple syrup producer), but any disruption of the natural cycle creates costs far beyond the immediate effects. Allergy sufferers are already feeling the effects, and the mild winter wa

s even more of a boon to insects than it was to us.

If the Clean Energy Race makes everyone run faster, we all win. Except maybe the bugs.

Thanks for the encouraging article! I look for signs of encouragement–and there are many–even as extreme weather events become ever more common and we move into the unknown of global weirding (climate change).

I find that so many investors do not understand that the world has changed and resources are constrained. (Jeremy Grantham is a notable exception and worth following, as is Tom Konrad) I want my portfolio to be as prepared as possible for the low carbon future.

It’s funny, I hesitated to publish it here at all, since the article is not really about stocks, but you’re not the response has been quite positive in terms of traffic and the reaction in social media.