By Harris Roen

Investors love Exchange Traded Funds (ETFs). They trade like stocks, and are an easy way to diversify within a certain sector. Over the past year, though, alternative energy investors would have been much better off putting their money in regular mutual funds. The results are detailed in the April edition of the Alternative Energy Mutual Funds & Exchange Traded Fund report.

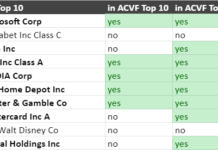

Performance for alternative energy mutual funds were very good for the past 12 months, averaging 11.7% for the eleven funds covered by the Roen Financial Report. In fact, eight out of 10 funds had double-digit gains for the year (there is no data for Brown Advisory Winslow Sustainability (BAWAX) since it only started trading in June 2012). Also, Most of the mutual funds are trading near the top of their annual price range.

Three month returns have also been respectable, with ten out of eleven funds posting annual increases (and Guinness Atkinson Alternative Energy (GAAEX) just showing a slight loss).

Returns for ETFs were much more variable than MFs. One year returns ranged from a gain of 24.2% for Market Vectors Global Alternative Energy ETF (GEX), to a loss of 35.2% for iPath Global Carbon ETN (GRN). Of the 17 alternative energy ETFs that the Roen Financial Report covers, over half showed annual gains. On average, though, returns were basically flat for both 12 months and 3 months.

Despite this lackluster performance for ETFs, their prospects seem to be getting better. On a rolling average basis, one-year returns have improved for alternative energy ETFs. In March, for example, the average ETF lost 6.8%. Similarly, there were one-year losses for February, January and December 2012. In fact, December saw an average ETF loss of 15.1% over the course of a year. The Roen Financial Report will be watching this trend closely to see if alternative energy ETFs continue to improve.

Though this discrepancy between ETFs and mutual funds may vary over time, alternative energy investors are wise to look at the entire fund landscape when deciding where best to deploy their assets.

About the author

Harris Roen is Editor of the “ROEN FINANCIAL REPORT” by Swiftwood Press LLC, 82 Church Street, Suite 303, Burlington, VT 05401. © Copyright 2010 Swiftwood Press LLC. All rights reserved; reprinting by permission only. For reprints please contact us at cservice@swiftwood.com. POSTMASTER: Send address changes to Roen Financial Report, 82 Church Street, Suite 303, Burlington, VT 05401. Application to Mail at Periodicals Postage Prices is Pending at Burlington VT and additional Mailing offices.

Disclosure

Individuals involved with the Roen Financial Report and Swiftwood Press LLC do not own or control shares of any companies mentioned in this article, but it is possible that individuals may own or control shares of one or more of the underlying securities contained in the Mutual Funds or Exchange Traded Funds mentioned in this article. Any advice and/or recommendations made in this article are of a general nature and are not to be considered specific investment advice. Individuals should seek advice from their investment professional before making any important financial decisions. See Terms of Use for more information.

Remember to always consult with your investment professional before making important financial decisions.

![mf_return_20130426[1].jpg](http://www.altenergystocks.com/wp-content/uploads/2017/08/mf_return_20130426_1_.jpg)