Tom Konrad CFA

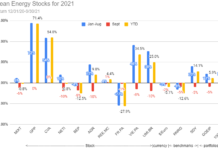

The stock market has had a rough five weeks since I introduced my annual Ten Clean Energy Stocks model portfolio on December 27th. My broad market benchmark (the iShares Russell 2000 index) is down 5.6% for the period. Clean energy stocks fared better, with the Powershares WilderHill Clean Energy ETF (NYSE:PBW) down only 0.5% as I write. My model portfolio of ten clean energy stocks is up 0.9% in local currency terms, but the weak Canadian dollar (down 3.5%) and Euro (down 1.5%) turned this into a US dollar decline of 1.0%.

In general the more speculative stocks performed better, but with much greater variation. The first six income stocks lost an average of 2% in US dollar terms, with a standard deviation of 3%. The next four growth stocks were flat on average, with a standard deviation of 8%. The two extra “speculative” picks performed speculatively, with one up 35%, and the other down 22%, for an average of 7%.

January has been fairly quiet for individual stocks in the portfolios, but where there has been significant news, I note it below.

Individual Stock Notes

(Current prices as of February 3rd, 2014. The “High Target” and “Low Target” represent the ranges within which I predicted these stocks would end the year, although I expect a minority will stray beyond these bands due to unanticipated events.)

1. Hannon Armstrong Sustainable Infrastructure (NYSE:HASI).

Current Price: $13.00. 12/26/2013 Price: $13.85. YTD Total US$ Return: Annual Yield: 6.4%. Low Target: $13. High Target: $16.

Sustainable Infrastructure REIT Hannon Armstrong fell back to the low end of the range between my high and low targets after a quick run-up based in its big dividend increase in December. The only slightly negative news was an SEC filing in which the company stated that it had agreed to amend the terms of a portfolio loan to geothermal developer EnergySource LLC. The balance of the loan amounts to $11.8 million or 74¢ a share. If the loan were in default and there were no chance of recovering any of its value, a 74¢ decline would be justified. That’s far from the case; a decline of around 5¢ a share seems more appropriate than the 85¢ decline we’ve seen. Hence, I have to attribute the vast majority of the pull-back to profit taking, and consider $13 an excellent entry point for anyone who does not already own the stock.

2. PFB Corporation (TSX:PFB, OTC:PFBOF).

Current Price: C$5.12. 12/26/2013 Price: C$4.85. Annual Yield: 4.9%. Low Target: C$4. High Target: C$6.

YTD Total C$ Return: 5.6%. YTD Total US$ Return:1.9%

Green Building company PFB declared its regular 6¢ quarterly dividend to shareholders of record on February 14th. The company also continues to repurchase its own stock. It bought back 5,700 shares over the period. A board member and large shareholder, Edward Kernaghan, also bought 3,800 shares on the open market.

3. Capstone Infrastructure Corp (TSX:CSE. OTC:MCQPF).

Current Price: C$3.55. 12/26/2013 Price: C$3.55. Annual Yield: 8.5%. Low Target: C$3. High Target: C$5.

YTD Total C$ Return: 1.1% . YTD Total US$ Return: -2.4%

Capstone paid its regular quarterly dividend of C$0.075 on January 31st.

4. Primary Energy Recycling Corp (TSX:PRI, OTC:PENGF).

Current Price: C$5.00. 12/26/2013 Price: C$4.93. Annual Yield: 4.1%. Low Target: C$4. High Target: C$7.

YTD Total C$ Return: 1.4% . YTD Total US$ Return: -2.1%

I interviewed Primary Energy’s CEO and wrote an in-depth article, which you can find here. I’ve also been adding to my position.

5. Accell Group (Amsterdam:ACCEL, OTC:ACGPF).

Current Price: €13.61. 12/26/2013 Price: €13.59. Annual Yield: 5.5%. Low Target: €11.5. High Target: €18.

YTD Total € Return: 0.1% . YTD Total US$ Return: -1.5%

Bicycle manufacturer and distributor Accell continues to rationalize its European operations. The company sold Hercules, one of its four German brands. Accell has owned Hercules for the last 20 years and will book a €3 million (€0.12) profit on the transaction.

6. New Flyer Industries (TSX:NFI, OTC:NFYEF).

Current Price: C$11.04. 12/26/2013 Price: C$10.57. Annual Yield: 5.1%. Low Target: C$8. High Target: C$16.

YTD Total C$ Return: 4.4% . YTD Total US$ Return: 0.8%.

Cannaccord Genuity upgraded bus manufacturer New Flyer to a “Buy,” most likely in response to strong deliveries in the fourth quarter. The company reiterated a warning that 2014 margins would be weak due to expected deliveries on bus contracts signed during the very competitive pricing market of the financial crisis.

New Flyer also received a $375,000 grant to work with a local community college to train employees at its St. Cloud Minnesota facility to build its new mid-size (“Midi”) buses. The company also paid its normal C$0.04875 monthly dividend.

7. Ameresco, Inc. (NASD:AMRC).

Current Price: 12/26/2013 Price: $9.64. Annual Yield: N/A. Low Target: $8. High Target: $16.

YTD Total US$ Return: -2.5%.

Energy performance contracting firm Ameresco started the year strong, but has since fallen back, seemingly in sympathy with the broader market decline. From the steady stream of contract announcements, it seems to me like the company’s pace of business may be picking up a little, but since the size of contracts varies widely, I’m far from confident about this.

Ameresco also announced a new tool using wireless sensing technology to allow a building’s controls to learn occupant behaviors and adapt energy use accordingly. A pilot test in a commercial office building produced 18% energy savings. I speculate that it might be possible to apply this tool to buildings under both future and existing performance contracts, which should improve their profitability to Ameresco and/or allow them to be offered to clients at more competitive prices.

8. Power REIT (NYSE:PW).

Current Price: 12/26/2013 $9.34 Price: $8.42. Annual Yield: N/A. Low Target: $7. High Target: $20.

YTD Total US$ Return: 10.9%

Power REIT was up strongly at the start of the month and had since held on to its gains. The company’s CEO, David Lesser, tells me that he thinks much of the gains have been due to his efforts getting the company’s story out there in conjunction with the offering of 7.75% Cumulative Preferred stock. The proceeds from this offering will be used to provide the equity portion of the company’s most recent solar land purchase, as well as another potential acquisition, if that deal is executed successfully. The company is seeking bank financing for the balance of the second deal and the refinancing of the bridge loans on the earlier deal.

Current shareholders and non-accredited investors are eligible to participate in the Preferred stock offering, which should appeal to income investors. While cash dividends on the preferred will not be paid until the civil action with Norfolk Southern (NSC) and Wheeling and Lake Erie (WLE) is resolved, the rent payable under NSC and WLE’s interpretation of the lease should be sufficient to both pay off Power REIT’s legal bills and allow the company to catch up with the cumulative preferred dividends.

9. MiX Telematics Limited (NASD:MIXT).

Current Price: $11.16. 12/26/2013 Price: $12.17. Annual Yield: N/A. Low Target: $8. High Target: $25.

YTD Total US$ Return: -8.8%

A South Africa based global provider of software as a service fleet and mobile asset management, MiX Telematics initially rose but then sold off in the last couple weeks along with the general emerging market decline. There was no significant news, but I thought this report from MiX on when and why drivers speed was interesting.

Like Primary Energy, I was planning on writing an in-depth article on MiX based on a CEO interview, but the company preferred to delay an interview until after its third quarter conference call coming on February 6th. I expect to write that article later this month.

10. Alterra Power Corp. (TSX:AXY, OTC:MGMXF).

Current Price: C$0.29 12/26/2013 Price: C$0.28. Annual Yield: N/A. Low Target: C$0.20. High Target: C$0.60.

YTD Total C$ Return: 1.8% . YTD Total US$ Return: -1.8%.

Renewable energy developer and operator Alterra Power expanded its joint venture with Philippine geothermal power developer Energy Development Corp. to the rest of its Peruvian geothermal projects. This is in line with Alterra’s recent strategy of focusing on core projects and either disposing of other assets or developing them with funds from joint venture partners, as is the case here.

Two Speculative Penny Stocks for 2014

Ram Power Corp (TSX:RPG, OTC:RAMPF)

Current Price: C$0.065 12/26/2013 Price: C$0.08. Annual Yield: N/A. Low Target: C$0.20. High Target: C$0.60.

YTD Total C$ Return: -18% . YTD Total US$ Return: -22%.

Geothermal power developer Ram completed the remediation of its San Jacinto-Tizate project on January 22nd, although the company did not provide any indication of how successful the remediation was. Management reiterated that the drilling is expected to increase output by 9 to 14 MW. The results of a plant capacity test are expected in March.

Finavera Wind Energy (TSX-V:FVR, OTC:FNVRF).

Current Price: C$0.105 12/26/2013 Price: C$0.08. Annual Yield: N/A. Low Target: C$0.20. High Target: C$0.60.

YTD Total C$ Return: 40% . YTD Total US$ Return: 35%.

There was no news for wind project developer Finavera, and the increase seems most likely to be a low-volume recovery from a share price depressed by tax loss selling at the end of 2013.

Final Thoughts

My picks and clean energy in general have mostly held up will during the sell off so far this year. The income stocks at the start of the list should hold up well in a market sell off, while many of the riskier stocks later in the list are more likely to be driven by company events than broad market moves. The exceptions are Ameresco and MiX, which will probably continue to follow broader market trends, hopefully with an upward bias.

Disclosure: Long HASI, PFB, CSE, ACCEL, NFI, PRI, AMRC, MIXT, PW, AXY, RPG, FVR.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

Nice update!

NFI released a PR last night–more sales to NYC! Also Finavera said on 1/31 that it granted stock options to certain directors and employees.

I saw both of those- I did not think the stock options were significant very significant since they are under the existing plan. On the downside, they amount to 6% of outstanding shares, but they are just options at the market price, and the timing is a positive- companies tend to time option grants to when they think the stock is at a low point.

On New Flyer, with the constant stream of contracts , it’s hard to consider any one very significant, although the fact that it’s NYC is good- New Flyer has historically had very low market share there, so this could be a sign that their consolidation of the industry may be paying off.