By all accounts, more money will be invested into renewables in 2014 than was invested in 2013. Our experts lay out where, why, when and how.

Jennifer Runyon

The world of renewable energy finance is vast: encompassing everything from venture capital funding for innovative start-ups, to research and development (R&D) and manufacturing expansion spending, to project finance and all the way through to investing in clean energy companies on the stock market. Because of that, for the general public, predicting where money will flow over the course of the next year is a shot in the dark at best. But there are finance experts who spend their lives tracking where the money is and where it isn’t and here we offer you their expert opinions on renewable energy cash flow in 2014.

Funding Innovation: Venture Capital Dollars No Longer Available

Renewable energy finance experts describe the early days of clean tech venture capital (VC) investment as being one fraught with “exuberance” and “frothiness.” Investors were eager to fund what they believed would be the next big thing and clean tech aka green energy aka renewable energy was where the action was. Dallas Kachan of boutique cleantech research and advisory firm Kachan and Company points to biofuels as a technology that received billions of dollars of investment capital in 2007 and 2008 and now has very little to show for it. Not a good result for an early-stage investor.

Kachan said that in 2014 VCs will be funding what he called “capital efficient plays,” for example, “energy efficiency or efficiency in general…so-called cleanweb investments,” he said. Cleanweb refers to the intersection of IT and sensors and big data, i.e. products and services that drive efficiency in homes by using the cloud (think nest thermostats) or drive efficiency in workflow or access to capital such as crowdfunding. “There has been an emphasis on capital efficient initiatives as opposed to 2007 and 2008 and the massive billions of dollars that we saw go into biofuels, for instance,” he explained.

Kachan said that in 2014 VCs will be funding what he called “capital efficient plays,” for example, “energy efficiency or efficiency in general…so-called cleanweb investments,” he said. Cleanweb refers to the intersection of IT and sensors and big data, i.e. products and services that drive efficiency in homes by using the cloud (think nest thermostats) or drive efficiency in workflow or access to capital such as crowdfunding. “There has been an emphasis on capital efficient initiatives as opposed to 2007 and 2008 and the massive billions of dollars that we saw go into biofuels, for instance,” he explained.

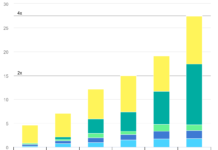

(Image, right: Global Total Investments in Clean Energy (2004-2012). Credit: Bloomberg New Energy Finance)

VC investment in renewable energy has been trending down for the past two years in fact and it will continue to do so in 2014 and beyond, said Kachan. “We predict that in 2014, we will continue to see companies having a harder and harder time raising venture capital,” he said, “but that’s not necessarily a bad thing.”

Kachan, a seasoned cleantech investment advisor, believes that 2014 may actually be the year that renewable energy expectations and deliveries begin to match. In other words, the technology is mature enough that investors understand what it is capable of providing and invest accordingly. In addition, major corporations are getting into renewable energy. “The largest companies in the world are taking a more active, aggressive role than ever in wanting to profit from clean energy,” said Kachan who explained that renewable energy and clean tech are still following the same trajectories of those technologies that came before them. “This is representative of the overall lifecycle of the maturation of the clean tech space,” he said. “If you look at other technology revolutions in the past where venture capital played a dominant role in the early days, sources of capital diversify over time,” he explained.

“That is clearly underway in cleantech,” he concluded and we need not worry about it. “It’s important to remember that this doesn’t mean the sky is falling, it just means that we are following the same trends, the same waves that happened in other industries.”

Project Finance: Utility-Scale Wind and Solar Still Grabbing the Lion’s Share

With five solid years of installed capacity growth coupled with steady cost reductions, it’s no surprise that renewable energy finance experts agree that large-scale wind and solar projects will receive the biggest portion of renewable energy dollars in 2014.

“Utility scale solar, mainly photovoltaic solar, and utility-scale wind will continue to be active in their growth in particular outside of the U.S.,” said Adam Umanoff, partner with Akin Gump law firm. Lynn Tabernacki, managing director of renewable and clean energy at Overseas Private Investment Corp. (OPIC) agreed. “In 2014, solar and wind will remain the mainstay of renewable energy investments because of sustained cost reductions for plant construction using these technologies,” she said.

Umanoff pointed to the Middle East as a region that is looking to tap renewable energy as an electricity source in the coming years. He said that Middle Eastern countries would like to dramatically reduce the amount of oil they use a fuel source for electricity generation so that they can garner more profits from selling their oil on the open market. “That’s what we’ve seen in the past year,” he said, mentioning, “the Saudis came out with a huge 5-GW plus mandate for solar.” Umanoff believes that CSP plus storage will play a role in building up that supply of renewable energy capacity.

Large energy end-users are also becoming more interested in renewable energy, said Umanoff. He said that the industry is active in Latin America. “In Chile, we’ve got very high power prices, relatively unreliable supply, and yet active commercial activity,” he said. And the same goes for Africa, “especially around the mining industry. There we are seeing both wind and solar looking very attractive,” he explained.

Tabernacki agreed and pointed to an uptick in public/private partnerships in developing nations as helping give rise to more renewable energy projects. “From the public side for example, the Power Africa Initiative has marshaled U.S. government trade and development resources for the specific purpose of energy development in six pilot countries in Africa,” she said. Specifically those countries are Kenya, Liberia, Ethiopia, Nigeria, Ghana, and Tanzania. Tabernacki also sees these types of partnerships in Asia. “There is a similar program directed to South-East Asia under the US-Asia Clean Energy Partnership,” she explained.

“Mobilization of grant funding, technical assistance, transaction advisory services, and project financing from these public sources is expected translate into an increase in renewable energy investments in these regions next year,” Tabernacki concluded.

Umanoff summed it up nicely, “as you go around the world: Latin America, parts of Asia, the Middle East are very attractive markets for renewable energy growth [in 2014].”

In the U.S., the story might be slightly different. Umanoff predicted explosive growth in the distributed solar industry as more customers see the financial benefits of putting solar panels on their roofs or in ground-mounted arrays close to their commercial facilities. He also pointed to incidents in the past where large industrial power users were without power for extended periods as drivers for renewable energy adoption, particularly in the form of micro-grids. “Industrial consumers who, on the heels of hurricane sandy were out of power for 4-5 days, they take a look,” he said.

In addition, in 2014, expect to see more solar installation companies tap into the burgeoning innovations in how to offer their customers low-cost financing options or attractive leasing models to help offset the cost of going solar. (More on financial innovations in the section below.)

The U.S. wind market will flourish in 2014 as companies work steadily to c

omplete construction on projects they began in late 2013 (wind project developers had to start construction by the end of 2013 in order to take advantage of the Production Tax Credit (PTC)). But since the PTC officially expired in 2013, don’t expect to hear about too many new wind power projects being commissioned in 2014 and beyond. Umanoff predicted that the U.S. will install upwards of 9 GW of wind power in 2014 and even more in 2015 as companies build out their planned projects.

Most experts agree that other renewable energy technologies will hold steady in 2014. Geothermal will continue to make progress in areas with good resourced such as the Philippines. “Large hydro continues to be very attractive but mainly in developing economies and new markets,” said Umanoff. “It’s very, very hard to permit a large hydropower facility in a mature, industrial democracy,” he said. Biofuels and biomass projects will make headway as well but in terms of gaining marketshare, the winners will be wind and solar.

Optimism Dominates the Investment Space

While investors will give many concrete reasons that they chose to invest in a technology, project or a company, one very important reason often overlooked and difficult to quantify is consumer sentiment. In others words, investors usually have positive or negative feelings about technologies, industries or companies and invest accordingly, whether they are aware of their emotional assessment of it or not.

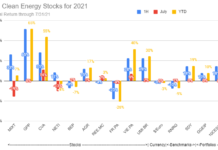

Navigant consulting has been examining consumer attitudes towards clean energy since 2009 and published its latest report “Energy and Environment Consumer Survey” in December 2013. The report is a summary of a survey conducted among 1,084 U.S. adults based on a “nationally representative and demographically balanced sample.” The survey asked for consumer attitudes towards 10 clean energy topics and the results are shown in the chart below.

Overall consumer sentiment toward solar and wind energy was up significantly in 2013 over 2012, indicating that in general, U.S. residents feel positive about clean energy. And when investors are looking for investment opportunities, it follows that they put their money into technologies, products, services and companies that they feel good about.

Perhaps that’s why all of the finance experts that we spoke to for this article said they were “optimistic” about the 2014 outlook for renewable energy finance.

“I remain optimistic that renewable energy investments will continue to gain ground in 2014,” said OPIC’s Tabernacki. “I think, without question, more money will be invested into renewable energy in 2014 than was in 2013,” said Akin Gump’s Umanoff. “I’m more optimistic than ever about the health of the clean-tech space,” stated Dallas Kachan. “I think that overall, we’re going to have a really good year,” said Tom Konrad, a private money manager who writes about clean energy investing.

Konrad believes that 2014 will be a great year for renewable energy finance, he said. He said that we saw the beginning of it in 2013 with the securitization of a bond by Solar City and pointed to Hannon Armstrong’s securitization of an energy efficiency bond in late December 2013 as another indicator that renewable energy financing is on track to take off in 2014.

“I think that we will see a few publicly traded ‘yield cos’ (yield companies) in solar listed in 2014,” he said. A yield co is a publicly traded company that is oriented towards income as opposed to growth. This type of investment opportunity is a major switch, said Konrad. “Any stock you have ever written about pretty much has been a growth stock,” he explained. “Tesla (TSLA) is a growth stock. People buy Tesla because they think the company is going to keep on gaining market share,” he clarified.

“Now there are some new income stocks that came public last year: Hannon Armstrong (HASI), Pattern Energy Holdings (PEGI), NRG Yield (NYLD) and Brookfield Renewable Energy (BEP), so there are four, I would say, renewable energy income stocks on U.S. exchanges.”

Further, Konrad expects to see at least one renewable energy income mutual fund unveiled in 2014 “because there are lots of things to put into it,” he said.

It makes perfect sense. Once renewable energy assets are operating efficiently, they generate payback for their investors. Now that the technology has matured enough to gain the trust of some of the more reticent, risk-averse investors like corporations and banks, expect to see lower cost of capital for projects and greater interest in renewable energy stocks, bonds and mutual funds.

Other newer financial innovations will expand in 2014, said Dallas Kachan, pointing specifically to crowdfunding. “When the equity-based crowdfunding systems start taking hold, that really stands a chance of unlocking large sums of hitherto unavailable capital for the whole cleantech space,” he said. Solar Mosaic, for example, which launched in officially in August of 2011 gained a lot of visibility in 2013. The company allows individuals to invest in solar projects and offers attractive returns to investors.

Kachan expects to see more innovative funding opportunities like Mosaic in 2014. “You will also see new systems, new initiatives targeted at the space, many of which, for the first time offer investors the chance to make money at making small investments in projects or innovation,” he said. Kachan cautions that he has some reservations about the long-term viability of equity-based crowdfunding – he worries what will happen when investors lose money, which undoubtedly will occur at some point. “I think it’s not going to take too many of those squeezes, those so-called down-rounds, and the requirements for pro rata investment. These things are going to potentially bite investors and it might turn off people from equity-based crowdfunding,” he explained. But nonetheless, he’s certain that we will see lots more in the financial innovation space in 2014. “That said, some people will make some money in doing this [equity-based crowdfunding] and that will encourage others to start doing this.”

Konrad agrees that financial innovation in renewable energy is probably going to be THE story of 2014. Ever the mathematician, Konrad guesses that about 60-75 percent of renewable energy investment will be driven by financial innovation, with the remainder being driven by policy, which he also feels will be favorable, at least on the state level, in 2014.

“I see 2014 as the year that renewable energy finance comes of age,” said Konrad.

This article is part of th Renewable Energy World January/February Annual Outlook Issue for 2014, which will be published on February 10, 2014. The issue includes our Global Directory of Suppliers. If you are not already a subscriber, why not subscribe now?

Jennifer Runyon is chief editor of RenewableEnergyWorld.com and Renewable Energy World magazine, coordinating, writing and/or editing columns, features, news stories and blogs for the publications. She also serves as conference chair of Renewable Energy W

orld Conference and Expo, North America. She holds a Master’s Degree in English Education from Boston University and a BA in English from the University of Virginia.

This article was originally published on RenewableEnergyWorld.com, and is republished with permission.