by Debra Fiakas CFA

Last week shares of Hydrogenics Corp. (HYGS: Nasdaq) took a steep dip down. Earlier in the week the company filed a shelf registration statement to raise up to $100 million in new capital over the next two years. Then before the last day of trading began the company issued new guidance for the year 2014, suggesting weaker sales in the first quarter than previously expected but reaffirming expectations for the full year.

The statement replaced an earlier shelf registration statement for a $25 million capital raise. The filing came as no surprise to investors, but the significant increase in the potential capital raise may have given a few some pause. What seems to have thrown a wrench in the chart is the disappointment over the first quarter sales guidance.

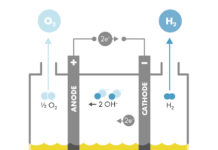

Hydrogenics has been developing fuel cell technologies. The company’s expertise is in water electrolysis, a technology for making hydrogen from water. Hydrogenics earns much of its revenue providing on-site industrial gas generation services, principally hydrogen. The company also knows proton exchange membranes and produces fuel cells for energy storage solutions. The company has managed to increase sales each year, but is still operating at a loss. In the most recent twelve months Hydrogenics reported $42.4 million in total sales, but suffered a loss of $6.1 million.

It is understandable why shareholders might be sensitive to any whiff of a weak top-line. However, in my view, the 10.6% sell-off on Friday following the new guidance announcement was an overreaction. An investment in a developmental stage company should not hinge on the shift of revenue from one quarter to another unless there are implications that market potential has weakened or customers have been lost. Management did suggest that realization of backlog will be mostly in the second half of the year. Such announcements are often followed by additional delays. However, management also provides encouragement that there its business pipeline is building, providing further support for sticking to its guidance for$50 million in total sales for the year and the possibility of finally reaching breakeven.

The stock has been reset, perhaps appropriately if profitability is not yet within the company’s grasp. Yet Hydrogenics has made progress, establishing a credible foothold in its markets. Even if you are skeptical about Hydrogenics’ guidance for 2014, the sell-off in HYGS might seem enticing to investors who are bullish on the company in the long-term. Unfortunately, a review of recent trading patterns suggest there is now pronounced bearish sentiment has now been registered in the stock that might take some time to play out. It might be better to wait for all selling to take its course before rebuilding positions.

Debra Fiakas is the Managing Director of Crystal Equity Research, an alternative research resource on small capitalization companies in selected industries.

Neither the author of the Small Cap Strategist web log, Crystal Equity Research nor its affiliates have a beneficial interest in the companies mentioned herein.